Dow Jones Industrial Average Rebounds Quickly After Rapid Dip Following US Fed Rate Hike

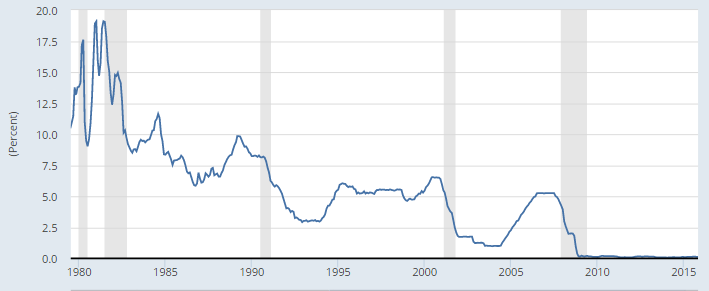

After a steep dip in the moments after the U.S. Federal Reserve announced a widely anticipated 0.25 percent rate hike, the first increase in U.S. borrowing costs since June 2006, U.S. stocks closed in positive territory Wednesday. Almost immediately after the annoucement banks raised their so-called prime rates, which increase the cost of borrowing from banks to corporations and are used as a base rate for mortgage and business loans.

“It’s like when a doctor starts pulling back on a patient’s medicine,” Stuart Hoffman, chief economist at PNC Financial Services Group, said. “[Janet] Yellen thinks the U.S. economy is healthy enough to begin returning the rate back to normal,” he added, referring to the head of the Fed, who announced the rate hike.

The Dow Jones Industrial Average (INDEXDJX:.DJI) closed up 224.18 points, or 1.28 percent, to 17,749. The Standard & Poor's 500 index (INDEXSP:.INX) advanced 29.66 points, or 1.45 percent, to 2,073. The Nasdaq composite (INDEXNASDAQ:.IXIC) gained 75.77 points, or 1.52 percent, to 5,071.

“Although recent turmoil in Asian markets and a global contraction in commodity prices had created some uncertainty regarding fiscal policy, strong performance in domestic labor markets, improving consumer spending and a myriad of other positive economic factors ultimately persuaded board members to raise rates,” Kevin Young, an analyst at global industry analytics firm IBIS World, said in an email.

Oil prices plunged after the announcement in anticipation that the Fed move would put more upward pressure on the U.S. dollar, which has been strengthening against a basket of main global currencies for the past year. Oil is priced in the U.S. currency, so a stronger dollar makes oil more expensive to import in many countries, which could push down demand amid a global oil glut.

West Texas Intermediate crude oil, the U.S. benchmark for oil prices, fell 4.44 percent to $35.69 per barrel for January delivery on the New York Mercantile Exchange. Brent crude, the global benchmark for oil prices, retreated 3.28 percent to $37.19 for January delivery on the London ICE Futures Exchange.

Nine out of 10 S&P 500 sectors ended the day up, with the decline reflected in energy stocks. Gains were led by utilities and telecommunications. Goldman Sachs Group Inc. (NYSE:GS) led Dow gains Wednesday as investors flocked to banks that will benefit from a rise in borrowing costs. Big declines were seen in chemicals giant DuPont (NYSE:DD) following last week’s rally on news of a proposed merger with Dow Chemical Co. (NYSE:DOW). Exxon Mobil Corp. (NYSE:XOM) dropped Wednesday afternoon following a Tuesday rally in energy stocks.

Other big gainers Wednesday included insurer UnitedHealth Group Inc. (NYSE:UNH), as Obamacare enrollment was extended on high demand, and Merck & Co. Inc. (NYSE:MRK), after the drugmaker won federal approval for a drug that reverses the effect of a muscle relaxant used during surgical procedures.

In the bond market, benchmark 10-year Treasury notes fell 5/32 in price to yield 2.2835 percent, Reuters reported, while the yields on two-year Treasuries climbed to 1.021 percent, the highest since April 2010. The dollar index, which measures the currency against a basket of other major currencies, lost ground following the Fed’s announcement and was down 0.42 percent at 97.806, according to Reuters, while the euro gained 0.51 percent at $1.0983.

© Copyright IBTimes 2025. All rights reserved.