Beijing Jingyuntong Technology will raise 2.52 billion yuan ($395 million) from an initial public offering in Shanghai after setting the price at over 50 times its historic earnings.

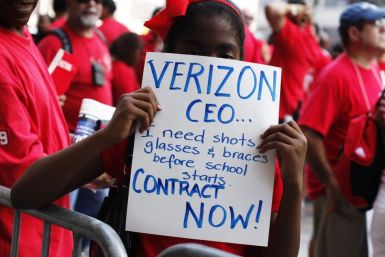

Talks resumed Wednesday between Verizon Communications and the unions representing 45,000 landline workers. Unease is said to be growing among many workers, however, who don't think they should have gone back to work.

When faced with a ticket sales dilemma for its football program, the Maryland Terrapins took a creative route -- selling the tickets on Groupon.

While snagging a deal is not a new concept, it seems lately that daily deal discount Web sites like Groupon dominate the Internet. Here is your guide for the top 12 best daily deal, Groupon alternative, Web sites.

Legendary corporate raider Carl Icahn has refused to give up on his pursuit of Clorox, despite the company swiftly rejecting every bid he's made.

AT&T has apparently figured out the key to lawmaker hearts: U.S. jobs. The telecommunications company has committed to bringing 5,000 jobs back to the United States once its proposed merger with T-Mobile USA is approved and finalized. AT&T says the jobs will be in wireless call centers, and will bring back positions that were previously outsourced abroad.

HP's TouchPad debacle just keeps going, and going, and going. The launched the product with big hopes and promises, then seven weeks later they killed it with barely an explanation at all. Discounted to $99, the TouchPad became the hottest tech gadget around for one week, until it sold out. Now, HP is back again, seemingly unable to let go of the TouchPad it created and then walked away from so quickly like it wanted nothing to do with the tablet at all. The latest: HP's statement today on...

Russian internet investment group Mail.ru raised its full-year revenue growth forecast to 50 percent from 40 percent on Wednesday after sales and profit rose at its social network, online gaming and e-mail activities in the first half.

Small U.S. businesses in July moderated what had been a blistering pace of borrowing, held back by uncertainty over U.S. economic growth and the debt crisis.

U.S. authorities are investigating whether business software maker Oracle Corp.'s deals in Africa violated federal anti-bribery laws, the Wall Street Journal reported, citing sources familiar with the matter.

Bloomberg LP lost a bid to dismiss a lawsuit by Swatch Group AG that accused the news service of secretly recording an earnings conference call with securities analysts and giving a transcript to clients.

Bank of America Corp is looking to sell its correspondent mortgage business and the unit's employees could be notified as soon as Wednesday, the Wall Street Journal said, citing people familiar with the matter.

Telecommunications giant AT&T Inc, whose proposed buy of T-Mobile USA is under scrutiny by U.S. regulators, promised to bring 5,000 wireless call-center jobs back to the United States if the deal wins approval.

eBay Inc expects sales from large exporters in China to maintain growth at 30-40 percent annually, with the e-commerce giant seeking acquisition opportunities as part of efforts to expand its footprint in the fast-growing market.

The regulator for Fannie Mae and Freddie Mac, as well as dozens of investors, on Tuesday lodged objections to Bank of America Corp's proposed $8.5 billion mortgage-backed securities settlement.

Bank of America Corp's mortgage practices came under fresh fire as state and federal regulators questioned whether the largest U.S. bank is doing what it must to address perceived harm to homeowners and investors.

Stocks rose for a third straight day on Tuesday in a volatile session, after minutes from the latest Federal Reserve meeting boosted expectations the U.S. central bank will act again to stimulate the economy.

Research in Motion continued its stock price climb on Tuesday -- gaining close to 6 percent during trading.

HP's TouchPad debacle just keeps going, and going, and going. The launched the product with big hopes and promises, then seven weeks later they killed it with barely an explanation at all. Discounted to $99, the TouchPad become the hottest tech gadget around for one week, until it sold out.

Barnes & Noble announced its Nook sales could more than double this year and one way it could hope to achieve that growth is through increased college bookstores sales of the digital reader.

Hong Kong-listed shares of China Construction Bank Corp rose more than 4 percent on Tuesday after Bank of America Corp said it will sell about half of its 10 percent stake in the Chinese lender, providing relief to investors by removing uncertainty surrounding the stake.

The initial reaction to Steve Jobs' resignation as Apple's CEO was speculation on just how far Apple's stock price would drop the next day. So just how far could another company, like Berkshire Hathaway, drop when Warren Buffett finally retires?

Chik-fil-A is offering free breakfast for a limited time, if customers go online to sign up and print out the invitation. But it might require some patience, since the fast food chain has had so much online response that the company's Web site was down Tuesday morning.

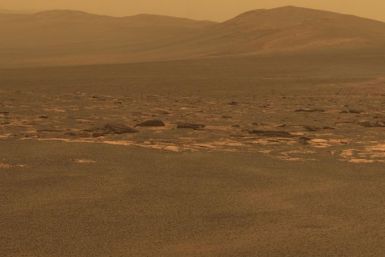

Alien life stands a far better chance of being discovered thanks to vastly improved scientific detection devices, say scientists meeting this week in Denver at an American Chemical Society conference.

Google chairman Eric Schmidt said Google+, the company's new social network that's come under scrutiny for its real names use policy, is for people to stand for something and who are willing to express themselves. Schmidt said if using a real name creates a danger, for instance for people in Iran or Syria, they don't have to use Google+.

U.S. home prices dipped just 0.1 percent in June from May, according to Case-Shiller -- providing a ray of light that the U.S. housing market may be stabilizing.

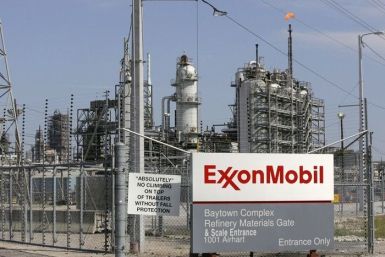

Exxon Mobil and Rosneft, Russia's top crude oil producer, announced a strategic agreement on Tuesday to jointly develop oil in the Russian Artic.

Bank of America Corp. was sued by the trustee of a $1.75 billion mortgage pool, which seeks to force the largest bank to buy back all of the loans in the trust because of alleged misrepresentations.

Stock index futures fell on Tuesday after equities rose nearly 8 percent in the past five sessions as investors cautiously awaited a batch of data for a better assessment on the state of the economy.

Maruti Suzuki, India's top car maker, on Monday has halted production at one of its plants in Haryana after it dismissed some workers and asked all others to sign a good conduct bond, a company spokesman said.