Earnings Preview: Chevron Corp. (COP), Exxon Mobil Corp. (XOM), ConocoPhillips (COP), Baker Hughes Inc. (BHI)

The biggest U.S. oil and gas companies, which report their earnings this week and next, are grappling with plunging revenues and shrinking spending plans. The collapse in oil prices over the last 18 months has forced both producers and oil-field services companies to slash tens of thousands of jobs and halt drilling on new wells — and the pain is only expected to deepen in 2016, analysts say.

Across the energy sector, operating earnings per share are expected to plunge 72.5 percent for the three-month period ending Dec. 31, versus the same period in 2014, data from S&P Capital IQ showed.

Stewart Glickman, an equity analyst with Standard & Poor’s in New York City, said the industry’s fourth-quarter results were less important for investors than energy companies’ plans to reduce capital expenditures in 2016.

Producers cut their budgets by billions of dollars last year to balance the blow of falling revenues, while oil-field services companies laid off large fractions of their workforce as demand for drilling new wells drastically slowed. Upstream producers, including Exxon Mobil Corp. and Chevron Corp., cut capital expenditures by 32 percent in 2015 compared with the previous year, according to Glickman’s review of about 30 oil and gas producers.

Spending could fall another 19 percent this year from 2015, although Glickman said he wouldn’t be surprised if cuts for 2016 were even steeper.

“You might see cap-ex cuts that are more significant than what the market is currently banking on,” he said. “If they feel like the capital market access is not as good as it used to be, you might see companies living within their means.”

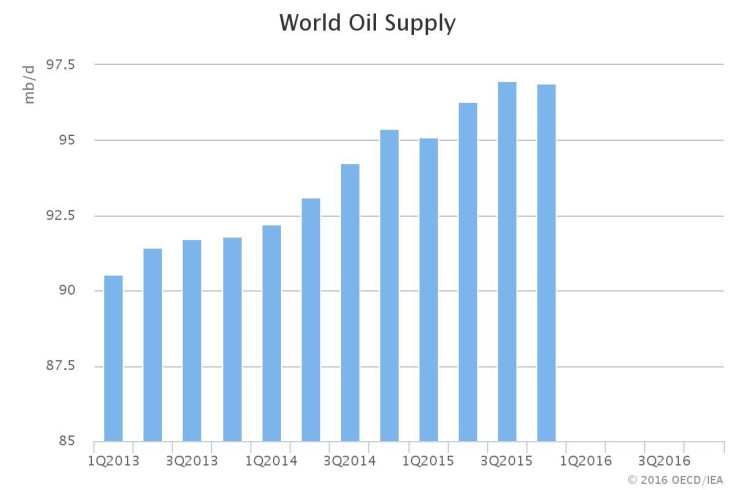

Oil prices have fallen than 70 percent from a peak of above $100 a barrel in June 2014. Global crude markets are awash in oil thanks to rising U.S. shale production and higher output from both OPEC and non-OPEC nations. At the same time, demand from key consumers — namely China — is growing more slowly than expected as those economies lose steam.

The existing supply imbalance is such that oil production is now effectively running two years ahead of demand, Morningstar analysts said in a 2016 energy outlook report.

So far, cutbacks in spending haven’t made a significant dent in U.S. oil production, since producers have little financial incentive to shutter operating wells. America’s crude output totaled 9.23 million barrels a day for the week ending Jan. 15 — less than the April 2015 peak of 9.7 million barrels a day, but still about double the amount of oil pumped in late 2008, data from the U.S. Energy Information Administration showed.

Still, curtailed spending will eventually cause U.S. oil output to fall later this year or in early 2017, which in turn would help boost prices above today’s level. A sharper turnaround in prices, however, would require one of three drastic events, the Morningstar analysts said.

First, Saudi Arabia would have to cave in to global demands that it cut oil production and cede market share to help raise prices. That’s unlikely to happen. Khalid al-Falih, who chairs the board of state-owned oil giant Saudi Aramco, said last week at the World Economic Forum that Saudi Arabia will not “withdraw our production to make space for others.” Geopolitical shocks in key oil-exporting countries, such as political upheaval in Venezuela or fresh attacks on Iraq’s oil fields, could similarly slow the world’s output. An unexpected boost in global demand would also ease the global supply glut. Oil demand is expected to total 95 million barrels a day this year and 96 million barrels next year.

