Oklahoma, With An Oil And Gas Boom, Is Facing A Budget Crisis

Oklahoma is doing better than most states post-recession: It has a growing economy -- in 2012 Oklahoma's GDP grew by 2.1 percent, just below the nation's 2.5 percent growth -- and the state collects hundreds of millions in taxes yearly from its thriving oil and gas industry. Despite all that, the state has been cutting critical services because costly subsidies and tax breaks for the energy industry are eating into its revenue.

Oklahoma is now facing a budget crisis that could force legislators to make further cuts to education, public safety and health care. Part of the problem causing the government cash crunch, The Associated Press reported, is that lawmakers have expanded so many tax breaks for oil and gas producers over the last decade that there is hardly enough left to fund basic state services.

The state's budget problem could further increase after its House of Representatives voted Wednesday 54-40 to approve an income tax cut, despite a projected $170 million shortfall next fiscal year. Gov. Mary Fallin proposed an income tax cut in February during her State of the State address. The state's highest income tax rate of 5.25 percent will drop to 5 percent in 2016, if state revenue projections exceed expectations at the end of the year. The bill now heads to her desk for signing.

“Why do we keep digging a hole?” said Democratic State Congressman Mike Brown.

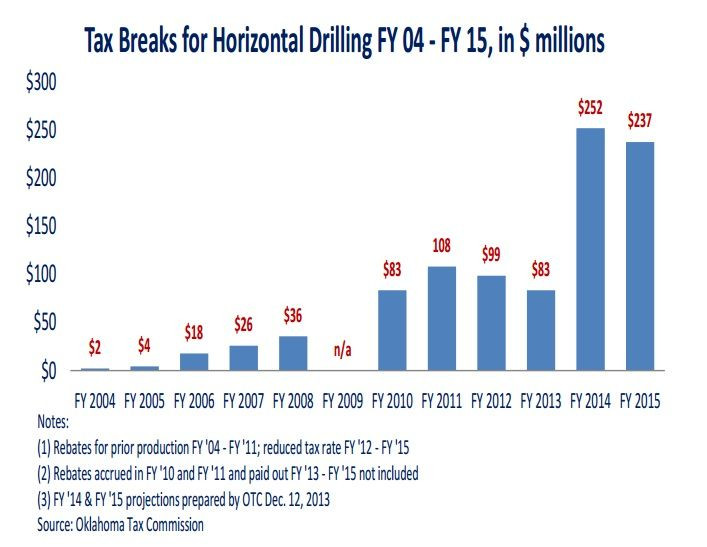

Critics singled out tax incentives for horizontal drilling -- a once risky experimental method that is now being used at almost all new oil wells in the state -- as the biggest culprit. Drillers pay a 1 percent tax in the first 48 months of production instead of the 7 percent rate for traditional production, and that will cost the state more than $250 million in lost revenue this year alone, according to the nonpartisan think tank Oklahoma Policy Institute. Experts at the institute argue that if those subsidies were removed and the revenue put toward education, it could result in a 13.7 percent increase in state aid funding for each district. That's an average of $369 more spent on each student statewide.

“It’s true that Oklahoma in some respects has done well and has come back from the recession. We have low unemployment and we’ve had a growing economy,” said Gene Perry, policy director at the institute. “But we’ve also, at the same time, had the largest cuts to schools in the country and you see the effects from ... repeated tax cuts and growing tax breaks.”

Research from Center on Budget Policy and Priorities last year found that Oklahoma's 22.8 percent spending cut (or $810) per student was the largest in the nation since the start of the 2008 recession. The Oklahoma Education Coalition has said the state's public schools are operating on $200 million less funding and 1,500 fewer teachers than in 2008. At the same time, student enrollment has grown by about 40,000.

Perry said that reducing state agencies’ budgets isn’t good for the long run. Instead, he is recommending that Fallin and other legislators take advantage of the prosperity brought by the oil and gas boom, and invest the money back into the state rather than giving it away in tax cuts and tax breaks.

“We have short-term prosperity due to this oil and gas boom,” he said. “But by cutting all of these important services that are important for business and for the economy, as much as they are for the average citizens, then we’re hurting our economy in the long run.”

But supporters of the tax cuts argue that Oklahoma is doing better than many other states in the nation, partly because reducing the tax burden puts more money in people's pockets, which in turn helps to boost the economy.

© Copyright IBTimes 2025. All rights reserved.