IAC, AOL Report Upbeat Quarters But Still Face Media Challenges

IAC/InterActiveCorp. (Nasdaq: IACI) and AOL Inc. (NYSE: AOL) both reported profitable second quarters on Wednesday, and both New York-based companies discussed the futures of their respective troubled media properties.

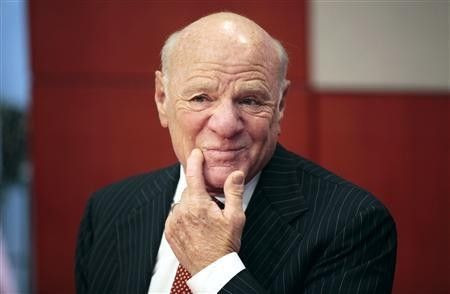

IAC's chairman Barry Diller said in an earnings call that Newsweek, the 89-year-old magazine, could potentially go online-only as the print industry struggles with falling ad rates. "We are examining all of our options," Diller said on the call.

IAC took a controlling stake in the magazine after the family of late billionaire Sidney Harman, who bought Newsweek for $1 and an assumption of all debt, declined to invest further in the weekly magazine, according to Reuters. Although Newsweek had a 27.5 percent increase in ad pages during the first quarter of this year, according to industry figures, both the magazine and the Daily Beast website are reportedly money-losers, although the exact number hasn't been disclosed. In contrast, IAC's web properties like the dating site Match.com are the company's profit engines.

Tina Brown, editor of both Newsweek and the Daily Beast, said there were no definitive plans to close the magazine's print edition, according to an internal memo obtained by Jim Romenesko. "In September we would be evolving our plan for the year ’13, with many options to choose from," she wrote in the memo.

Meanwhile, once-dominant online portal AOL, perhaps best known nowadays for its ownership of the Huffington Post, has been criticized for its operations at Patch, its network of hyperlocal news websites. The activist hedge fund Starboard Value, a major AOL shareholder, put it bluntly earlier this year: "Patch is not a viable business."

But Tim Armstrong, AOL's CEO, continues to be a champion of Patch, which launched before the Huffington Post acquisition. Patch's traffic numbers grew at double digit-rates year-over-year and quarter-over-quarter, and revenue doubled compared to the previous year, AOL said Wednesday. The company expects Patch to have $40 million to $50 million in revenue this year.

Armstrong told Ad Age that the websites will expand their offerings into local ecommerce and listings, focusing on smaller towns and cities. "Craigslist and other companies like that that sell used merchandise haven't really scaled into communities," he told Ad Age. "They've been very metro-focused. One of the opportunities for Patch ... is the ability for us on the commerce side to offer the people the ability to do listings and other things like that locally."

IAC and AOL face different challenges, but the moves underscore the turmoil and uncertainty throughout the media industry, both in print and digital. The companies are fortunate that the majority of their revenue is not advertiser-dependent -- IAC gets money from subscriptions to Match.com and other sites, while AOL also has subscribers for its Internet and email services.

Investors appeared unshaken by the predicaments facing the media segments of both companies. IAC shares rose 5.9 percent to $51.18 at Wednesday's close. AOL jumped 7.24 percent to $29.48.

© Copyright IBTimes 2025. All rights reserved.