Pluristem Therapeutics, Facebook Inc, ARM Holdings Plc, Francesca's Holdings Corp, BP Plc, Nokia Corp, Alcatel Lucent SA, Capital One Financial Corp, Netflix and Lennar Corp. are among the companies whose shares are moving in pre-market trading Wednesday.

Manufacturing downturns spared no one in August, surveys of purchasing executives showed, in the latest sign of weakness in the global economy. While the batch of gloomy data has boosted hopes for further central bank actions, some economists remain skeptical that there would be any significant effects.

U.S. stock index futures pointed to a lower open Wednesday as investor confidence continued to be weighed down by high degree of uncertainty about policymakers announcing stimulus measures to revive economic growth momentum.

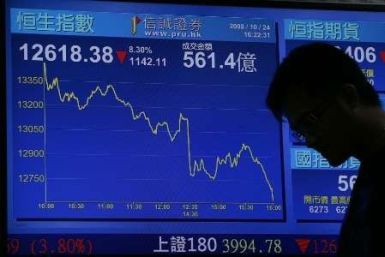

Asian stock market declined Wednesday as weak economic reports from U.S. and China weighed on the sentiment. Concerns over global economic downturn resurfaced after the Institute for Supply Management (ISM) said that U.S. factory activity contracted for the third straight month in August

Crude oil futures declined Wednesday as weak manufacturing reports from the U.S. and China raised concerns of a further global slowdown.

European markets remained in a tight range Wednesday as investors continued to be nervous ahead of the meeting in which the European Central Bank is expected to announce policy measures to boost the euro zone economy and revive growth momentum

The top after-market Nasdaq gainers Tuesday were Wendy's Company, Santarus Inc, Sarepta Therapeutics Inc, Glu Mobile Inc and Facebook.

August saw the Indian private sector business growing at its swiftest in six months. The rapid progress was augmented by development in new business since February amid increasing optimism about the future, according to a survey on Wednesday.

The top after-market NYSE gainers Tuesday were Guidewire Software, Cenveo Inc, Six Flags Entertainment Corp, CONSOL Energy and Pep Boys-Manny, Moe & Jack. The top after-market NYSE losers were Greenhill & Co, Assured Guaranty Ltd, Kindred Healthcare, Nustar Energy L.P. and Giant Interactive Group Inc.

China's services activity growth declined in August to the slowest pace in a year after the recovery in July, according to the HSBC Purchasing Managers' Index released Wednesday.

Asian markets fell Wednesday as investors' concerns about the weakening global economy was revived by the declining U.S. manufacturing activity and disappointing China's services activity.

Asian shares and the euro eased Wednesday, with investors waiting for a European Central Bank meeting on Thursday and U.S. payrolls on Friday for signs of more action to counter European debt woes and support growth.

Hudson's Bay Co., the owner of Lord & Taylor and North America's oldest continuously operating retailer, plans to go public on the Toronto Stock Exchange by November in one of the biggest retailer offerings since the financial crisis began, according to reports.

Manchester United PLC (NYSE: MANU), the 19-time English Premier League soccer champion, is valued at an average of $17 per share.

Indians actually share the values promulgated by the Republican Party rather than the Democrats whom they usually vote for.

Oil & Natural Gas Corp. (Mumbai: ONGC), India's largest state-controlled energy driller, could lose its bid for $5 billion in Canadian assets controlled by energy giant ConocoPhillips Co. (NYSE: COP), due to its investments in Iran, which is facing U.S. sanctions.

During the holiday week, economy-watchers are likely to focus on Friday's August nonfarm payrolls report and the European Central Bank’s governing council meeting, on Sept. 6.

This means that Tokyo’s population in 2100 will match the numbers from 1940.

The head of the European Central Bank is signaling that the ECB may be ready to offer short-term loans to the monetary union's most at-risk members like Spain and Italy.

StemCells Inc, Tower Semiconductor Ltd, Nokia Corp, Anheuser-Busch InBev, Telefonica, Valeant Pharmaceuticals, Banco Santander, Coca-Cola Co, Harmony Gold Mining Co and ARM Holdings plc are among the companies whose shares are moving in pre-market trading Tuesday.

IT sector funds were the top performers in August among Indian mutual funds that focus on domestic stocks as lower valuations of the sector's shares after their sharp declines in July revived investor interest.

Asian stock markets ended lower Tuesday as investors remained watchful ahead of the European Central Bank (ECB) meeting and U.S. non-farm payrolls data later this week.

The U.S. stock index futures point to a higher open Tuesday as market sentiment was underpinned by expectations that policymakers around the world will announce stimulus measures to rejuvenate the economic growth momentum.

Most of the European markets fell Tuesday as investors continued to remain cautious waiting for the policymakers to announce stimulus measures to boost the euro zone economy and revive the growth momentum.

Asian markets remained in a tight range Tuesday as investors were waiting for the outcome of meetings among the policymakers in the euro zone which is expected to announce measures to tackle the debt crisis affecting the region.

Asian stock markets mostly ended higher Monday on hopes that major central banks around the world would soon announce a new round of stimulus measures to tackle the deteriorating global economic conditions.

European markets were mixed Monday as investors continued to remain watchful waiting for policymakers to announce the stimulus measures to boost the euro zone and revive the growth momentum.

With India's economic growth faltering as a result of weak governance, policy paralysis and opposition to reforms, investors feel the urgent need to push for plans to allow foreign direct investment in financial sector and multi-brand retail trade.

Crude oil prices declined in Asia Monday as sentiment was dampened after reports indicated a sharp slowdown in the Chinese manufacturing activity in August.

Most of the Asian markets rose Monday as investors remained hopeful that the world's central banks would announce stimulus measures soon to help boost the global economic growth.