Has Spotify Reclaimed The No. 1 Spot In The US?

Apple (NASDAQ:AAPL) and Spotify (NYSE:SPOT) remain locked in an intense battle for leadership in the U.S. market for paid music streaming. The U.S. is the largest music market in the world, and Apple Music reportedly overtook Spotify in terms of paid subscribers in February. But Spotify isn't sitting still, leveraging aggressive promotions like free smart speakers in an effort to push back against Apple poaching subscribers.

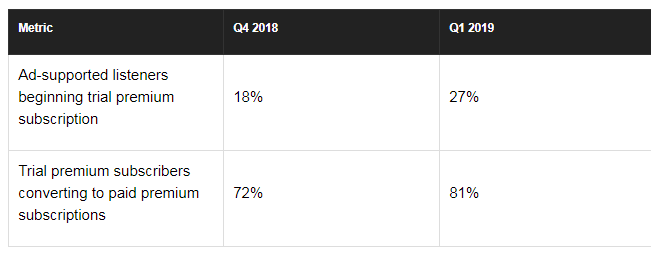

Spotify is making progress with improving its conversion rate of trial users to paid subscribers.

A close call

Consumer Intelligence Research Partners (CIRP) released a research report this morning that estimates that Spotify added 3 million subscribers in the first quarter. However, the report does not mention how many premium subscribers Spotify may now have in total. I reached out to CIRP for clarification, and co-founder Mike Levin said CIRP estimates that Spotify ended the first quarter with 28 million to 29 million premium subscribers.

For reference, The Wall Street Journal article earlier this month reporting Apple becoming No. 1 said that Apple Music ended February with 28 million U.S. subscribers, compared to Spotify's 26 million. That means that there is a possibility that Spotify has reclaimed its No. 1 spot in the all-important U.S. market, depending on the accuracy of the estimates and how many U.S. subscribers Apple may have garnered in the month of March.

Lacking official disclosures from either company on U.S. subscribers, the only thing that investors can safely say is that Apple Music and Spotify are neck and neck in this race.

Spotify is filling its funnel

Offering a free tier supported with ads is one of Spotify's key points of differentiation from Apple Music, one that creates a funnel of users that may convert to paid subscribers. Spotify has estimated that 60% of its paid subscribers come from the free tier, and that it typically takes about 12 months for the Swedish company to break even on those subscribers.

CIRP estimates that Spotify is getting more free users to try out a premium subscription, and that more of those trials are converting into paid subscriptions compared to the fourth quarter. Meanwhile, the proportion of subscribers that canceled their subscriptions, either to use the free tier or to stop using Spotify altogether, was relatively flat.

"Spotify continues to fill its 'funnel' by increasing its initial customer trials of the Premium service and converting those trial customers to paid subscribers," Levin said in a statement. "Once someone begins a trial, they are increasingly likely to begin paying for a Premium membership. Spotify has also managed its churn rate, so the number of members who end a paid Premium membership seems to have stabilized at 13-14% in a given quarter."

Spotify reports first-quarter earnings next Monday.

This article originally appeared in the Motley Fool.

Evan Niu, CFA owns shares of Apple and Spotify Technology. The Motley Fool owns shares of and recommends Apple. The Motley Fool has the following options: long January 2020 $150 calls on Apple and short January 2020 $155 calls on Apple. The Motley Fool has a disclosure policy.