US Oil Sector Bankruptcies To Rise In 2016 As 'Panic And Fear' Grip Industry

America’s oil fields until recently buzzed with activity and swam in cash as oil prices rose above $100 a barrel and hydraulic fracturing spurred a U.S. drilling boom. Now dozens of companies are facing bankruptcy and tens of thousands of people are out of work — and the pain is expected to deepen this year as the oil-price collapse continues.

“There’s panic and fear in the marketplace right now,” said Jeff Nichols, a partner in the law firm Haynes and Boone’s energy practice in Houston. “It seems to be the inverse of the irrational exuberance that happened when prices were extremely high.”

Oil field service companies in particular will struggle as producers reduce their orders or delay payments on heavy equipment rentals, drilling materials and well-site services like hauling hazardous waste. Thirty-nine such companies filed for bankruptcy protection in 2015, representing more than $5 billion in aggregate debt, Haynes and Boone said Tuesday in its latest oil market bankruptcy report. That’s well under 5 percent of the hundreds of middle-market oil field service companies in the country, the law firm estimated.

Patrick Hughes, who heads Haynes and Boone’s Denver office, said he expected bankruptcy filings in this sector would exceed last year’s totals. “Best guess is at least double 2015 on bankruptcies, with that being maybe 20 percent of the number needing some form of restructuring,” he said in an email.

Oil prices have plummeted 70 percent over the past 18 months as a growing global supply glut has bumped against weaker economic outlooks in China and other key markets, sparking worries over declining demand. West Texas Intermediate, the U.S. crude oil gauge, on Wednesday hit its lowest level since September 2003, sliding below $27 a barrel in early trading against a backdrop of plunging global equities.

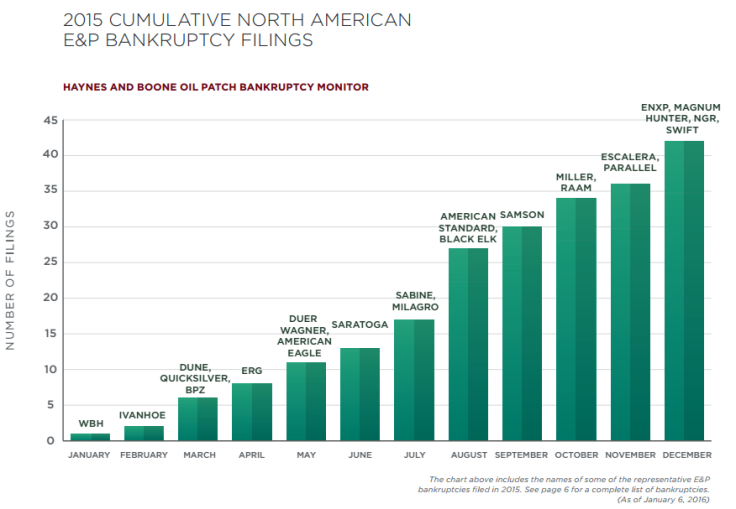

Companies in exploration and production — the industry’s high-risk, high-reward segment — have seen even higher numbers of bankruptcy filings and debt loads than oil field service firms. Among E&P firms, 42 filed for bankruptcy protection in 2015, together involving around $17 billion in cumulative debt, Haynes and Boone found in a Jan. 6 report. That’s still less than 1 percent of the estimated 6,000 independent oil and natural gas producers in the U.S.

“Unless the price of oil goes dramatically up, we will continue to see that trend,” Charles Beckham, a partner at the law firm, said during a panel Tuesday at Haynes and Boone’s New York City office.

The biggest problem for most U.S. oil drillers is a lack of cash. Many companies need to keep up some degree of oil output to meet the terms of lease agreements or manage their ballooning debt obligations. AlixPartners, which specializes in corporate restructuring, estimated that North American drillers will come up $102 billion short on the cash they need this year to maintain even basic operations.

“There’s still a minimal amount of [capital expenditure] they need going forward to keep the lights on, and to live for another day,” Buddy Clark, who heads Haynes and Boone’s energy practice group, said during the panel in New York. He said many companies are trying to “keep as much of their manpower and teams in place as they possibly can for when prices turn around.”

The cash crunch could push producers to adopt widespread pay cuts or wage freezes, curb employees’ hours or pressure oil field service contractors for deeper discounts or delayed payment schedules. And even a “lights on” approach — budgeting only enough money for essentials — might not be enough to keep companies afloat, AlixPartners analysts said in their 2016 industry outlook.

“They’re quickly beginning to exhaust their options, and that’s why you’re seeing more bankruptcies,” Dennis Cassidy, the firm’s managing director, told the energy news site FuelFix. “There isn’t an easy solution.”

U.S. oil production has held steady despite the financial pressures gripping the industry. Crude production totaled 9.227 million barrels per day for the week ending Jan. 8, according to the U.S. Energy Information Administration. That’s down from the April 2015 peak of 9.7 million barrels per day, yet still about double the pre-boom levels of 2008.

But U.S. output is expected to fall later this year as the sharp cuts in investments and falling number of new wells drilled catch up with producers. That could help U.S. oil producers and service providers in the long run if the drop in supply helps push up prices.

“Most analysts still expect oil to be in the price range of $45 to $50 [a barrel] for 2016,” Nichols said. He pointed to a Jan. 12 Wall Street Journal survey of 12 banks, which said they see U.S. crude averaging $48 a barrel this year, down $5 from the newspaper’s previous survey.

Still, Nichols added, “some analysts are revising that downward as we speak.”

© Copyright IBTimes 2025. All rights reserved.