Canada Open To More Measures To Curb Housing Speculation, Minister Says

Canada's ruling Liberals are eyeing more measures to curb housing speculation after introducing a foreign buyer ban and heftier taxes on property flippers in their budget earlier this month, the housing minister said on Thursday.

Minister Ahmed Hussen, asked about imposing further measures to slow investor activity such as requiring larger down-payments for second, third or subsequent homes, did not rule out the option.

"We are curbing speculation by doing a number of things ... but also we haven't closed the door to further measures," Hussen told Reuters in an interview. He noted that Canada's tax and real estate systems are complex, which complicates the process.

"We have to study further and really examine closely what further measures we can take to deal with issues around speculation," he said.

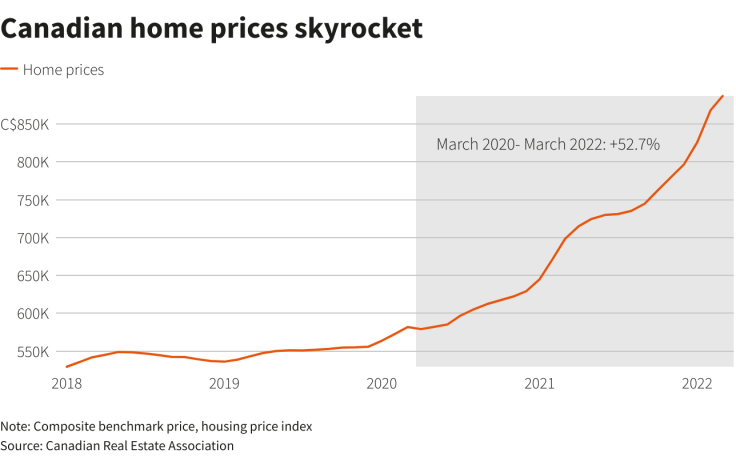

Housing prices have surged more than 50% in the last two years, driven by low interest rates, a desire for more space and speculative activity. The Bank of Canada found investors now buy one in every five homes.

GRAPHIC: Canadian home prices skyrocket

Hot housing helped drive Canada's inflation rate to a 31-year high in March. Price and sales growth are expected to stay elevated this year, but moderate by late 2023 or early 2024, Canada's national housing agency said Thursday.

To curb speculation, the government is putting in place a temporary ban on foreign buyers and a new measure to more fully tax properties resold within a year of purchase.

Under the current tax system, a home buyer who leaves property empty only to sell it a few months later is taxed the same as the one who owns a property and rents it out for decades, before selling.

"Right now our tax system treats two scenarios the same, and we have to change that," said Hussen.

The minister was confident that the ban on foreign buyers, which will be in effect for at least two years, will "certainly create more homes for Canadians."

Foreign owners hold a relatively small share of Canadian homes, but have an outsized role in certain markets - like freshly built urban condos - helping drive price escalation, experts say.

But critics say more should also be done to curb domestic speculation, including requiring larger down-payments for investment properties.

Canadians can buy a principal residence with just 5% down, provided they qualify for mortgage insurance. For second and subsequent properties, a 20% down payment is required, though buyers can tap their home-equity lines of credit to pay it.

Canada's financial regulator on Thursday highlighted a housing market downturn as one of the risks facing the country's financial system.

© Copyright Thomson Reuters {{Year}}. All rights reserved.