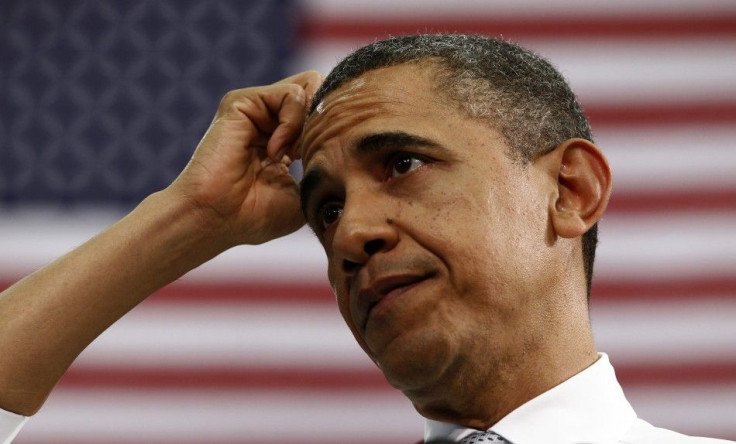

Obama Tax Return Released: White House Says President Should Be Paying More

President Barack Obama and First Lady Michelle had a gross income of $789,674 in 2011, according to tax forms released on Friday. They paid an effective tax rate of about 20.5 percent, or $162,074. They also donated a total of $172,130 to nearly 40 different charities.

About half of the first family's income is the President's salary; the other half is from sales proceeds of the President's books, said the White House report. The tax forms have been made publicly available online, along with forms for Vice President Joe Biden and his wife Jill.

A White House statement took this opportunity to promote progressive tax reform.

The President believes we must reform our tax system which is why he has proposed policies like the Buffett Rule that would ask the wealthiest Americans to pay their fair share while protecting families making under $250,000 from seeing their taxes go up, said the statement.

Under the right system, it continued, Obama should actually be paying more. Under the President's own tax proposals, including the expiration of the high-income tax cuts and limitations on the value of tax preferences for high-income households, he would pay more in taxes while ensuring we cut taxes for the middle class and those trying to get in it.

Tax reform has become a powerful talking point in the lead-up to the November election. Faced with presumptive Republican candidate Mitt Romney, who has been criticized for seeming out of touch with average Americans, Obama knows that touting progressive tax rates gives him the populist edge.

[Romney] thinks millionaires and billionaires should keep paying lower tax rates than middle-class families. In fact, Romney himself isn't paying his fair share, said a statement from the Obama campaign. Tax forms released by the Romney campaign show that he made over $21 million in 2010 and paid only about 13 percent of that in taxes.

To address this issue, Obama has been lately touting a piece of legislation called the Buffett Rule. It's named for billionaire investor Warren Buffett, who argued in a New York Times opinion piece last year that the federal government should be taxing him more.

The White House agrees that federal tax code changes over the past few decades have overwhelmingly favored the richest Americans, so that millionaires and billionaires now enjoy some of the lowest federal tax rates in American history. The middle class, on the other hand, has actually seen an increase in tax rates since 1960.

The Buffett Rule would require those making $1 million or more per year to pay a minimum federal tax rate of 30 percent on all income. This would close a giant loophole created by low tax rates on long-term capital gains, a major source of income for America's most wealthy. A piece of legislation that would enforce this rule is currently awaiting a vote in Senate.

The bill could raise federal revenues by about $46.7 billion over the next ten years, according to the Joint Committee on Taxation. Critics say this would have little effect on our national deficit; furthermore, most analysts agree that the bill has little to no chance of passing the House of Representatives in the first place. Some have called the Buffett Rule a politically-motivated gimmick, which Obama has denied.

A bigger opportunity for tax reform will come up at the end of this year, when Bush-era tax cuts for those making $250,000 or more are set to expire. If Obama can convince fiscal conservatives to allow this to occur, federal taxes will become more progressive and government revenues would increase by about $800 billion over the next decade.

© Copyright IBTimes 2025. All rights reserved.