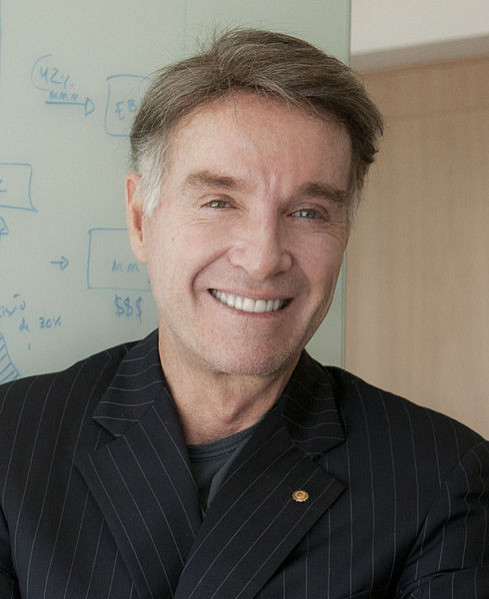

Brazil's Former Richest Man Eike Batista Lost His Empire In 2013; 2014 Uncertainty As Brazil's Economy Slowly Recovers

Tycoon Eike Batista has not had a good year. Formerly known as Brazil’s richest man, the ex-billionaire spent the last 12 months watching his empire slowly crumble to pieces. Just in October, his oil company OGX Petróleo e Gas Participações SA (BVMF:OGXP3) filed for bankruptcy, and logistics business LLX (BMVF:LLXL3) was taken over by U.S. equity fund EIG. And that's besides Batista being dropped from Bloomberg’s billionaire index.

Batista’s brainchild and holding company, EBX -- covering construction, mining, energy, entertainment and, especially, oil and gas, was worth $34.5 billion as of March 2012. OGX had been its center; since its founding in 2007 it had netted Batista two-thirds of his wealth. Back then, Batista’s aspirations were to become number 1 on Bloomberg’s list of richest people in the world, beating the Mexican tycoon and fellow Latin American Carlos Slim Helu, and with such predictions, he charmed investors and partners alike.

But those promises did not pan out. Batista’s former golden-egg goose turned out to be his downfall: in July last year, OGX announced that its only working field would stop producing in 2014, and barely three months later the company filed for financial rescue.

With such precedents, the future does not bode well for Batista. His latest attempt, a state-of-the-art semiconductor plant in the hills of southeastern Brazil, is still under construction despite doubts about its future. His partners in the project are looking for a replacement investor.

This foray into a high-tech venture is a rarity in the mogul’s career, but as reported by the Wall Street Journal, it was government planners who sought his help in the first place to ensure the chip project’s success. This was hardly the first time Batista was approached by officials for his business vision: in 2011, President Dilma Rousseff asked him to persuade Foxconn, the China-based assembler of many Apple (NASDAQ:AAPL) devices, to invest in a factory in Brazil. Batista met with Foxconn chief Terry Gou in Rio de Janeiro and told reporters that the Chinese company would invest billions in Brazil -- but it never happened.

Many have pointed out that Batista’s collapse is a look into the weaknesses of Brazilian economy: a state-managed capitalism, in which businesspeople benefit from billions of dollars of steeply discounted government loans under a strategy to back business considered critical for the growth of the country. Since 2009, Brazil has lent businesses around $100 million, adding to its public debt.

Brazil’s 2013 has run similar to Batista’s. After years of fast growth culminating in 7.5 percent GDP growth in 2010, Brazil’s economy slowed down to a disappointing 0.9 percent growth in 2012 and worrying figures in 2013, with Q3 seeing a 0.5 percent contraction. Analysts have called this Brazil's “new normal,” adding that it will take a few years until Brazil is back to pre-financial crisis growth level. 2014 will be slightly better, with growth forecast between 2 percent (as noted by Citibank) and 2.4 percent (JP Morgan). The Brazilian government is remarkably more optimistic, forecasting growth for this year at 4 percent.

In that environment of slow growth and uncertainty, Batista will be trying to keep his remaining businesses afloat, along with his meager $200 million remaining fortune.

© Copyright IBTimes 2025. All rights reserved.