IMF Cuts 2016 Global Growth Forecast To 3.2%, Citing Low Oil Prices And China’s Economic Slowdown

The global economy is losing steam, raising fears of a sluggish recovery in the world’s key markets.

The International Monetary Fund has cut its outlook for 2016 economic growth for the fourth time in the past year, citing low oil prices, China’s slowdown and chronic weakness in advanced economies. The lender said Tuesday it expected annualized global growth of 3.2 percent, down from the 3.4 percent it predicted in January.

“Global growth continues, but at an increasingly disappointing pace that leaves the world economy more exposed to negative risks,” Maurice Obstfeld, IMF’s economic counselor and director of research, told reporters Tuesday at the presentation of the fund’s latest “World Economic Outlook” report in Washington.

“Growth has been too slow for too long,” Obstfeld said.

The U.S. was one of the relative bright spots in the otherwise murky outlook. Its economy is now seen as expanding by 2.4 percent in 2016, compared with the 2.6 percent forecast earlier this year. In 2017, the global economy is now expected to grow by 2.5 percent, down slightly from the 2.6 percent forecast in January, the IMF said.

China’s Economic Slowdown

The IMF raised China’s growth forecast slightly to 6.5 percent this year and 6.2 percent in 2017, in part because of the government’s recently announced stimulus plan. But the fund said it still expects China’s growth to continue to weaken as the country sheds its “prior excesses” of strong credit and investment growth and transitions to a more balanced growth path.

“A sharper slowdown in China than currently projected could have strong international spillovers through trade, commodity prices and confidence, and lead to a more generalized slowdown in the global economy, especially if it further curtailed expectations of future income,” the IMF said in the World Economic Outlook.

China is shifting away from a manufacturing-dependent economy to one driven by consumer demand. As the nation’s lowers its demand for crude oil, steel, coal and other raw materials that once fueled China’s economic expansion, other export markets will continue to feel the pain.

The IMF noted that economic activity weakened sharply in other Asian advanced economies with close ties to China, including Hong Kong and Taiwan, during the first half of 2015, owing in part to steep declines in exports.

'Brexit' Threat

A British exit from the European Union could cause “severe regional and global damage” that would drag down U.K. growth for years to come, the fund said.

The U.K. in June will hold a historic referendum to decide whether Britain should remain in the 28-nation EU bloc. A “Brexit” would disrupt established trade agreements and create an “extended period of heightened uncertainty” as “protracted” negotiations with EU leaders on a new deal “weigh heavily” on confidence and investment, the IMF said.

Prime Minister David Cameron said Tuesday he agreed with the IMF’s conclusion that a Brexit would threaten to upend the U.K. economy. “We are stronger, safer and better off in the European Union,” Cameron said on Twitter.

The IMF is right - leaving the EU would pose major risks for the UK economy. We are stronger, safer and better off in the European Union.

— David Cameron (@David_Cameron) April 12, 2016

Despite the headwinds, the British economy is still forecast to grow 1.9 percent in 2016 and 2.2 percent in 2017, driven by domestic demand in the private sector spurred by low energy prices and a thriving property market, according to the IMF report.

Brazilian Crisis

Brazil’s prolonged recession and the simmering political tensions will drag on Latin America’s economic growth for the next two years, the IMF said in its World Economic Outlook.

The fund expects Brazil’s economy to contract 3.8 percent this year and level off to zero growth in 2017. That could force another downward revision of the IMF’s already sluggish economic growth forecast for the global economy.

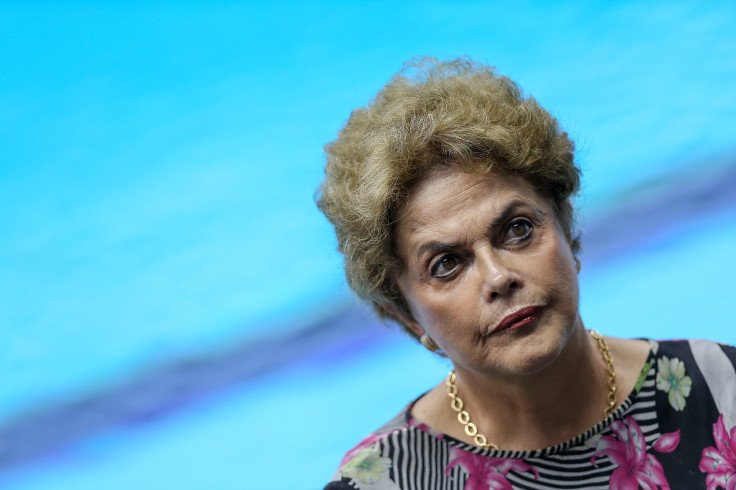

Brazil, Latin America’s largest economy, is headed for its worst recession in nearly a century. Foreign investment and consumer spending have plummeted, in part the result of President Dilma Rousseff’s economic interventions, her critics say.

The embattled leader is facing calls for impeachment amid a widespread corruption scandal ensnaring dozens of Brazilian politicians. A legislative commission Tuesday voted 38-27 in favor of impeaching Rousseff, which sends the issue to the full lower house of Congress for a vote in the coming days.

“Domestic uncertainties continue to constrain the [Brazilian] government’s ability to formulate and execute policies,” the IMF said.

Citing Brazil and falling commodity prices, the fund revised its 2016 recession estimate for Latin America to 0.5 percent from 0.3 percent. It would be the region’s second straight year of contraction and the worst performance of any global region, including slow-recovering Europe. While the IMF expects most of Latin America’s economies to gain steam next year, growth will remain moderate if Brazil’s economy keeps shrinking.

© Copyright IBTimes 2025. All rights reserved.