Netflix's Hidden Price Hike

Netflix (NASDAQ:NFLX) just raised prices. Customers hated it. Investors loved it. It caused a stir, and then it faded away -- and, if patterns hold, it should be at least a year or two before we see Netflix hike prices again. But that doesn't mean that customers won't find themselves paying more for Netflix over the coming months and years. Trends suggest Netflix's customer base will create an invisible price increase of its own, one that will matter to Netflix in 2019, 2020, and beyond.

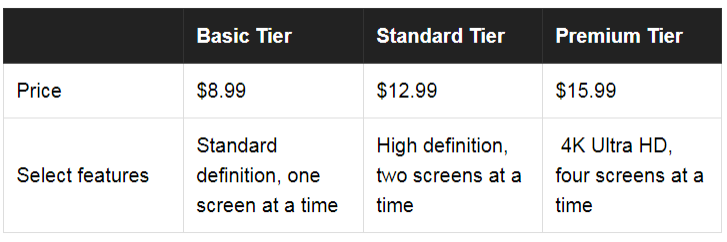

Netflix's service tiers

To understand what might happen, we need to understand Netflix's price tiers.

Netflix's most popular plan is its standard plan, which offers multiple streams -- useful for families -- and 1080p high-definition streaming. The basic plan is quite limited in an era when standard definition feels quaint, especially since it limits things to just one stream (not likely to be popular among the more than 70% of people who share subscription passwords for services like Netflix).

Then there is the premium plan. It offers additional streams and 4K Ultra HD streaming quality. That 4K Ultra HD is increasingly becoming the norm in the TV and streaming marketplace.

The rise of 4K Ultra HD

4K Ultra HD is the latest and greatest mainstream high-def format. Like its predecessors 720p and 1080p, 4K is named after its pixel count: 4,000, though pedants will note that this figure is rounded up from the more accurate 3,840 and refers to pixels along the long side; the numbers 720 and 1,080 were taken from the short side. Whatever the details, though, 4K is the best HD the typical consumer can buy. Its eventual replacement, 8K, was a novelty at tech trade show CES this year and is not expected to make much of a consumer splash anytime in the next couple of years.

The CES debut of 4K came way back in 2012. Consumer models that followed were pricey, and 4K -- like all fancy new TV technology -- took a while to go from novelty to industry standard.

But we're there. TVs with 4K are way down in price since 2012. Once in the thousands of dollars, they now sell in the hundreds. This technology is not just for early adopters and conspicuous consumers anymore.

Streaming devices are following suit: Roku (NASDAQ:ROKU) and Amazon.com(NASDAQ:AMZN) battled in the low-cost 4K streaming market this past Christmas season. And more and more streaming services offer 4K streaming as a standard feature or (as Netflix does) as a premium-tier perk.

There is little reason for any consumer with the means to buy a 4K TV to opt for anything less, and that's been true for a few years now. And when owners of new 4K TVs fire up Netflix, they want to see 4K video. That's possible only with Netflix's premium plan.

Netflix's ideal upsell situation

Netflix's most popular plan does not deliver the high-def format that is now the industry standard. That's a reason for subscribers to upgrade, and Netflix knows it: Fire up standard Netflix on a new 4K Roku TV, and a pop-up box will suggest that you upgrade to Premium right then and there.

Do consumers make the jump? Studies suggest that they do. The most recent Parks Associates study of Netflix's tiers, released in summer of 2018, showed a significant increase in the number of premium subscribers year over year. The number of basic subscribers, meanwhile, seems to be shrinking.

Assuming that account-sharing habits are not undergoing a massive shift, this change must be driven by streaming quality. As new high-definition formats become standard, Netflix's standard-def plan begins to look like a relic -- and its 4K plan begins to look like less of an extravagance.

4K and the future of Netflix

There are ways that this trend could be disrupted, of course. Netflix could add 4K streaming to its standard pricing, using its recent price hike to subsidize the new feature (4K streaming does cost Netflix more, because larger 4K files demand more server space and upload bandwidth). But if current trends hold, more customers will move up the rungs of Netflix's pricing structure between regular price increases.

This article originally appeared in the Motley Fool.

John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Stephen Lovely owns shares of Amazon and Netflix. The Motley Fool owns shares of and recommends Amazon and Netflix. The Motley Fool has a disclosure policy.