How Stocks Might Be Impacted By The Midterm Election Results

In the aftermath of the midterm elections, curiosity surrounds how the financial markets will react. The White House and Senate remain in Republican control, while Democrats won the majority in the House.

According to Investor’s Business Daily, a divided Congress may be beneficial to the markets.

“The best outcome, an average 18.7% two-year return, came when Congress was divided. Unified control of Congress by the same party as the president yielded an average 17.3% two-year gain. When control of Congress was unified under the opposition party, gains averaged 15.7%," IBD wrote on Tuesday.

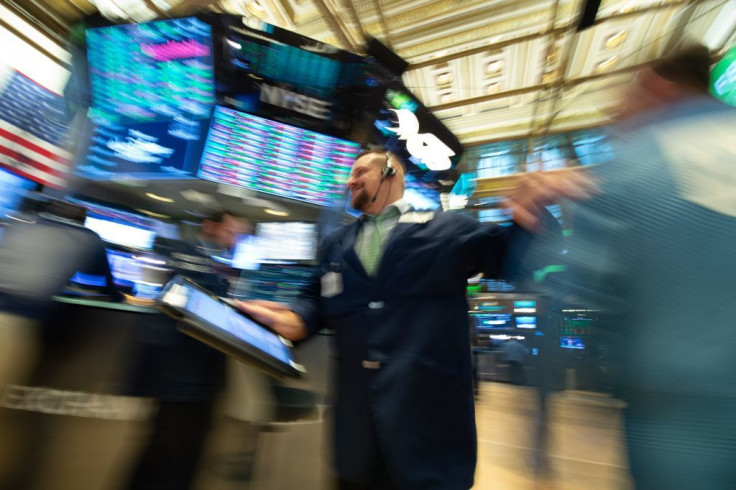

The markets opened sharply higher Wednesday. As of 2:55 p.m. ET, the Dow Jones had gained 458 points, or 1.79 percent, while the S&P 500, gained 48.94 points, or 1.77 percent, and the Nasdaq jumped 165.21 points, or 2.24 percent.

The markets were less volatile due to the elections panning out as most analysts had expected.

Because the Democrats now control the House and the Republicans have a more solid grip on the Senate, one theory being reported is that President Trump’s trade battles with China may have to be dialed down.

"Our base case of the Democrats taking over the House holds the potential to reduce downside risks from trade policy friction," wrote Deutsche Bank's Binky Chadha.

In premarketing trading Wednesday, Boeing gained 0.25 percent, while Caterpillar gained 1.48 percent. Both defense companies were previously mentioned as possible candidates for losses due to the trade tensions. Last November, Boeing made an arrangement to sell $37 billion dollars worth of new planes to a company in China. Caterpillar has about 20 facilities in China, so its operations are tied to the Asian economic powerhouse.

The election may also prompt President Trump to make some significant changes to trade that will help boost the U.S. economy.

"I think it starts at the G-20 meeting with China. It looks like the president could do something big on trade," said Dan Clifton, head of policy research at Strategas Research.

President Trump and Republicans could find common ground with Democrats on infrastructure plans. Prior to the midterm elections, the Democrats were talking about a $1 trillion dollar infrastructure package, though Republicans may disagree on which infrastructure projects to support. If both parties do manage to agree and get funding for projects, it would mean growth for equipment manufacturers, oil and gas companies, construction companies, and steel producers.

Construction rental company United Rentals was up 2.5 percent in premarket trading.

"The Democrats are likely to push plans for large-scale infrastructure spending. Republicans have generally opposed Democratic plans on this issue, but President Trump has expressed support for infrastructure spending and might be willing to help," wrote HSBC chief U.S. economist Kevin Logan.

Another potential area of agreement between the Democrats, Republicans and President Trump is price controls for prescription drugs. In October, the President signed two bills intended to lower pharmaceutical drug prices.

"I think we could find common ground on reducing the cost of prescription drugs if the president is serious about his saying that he wants to do that," said Nancy Pelosi, who is expected to become the next Speaker of the House.

© Copyright IBTimes 2025. All rights reserved.