Fed Too Downbeat on the Economy, Says Philadelphia Fed President

The inflation hawks might have gotten their wings clipped last week, but that has not kept some of them from high-flying media appearances.

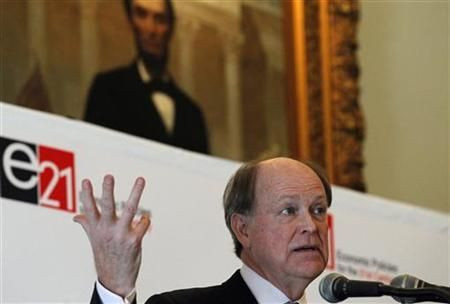

The Federal Reserve's assesment of the economy is too pessimistic, and will likely change as the year progresses, Philadelphia Federal Reserve President Charles Posser told CNBC. Posser is one of the most influential dissenters at the U.S. central bank.

Even more notably, he said the Fed will likely begin raising benchmark interbank lending rates before mid-2013 -- a direct contradiction of last Wednesday's statement by the bank that it would keep rates at current levels through late 2014.

In a televised appearance, Plosser said the Federal Reserve's we've got to do more attitude was unwarranted, as the economy was steadily, if slowly, recovering. He sees GDP growth of close to three percent for the next two years and unemployment dipping below eight percent by yearend.

That view stands in stark contrast to the ones expressed on Wednesday.

Economic conditions -- including low rates of resource utilization and a subdued outlook for inflation over the medium run -- are likely to warrant exceptionally low levels for the federal funds, the board of governors of the U.S. central bank said Wednesday in a statement.

Plosser said that statement was not a commitment and it shouldn't be interpreted as a commitment. It will depend on how the economy moves going forward.

Plosser was not part of the decision-making that took place last week -- the members that make up the Fed's rate-setting committe rotate on a regular basis -- but during his tenure last year, he was considered one of the three inflation hawks at the central bank, as he was consistently more worried than his peers about the effects of accommodative monetary policy would have on price stability.

His public statements are also considered highly influential. Macroeconomic Advisers, LLC, an economics research firm, recently calculated that -- among Fed chiefs -- Plosser's speeches had the largest impact on the U.S. government debt market.

Plosser is not the first Fed president to publicly rail against the Federal Reserve board since that body's statement Wednesday. On Friday, Richmond Federal Reserve Bank President Jeffrey Lacker, who was the lone dissenting voice from Wednesday's action, explained his vote in a statement.

I expect that as economic expansion continues, even if only at a moderate pace, the federal funds rate will need to rise, Lacker wrote.

© Copyright IBTimes 2024. All rights reserved.