India Won’t Cut Iranian Oil Import, Says Mukherjee

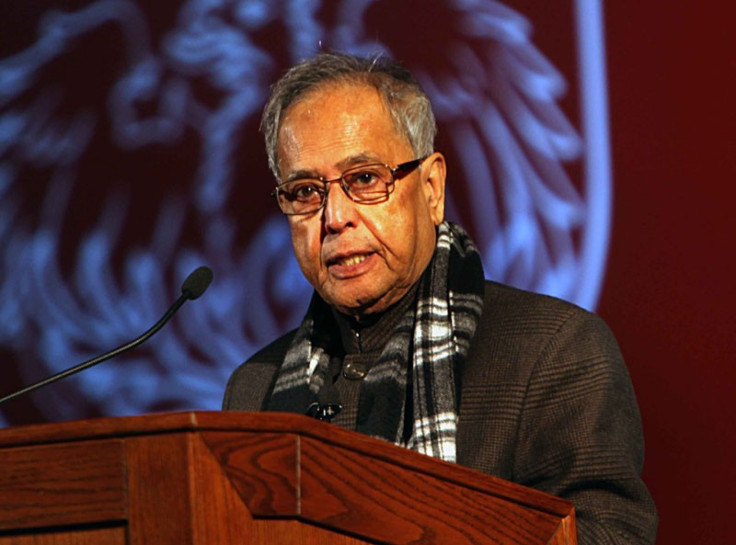

India, the world's fourth-largest oil consumer, will not take steps to cut petroleum imports from Iran despite U.S. and European sanctions against Tehran, finance minister Pranab Mukherjee said on Sunday during a visit to Chicago.

The United States wants buyers in Asia, Iran's biggest oil market, to cut imports to put further pressure on Tehran to rein in its nuclear ambitions. Washington suspects Iran of trying to make nuclear weapons, but Tehran says its nuclear program is for peaceful means.

India, which imports 12 percent of its oil from the Islamic Republic, cannot do without Iranian oil, Mukherjee said.

It is not possible for India to take any decision to reduce the imports from Iran drastically, because among the countries which can provide the requirement of the emerging economies, Iran is an important country amongst them, Mukherjee told reporters in Chicago at the end of a two-day visit aimed at wooing U.S. investment.

New U.S. sanctions, authorized on Dec. 31 and which penalize any financial institutions dealing with Iran's central bank, could make it more difficult for India to pay Iran for oil imports.

The European Union banned oil imports from Iran earlier this month.

Mukherjee said he projects India to return to its path of high economic growth, despite an expected slowdown to a 7 percent pace this year from 8.5 percent last year. The Indian fiscal year ends in March.

This year, because of the European debt crisis and the slowing of developed economies, there has been a slowdown in India's growth, he said. It will be possible to make it up in a year or two.

The Reserve Bank of India (RBI) last week held its policy rate steady and signaled its next move could be a rate cut, after signs that outsized price pressures may be ebbing.

Inflation, as measured by wholesale prices, rose 7.47 percent in December, its slowest pace in two years, and Mukherjee said he expected further declines.

If this trend continues, I am optimistic (India will see inflation of) 6.5 percent to 7 percent by end of the year, he said.

But a possible move by the U.S Federal Reserve to ease monetary policy further could reverse that outlook, he said.

Fed Chairman Ben Bernanke last week opened the door to a third round of quantitative easing, suggesting that a continued decline in inflation and ongoing economic weakness could justify new bond buying.

The Fed's last round of bond-buying drew loud criticism from emerging economies who said it sparked inflation and hurt their exports.

Mukherjee repeated that criticism on Sunday, saying U.S. quantitative easing creates inflationary impacts in emerging economies and boosts uncertainty.

© Copyright Thomson Reuters {{Year}}. All rights reserved.