LifeInsuranceReview.com Shares the 5 Things Your Life Insurance Agent/Broker Won't Tell You (But You Really Need to Know!)

Discover How a Fiduciary Review of Your Life Insurance Will Benefit You

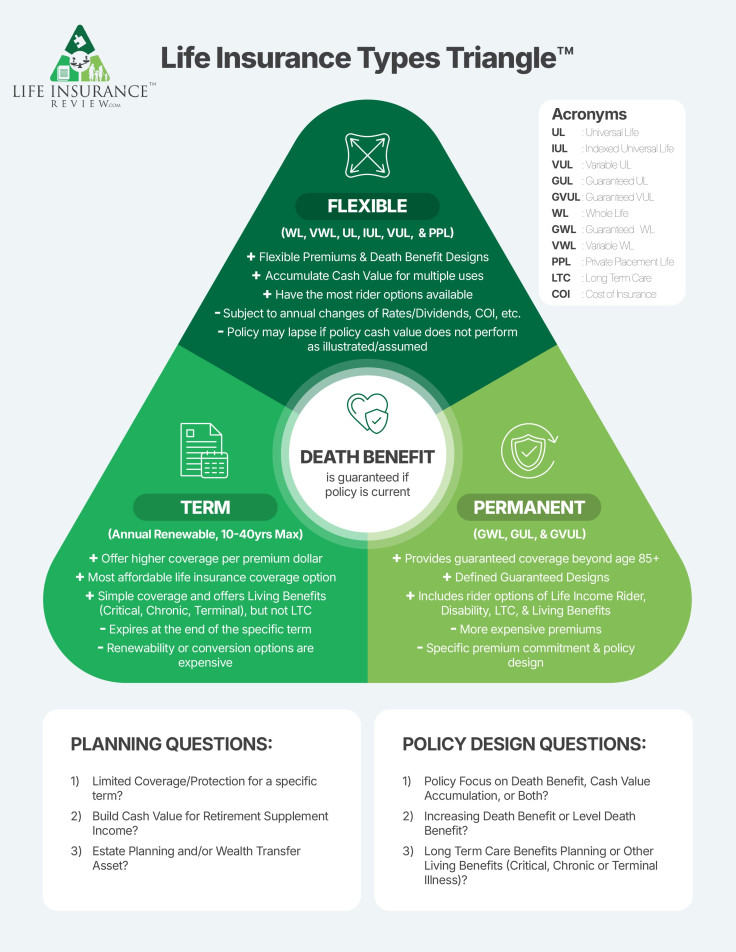

Navigating your life insurance needs can be daunting. You can get lost in a maze of options, terms, and decisions that are overwhelming. Worse, you risk being left in the dark about key details that could impact your financial future. That's where LifeInsuranceReview.com comes in. The company, led by attorney James Burns and life insurance analyst John Nguyen, is committed to shedding light on the things most life insurance agents/brokers won't tell you—but that you really need to know.

"Life insurance is usually sold, not bought," says Burns. "Most people don't fully understand what they're signing up for. Agents and brokers are often incentivized to sell policies that benefit them, not the customer. We want people to know what their agents and brokers might not want them to know."

LifeInsuranceReview.com offers independent, fiduciary-led reviews of life insurance policies, helping consumers make informed decisions. Burns and his team have identified five key things that life insurance agents, brokers, and even some financial advisors may not disclose.

1. Conflicts of Interest Are Common

"One of the things people don't realize is that life insurance agents and most brokers are not fiduciaries," explains Burns. "That means they're not legally obligated to act in your best interest. They can sell you a policy that benefits them more than it benefits you. For example, without getting a second opinion, you might not realize that you were sold a $750,000 policy instead of a $2 million one, even though you paid the same premium. The $2 million policy could have offered better protection, more benefits, and better alignment with your specific financial plan."

Many agents and even brokers are tied to specific companies or product lines, which can limit the range of options they offer.

"It's like going to a car dealership that only sells one brand," Burns adds. "You might not be getting the best car for your needs, just the one they're incentivized or even required by their company to sell."

LifeInsuranceReview.com, by contrast, operates on a fiduciary basis.

"We are a fee-based firm that is solution focused," says Burns. "Our only goal is to be on your side, to empower you to get the best policy for your planning needs."

2. The Commission Structure Can Skew Advice

Another detail that often goes undisclosed is the commission structure behind life insurance sales.

