Stock index futures pointed to a higher open on Wall Street on Wednesday, with futures for the S&P 500 up 1 percent, Dow Jones futures up 0.79 percent and Nasdaq 100 futures up 0.97 percent at 0900 GMT (5 a.m. ET).

The Bank of Japan kept its policy settings unchanged on Wednesday, saving up its scant ammunition for later, while the yen stabilized in the wake of Switzerland's radical action to curb its soaring currency.

NASA mission managers in Houston are currently working on contingency plans, as both Russia and the U.S. have said that temporarily abandoning the $100 billion ISS is a possibility.

Shaw Group said it will sell its 20 percent stake in nuclear power plant company Westinghouse Electric Co to Japan's Toshiba Corp to eliminate nearly $1.7 billion of debt and strengthen its balance sheet.

Toyota Motor Corp <7203.T> is working to create a robust supply chain that would recover within two weeks in the event of another massive earthquake like the one on March 11 that is still affecting output after six months, a top executive said.

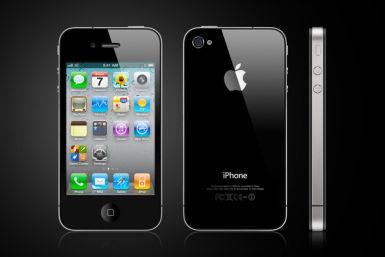

The most-anticipated device of the year, Apple Inc.'s iPhone 5, is already facing stiff competition from Android smartphones amidst all rumors. The release date of the iPhone 5 is growing closer as the latest rumor has revealed that retailer Best Buy is set for an October launch.

Honda Motor Co. is recalling 962,000 Fit, CR-V Crossover and Fit Aria vehicles worldwide because of defects in power windows and computer systems.

Switzerland's central bank turned the tables on Tuesday on investors who have driven up the franc, sinking it nearly 9 percent to the euro, while European stocks eked out some gains after sharp losses a day earlier.

Switzerland's central bank stepped in to stop investors driving up the franc on Tuesday, sending the euro up nearly 9 percent and stifling a tentative European stock recovery from sharp losses a day earlier.

European financial markets steadied Tuesday, with the euro jumping against the Swiss franc, after a sharp sell-off a day earlier due to fears for the euro zone's future and that of its banking sector.

European financial markets steadied on Tuesday, with the euro jumping against the Swiss franc, after a sharp sell-off a day earlier due to fears for the euro zone's future and that of its banking sector.

Japan's Toshiba Corp is in talks with Shaw Group over the U.S. company's 20 percent stake in nuclear power plant company Westinghouse Electric Co, a person familiar with the matter said.

Scientists have created the first artificial embryonic stem cells from two endangered species, a breakthrough that could potentially save animals in danger of extinction.

The global economy is unlikely to fall back into recession but there are risks, World Bank President Robert Zoellick said on Tuesday.

Asian shares fell and U.S. Treasury yields dropped to the lowest levels in at least 60 years on Tuesday on fears that Europe's sovereign debt troubles are worsening and could trigger a second full-blown banking crisis.

A new reagent developed by researchers in Japan could turn biological tissues transparent, thereby offering an ideal means to analyze the complex organs and networks that sustain living systems.

Asian shares fell and the euro slipped Tuesday amid fears that Europe's sovereign debt troubles are worsening and could trigger a second full-blown banking crisis.

Japan's Toshiba Corp is in discussions to buy out U.S.-based Shaw Group's 20 percent stake in nuclear power plant company Westinghouse Electric Co, the Wall Street Journal reported, in a deal that would erase all American ownership of the 125-year-old Westinghouse.

Japan's Toshiba Corp is in discussions to buy out Shaw Group's 20 percent stake in nuclear power plant company Westinghouse Electric Co, the Wall Street Journal reported, in a deal that could erase any U.S. ownership of Westinghouse.

Asian shares fell and the euro slipped on Tuesday amid fears that Europe's sovereign debt troubles are worsening and could trigger a second full-blown banking crisis.

The Bank of Japan is expected to refrain from easing monetary policy this week, with the yen's retreat from its record high and a resilient stock market allowing it to save for later its limited options to support the fragile economy.

Group of Seven financial leaders, worried about risks to global growth, are likely to agree this week to keep monetary policy accommodative, slow fiscal consolidation in countries where that is possible and implement structural reforms, a G7 source said.