In the statement released with the initiation of the new program, it was obvious the Fed hoped to stimulate the economy while lowering unemployment and boosting the housing market.

The Palestinian Authority's budget is short some $400 million, a gap that will remain and cause serious fiscal difficulties, even if all donors fulfill their 2012 pledges to Palestine, the World Bank warned on Wednesday.

The Washington-based International Monetary Fund has had enough of Argentina's attempts to reduce its inflation-indexed debt payments by using sketchy stats.

There are fears over the economic impact of the dispute between China and Japan if the row over islands in the East China Sea is not resolved soon.

FedEx's forecast cut, signs of stagnation in Germany, drops in oil price and looming political tensions spell trouble for the global economy.

The stock markets are having a monster rally. But next earnings season might challenge that.

The high abortion rate of female fetuses has led to a dramatic gender imbalance in India ? over the fifty-year period from 1961 to 2011, the number of girls born per 1,000 boys plunged from 976 to 914, according to the census.

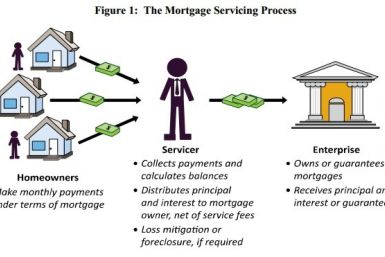

The taxpayer-owned Fannie Mae paid more than legally required to Bank of America Corp (NYSE: BAC) and 12 other lenders when it spent $1.5 billion in termination fees for servicing rights on 1.1 million loans between 2008 and 2011. The mortgage giant argues that while it paid a premium over the minimum required price, it paid for the transfers at an ?appropriate rate.?

Many European banks have used easy credit from the European Central Bank to expand their balance sheet rather than use the easy credit to slim down and cut the level of risk in the assets they hold. In other words, too-big-to-fail is alive and well in the recession-plagued euro zone.

Popular art often mirrors common ideas about current economic affairs and reflects the conventional wisdom guiding public opinion. This is particularly true of film.

Tax cuts for the rich don't seem to be associated with U.S. economic growth and instead are linked to a different outcome: greater income inequality in the U.S. These findings will likely fuel the already bitter political fight over extending the Bush tax cuts for upper-income groups.

The top after-market NYSE gainers Monday were Alliance One International, AU Optronics Corp, Dole Food Co, Tenet Healthcare Corp and KKR Financial Holdings LLC. The top after-market NYSE losers were HNI Corp, Advanced Micro Devices, Steelcase Inc, ExactTarget and K12 Inc.

Most of the Asian markets dropped Tuesday as investor confidence was weighed down by the intensifying tensions between China and Japan and the increasing concerns over the euro zone debt crisis.

Asian shares retreated from four-month highs Tuesday as markets paused from last week's rallies, calculating the impact on growth from the Federal Reserve's aggressive stimulus and eyeing whether Spain will request a bailout to ease its fiscal strains.

A French polling group found that 64 percent of France would vote against switching to the euro currency if the referendum were held today, but also are against moving back to the franc.

General Electric Co. (NYSE: GE) and ING Groep NV (NYSE: ING) may sell their stakes in two Thailand banks, but their message to Asia's 11th largest economy could very well be, "It's not you, it's us."

Financial markets yawned Monday in the face of an anemic U.S. manufacturing report from the Federal Reserve Bank of New York that showed industrial production in the Northeast falling to a nearly two-year low.

YPF SA, Nokia Corp, Home Depot Inc, Home Depot Inc, Arcelormittal, Arch Coal Inc, Royal Bank of Scotland Group plc and Weatherford International Ltd. are among the companies whose shares are moving in pre-market trading Monday.

Asian stock markets ended mixed Monday after they rallied to a four-month high in the previous session following the U.S. Federal Reserve's move to boost growth in the world's largest economy with a third round of bond purchases.

The U.S. stock index futures point to a lower open Monday after the rally seen last week following the announcement of the Federal Reserve's plan to buy mortgage securities.

European markets fell Monday as investor sentiment turned negative after fears of the debt crisis affecting the euro zone were revived undermining the optimism over the stimulus measures announced by policymakers to bolster economic growth.

There were quiet celebrations in the offices of Prime Minister Manmohan Singh late last week after he stunned the country with a slew of steps to revive the tanking economy.

Most of the Asian markets dropped Monday after the rally last week when investor confidence was buoyed by the optimism that the stimulus measures announced by the central banks in the U.S. and the Europe would help revive the global economic growth momentum.

The Canadian Auto Workers, or CAW, will concentrate on the Ford Motor Co. (NYSE: F) as it attempts to negotiate a collective-bargaining agreement in the roughly 24 hours left before its fast-approaching strike deadline on Monday at 11:59 p.m. EDT.

Asian stock markets posted their biggest weekly gains in almost nine months after the U.S. Federal Reserve announced that it would purchase $40 billion in mortgage-backed securities per month for an open-ended period until the labor market improved substantially.

If sales following the iPhone 5 release date are as high as analysts predict, the Apple smartphone could aid the struggling US economy. .

The top after-market NYSE gainers Friday were AutoZone, Main Street Capital Corp, Owens & Minor, YPF SA and FelCor Lodging Trust Inc. The top after-market NYSE losers were Accretive Health, Chiquita Brands International, Chesapeake Utilities Corp, Alliance One International and Weight Watchers International Inc.

The top after-market Nasdaq gainers Friday were MIPS Technologies, Star Scientific Inc, ACADIA Pharmaceuticals Inc and Alpha and Omega Semiconductor Limited. The top after-market Nasdaq losers were Nanosphere Inc, Orexigen Therapeutics Inc, Fulton Financial Corporation and Acme Packet Inc.

With the Bank of Korea unexpectedly holding its policy rate at 3 percent, market participants feel that stimulus measures will be urgently needed to reinvigorate the country?s weakening economy.

Most of the Asian markets gained in the week as investor confidence was lifted following the announcement of another round of quantitative easing by the U.S. Federal Reserve which is expected to rejuvenate the economic growth.