“Without one or more of these occurring, ‘lower for longer’ looks to be the unavoidable near-term course for the industry,” according to Morningstar.

Chevron Corp. (NYSE:COP), Murphy Oil Corp. (NYSE: MUR), Phillips 66 (NYSE:PSX) and Valero Energy Corp. (NYSE:VLO) will report fourth-quarter earnings later this week. Exxon Mobil Corp. (NYSE:XOM) and ConocoPhillips (NYSE:COP) will report their earnings the first week of February.

Oil-field services giant Baker Hughes Inc. (NYSE:BHI) is expected to report Thursday. Its rivals Schlumberger Ltd. (NYSE:SLB) and Halliburton Co. (NYSE:HAL) both posted fourth-quarter losses on Friday and Monday, respectively.

Here’s what to look for in earnings reports from the energy sector.

Baker Hughes Inc. (NYSE:BHI) will report earnings Thursday. The oil-field services provider is expected to report $3.5 billion in revenue, down from $6.6 billion in the year-ago period, according to analysts polled by Thomson Reuters.

The Houston supplier is forecast to report an unadjusted loss of $44.45 million, or 0.09 cents per share, down from a previous gain of $663 million, or $1.52 per share, in the October-December period of 2014. The stock has shed nearly 32 percent of its value in the last 12 months.

Baker Hughes has slashed more than 16,000 jobs worldwide since the start of 2015 as producers cancel new projects, delay payments and drive down prices for drilling equipment rentals, on-site services to the oil patch and hazardous waste handling. Thirty-nine companies in this segment filed for bankruptcy protection in 2015, representing more than $5 billion in aggregate debt, the law firm Haynes and Boone reported last week.

Halliburton is preparing to acquire Baker Hughes for $35 billion, although a growing list of antitrust concerns could threaten the merger.

Chevron Corp. (NYSE:COP) is scheduled to announce earnings Friday. The oil and gas producer is expected to report $28.7 billion in revenue, a nearly 38 percent drop from its revenue of $46.1 billion for the same period in 2014, the Thomson Reuters poll results showed.

The San Ramon, California, company is forecast to report an unadjusted gain of $913 million, or 0.50 cents per share, down from its gain of nearly $3.5 billion, or $1.85 per share, in the year-ago period. The stock has lost nearly 24 percent of its value since Jan. 26, 2015.

Much of Chevron’s growth in the next few years will come from its two liquefied natural gas projects in Australia, including the $54 billion Gorgon facility and $29 million Wheatstone project. Each will add about 200,000 barrels of oil equivalent per day at peak production levels. But the projects have been mired in delays and cost overruns. The increase capital, combined with lower earnings from cheaper crude prices, should combine to offset the benefits of greater production and higher downstream earnings, Morningstar equity research analysts said in a Jan. 14 note.

Exxon Mobil Corp. (NYSE:XOM) will report earnings Feb. 2. The Irving, Texas, energy behemoth is expected to report $52.5 billion in fourth-quarter revenue, down from $87.3 billion for the same period in 2014, according to the Thomson Reuters poll.

Exxon is forecast to report an unadjusted gain of over $3 billion, or 70 cents a share, down from its gain of $6.6 billion, or 1.56 cents a share, in the year-ago period. The stock has lost nearly 18 percent of its value from Jan. 26, 2015.

The company’s reliance on higher-cost projects to replace its reserves is driving the decline in returns, Morningstar analysts said in a Nov. 4 note. Exxon spending should stay relatively high through 2017, as well. But its investment levels are projected to fall over the next five years as Exxon brings on longer-life production that requires less reinvestment to maintain, according to Morningstar.

ConocoPhillips (NYSE:COP) is scheduled to announce earnings Feb. 4. The oil giant is expected to report $9.06 billion in revenue, down from $11.85 billion in the year-ago period, the Thomson Reuters poll showed.

The Houston, Texas company is forecast to report an unadjusted loss of $456.3 million, or a loss of 46 cents per share, down from a smaller loss of $39 million, or 0.03 cents per share in the October-December period in 2014. Its shares have lost nearly 47 percent of their value in the last 12 months.

© Copyright IBTimes 2025. All rights reserved.