"Agents and brokers make their money through commissions and sales incentives," Burns explains. "The more expensive or complex the policy, the bigger their payout generally. Agents and brokers might push certain policies because they stand to earn more. But those policies might not be the best fit for the client and/or the policy coverage is comparatively lower."

LifeInsuranceReview.com takes a different approach by being 100% on the side of the consumer, offering review services. They review your policy to ensure that you have a policy that meets your needs and nothing else. They are driven to positively disrupt the life insurance marketplace for the betterment of all consumers.

Attorney Burns and life insurance analyst Nguyen have interviewed numerous insurance professionals to join their team, only to be reminded of a troubling trend that persists in the industry: many professionals still prioritize sales over genuine service and protection. Time and again, they've heard from candidates that, in their previous companies, the focus was simply on getting families some form of life insurance, rather than truly assessing the best coverage options. This reinforces that, despite changes over time, the industry's 'sell-first' mindset hasn't evolved much.

Nguyen explains, "We strongly disagree with this approach. Our philosophy is to always do what's right for the consumer. It's not about just selling a policy so that a family has 'something.' It's about ensuring our clients receive the best possible protection and value. Consumers deserve a higher standard, and that's exactly what we are committed to providing."

3. Policy Illustrations Can Be Deceptive

One of the biggest misconceptions in life insurance is the trust consumers place in policy illustrations—those optimistic figures that show how much a policy's cash value can grow over time.

"People think these are guarantees," says Burns, "but they're just projections based on many assumptions variables. And those assumptions are generally overly optimistic. We reviewed original illustrations that show as high as 12% returns, which is completely unrealistic. Realistically, it would be between 4–6% maximum."

This is especially true for cash value accumulation life insurance policies, which are often marketed as vehicles for tax-free growth, claiming to match or beat the general stock market because of their tax benefits and features.

"In reality, the policy may perform very differently than what the illustration suggests," Burns warns. "Unless it's a term life policy, cash value life policies are mostly 'trust me' policies with many uncertain variables."

At LifeInsuranceReview.com, the team helps consumers separate fact from fiction. Our professionals go beyond the marketing materials, carefully examining the fine print and even stress-testing the projected illustrations.

4. Alternatives Are Often Overlooked

"Agents and even brokers tend to focus on a few select policies, often because those are the ones they're most familiar with or the ones they're incentivized to sell," explains Burns. "But, based on our experience, 9 of the 10 cases we reviewed, we see that there are better options out there that they're not telling you about."

LifeInsuranceReview.com empowers clients to explore all available options.

"We're here to give you a complete picture," Burns adds. "That way, you can choose the policy that truly fits your needs, not just the one your agent or broker tells you is best."

5. You Have a 'Free Look' Period — Did You Know That?

One of the most important, yet least-discussed, provisions in life insurance is the 'Free Look' period. This is a window of time, typically 10–30 days, where you can cancel a new policy without any penalties.

"It's essentially a no-risk trial," Burns explains. "But agents don't always highlight this because they don't want you to thoroughly review what they told and sold you and/or second-guess your purchase."

The Free Look period is an invaluable opportunity to have a third-party review your policy.

"This is the perfect time to at least get a second opinion," says Burns. "At LifeInsuranceReview.com, we can review your policy during this window and make sure it's the right fit for you."

Burns stresses that life insurance is not a one-size-fits-all product.

"Your needs change over time," he says. "Maybe you've had kids, bought a house, or started a business. Those life changes mean you should be reviewing your policy regularly to make sure it still fits."

LifeInsuranceReview.com is empowering consumers with the information they need to make the best decisions about their life insurance. The company's proprietary 28-point review process leaves no stone unturned.

"We look at everything—structure, benefits, exclusions, cash value performances (if applicable), charges, fees, etc, etc," says Burns. "We want to make sure that when you purchase a policy, you fully understand what you're getting."

If you've ever wondered whether your life insurance policy is truly benefiting you—or just the financial company or agent who sold it—LifeInsuranceReview.com is your go-to resource. They are independent consumer advocates. With their fiduciary-first approach, you'll receive the unbiased, expert guidance and fiduciary advice you deserve.

For more information, visit LifeInsuranceReview.com and learn about our exclusive referral & professional partner's program, email us at partners@lifeinsurancereview.com, or call John Nguyen, EA, CLU®, ChFC® at 1-888-750-LIFE, ext. 108.

© Copyright IBTimes 2025. All rights reserved.