Fiat Chrysler's Profit Just Roared Past Ford's

Fiat Chrysler Automobiles (NYSE:FCAU) reported on Oct. 30 that its third-quarter adjusted operating profit rose 13% year-over-year to 1.99 billion euros, and also said that it would pay a special 2 billion euro dividend to investors after the sale of a subsidiary closes next year. But FCA's net profit fell 38% after a one-time charge of 713 million euros, which it booked in anticipation of the hefty fine it expects to have to pay shortly to settle its diesel-emissions violations case with the U.S. Justice Department.

This article originally appeared in the Motley Fool.

Excluding that one-time charge, FCA's operating profit beat the Wall Street consensus estimate as reported by Thomson Reuters. It also beat the adjusted operating profit posted by its larger rival, Ford Motor Co. (NYSE:F).

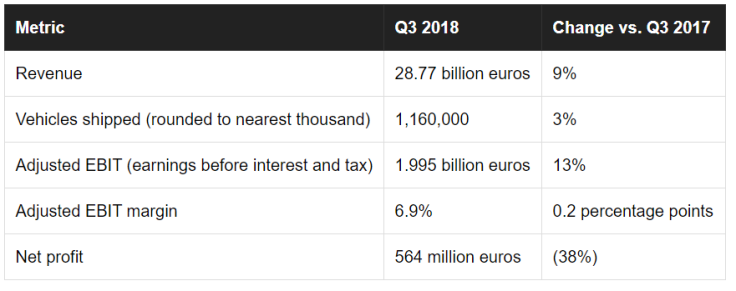

FCA's third quarter: The raw numbers

All financial figures are reported in euros. As of Sept. 30, 1 euro = about $1.16.

Business unit performance

All of the profit numbers for FCA's regions and business units are presented as FCA reports them, on an "adjusted EBIT" basis. "Adjusted EBIT" is earnings before interest and tax, "adjusted" to eliminate the effects of one-time items.

- FCA's NAFTA (North America) unit earned 1.94 billion euros, up 51% from its result in the third quarter of 2017. The all-new 2019 Ram 1500 pickup helped drive higher sales, better pricing, and an improved product mix. Dragging on those results were the higher prices it had to pay for key commodities, notably aluminum and steel. But margin in the region rose to 10.2% from 8% a year ago, beating Ford's 8.8% North American margin in Q3.

- The LATAM (Latin America) unit earned 83 million euros, up 41% from a year ago. That was a notable success in a region where key rivals (including Ford and General Motors) have struggled. An 8% increase in sales, better pricing, and improved mix drove the gain, though unfavorable exchange-rate movements sapped some strength from the overall results.

- The APAC (Asia, Pacific, Africa, and China) unit lost 96 million euros, compared to the profit of 109 million euros it delivered a year ago. FCA's sales fell 30% in the region, largely because of marketwide weakness in China, and increased regional competition in the SUV segment.

- The EMEA (Europe, Middle East, and Africa) unit lost 25 million euros, versus a profit of 127 million euros a year ago. A jump in Jeep sales wasn't enough to offset a broader decline; overall sales fell 4%. FCA had to heavily discount its inventory of used cars ahead of the European Union's transition to new vehicle-emissions standards on Sept. 1, which hurt its margins. But CEO Mike Manley noted that all FCA models were certified under the new standards before they took effect, meaning that new-vehicle sales should be robust in the fourth quarter.

- Maserati earned just 15 million euros in the third quarter, a drop of 87% from a year ago. The story is simple: Maserati's revenue fell 23% as sales declined 19% on decreases in Europe and China.

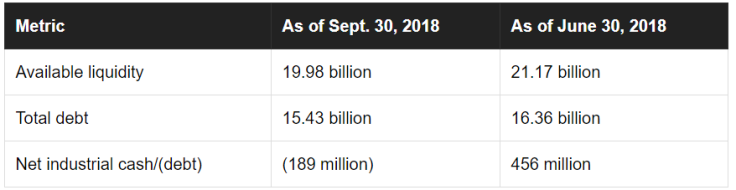

Why FCA trimmed its full year net cash guidance

CFO Richard Palmer detailed FCA's current expectations for its full-year results:

We expect revenue and adjusted EBIT at the lower end of the range due to the reduced volumes for management of inventory in NAFTA and lower than forecast sales in LATAM, due to Argentina, and EMEA.

These are largely offset in terms of profitability by improved mix and price in NAFTA and LATAM, but have impacted our working capital negatively in Q4, which has caused us to adjust our net industrial cash guidance, together with the impacts of the pull-forward of the discretionary pension contribution. Q4 cash flow target is around 2 billion euros, in line with the prior year performance.

For the full year, FCA now expects:

- Net revenue between 115 billion and 118 billion euros. (Unchanged from prior guidance. 2017 result: 110.9 billion euros.)

- Adjusted EBIT between 7.5 billion and 8 billion euros. (Unchanged from prior guidance. 2017 result: 7.05 billion euros.)

- Adjusted net profit of about 5 billion euros. (Unchanged from prior guidance. 2017 result: 3.77 billion euros.)

- Net industrial cash at the end of 2018 of between 1.5 billion and 2 billion euros. (Prior guidance: about 3 billion euros. 2017 result: Net industrial debt of 2.39 billion euros at year-end.)

The upshot: FCA probably won't beat Ford over the long haul. But the company's profitability gains weren't a one-time fluke.

John Rosevear owns shares of Ford and General Motors. The Motley Fool recommends Ford. The Motley Fool has a disclosure policy.