Resist protectionism, group says

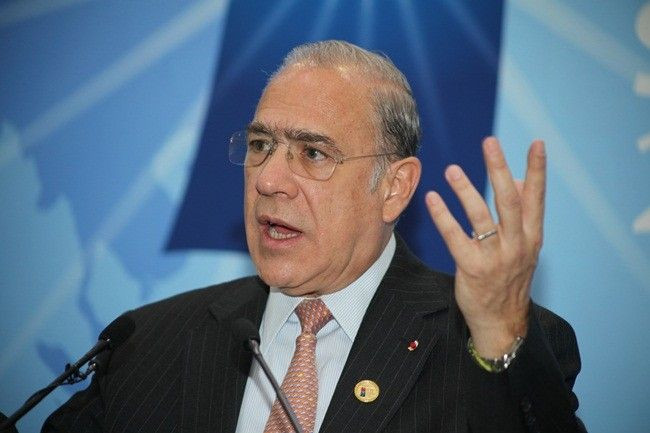

Angel Gurria, Secretary- General of the Organization for Economic Cooperation and Development, an organization consulted by the nations of the world, including most of the nations of the G-20, put the very complex matter of what the G-20 is attempting to do at its summit in Seoul this week, in simple and precise terms.

With the G-20, the key is cooperation, cooperation, cooperation, he said at a press conference Thursday.

Established in 1961, the OECD works to bring together the governments of countries committed to democracy and the market economy to support sustainable economic growth and financial stability, boost employment and living standards, help other countries develop and increase world trade.

The OECD has assisted the G-20 from the beginning in identifying and addressing problems. Only two G-20 countries - Saudi Arabia and Argentina - do not avail themselves of the OECD's reports and analyses.

Gurria warned that, as economies around the world emerge from the severe global recession, the atmosphere will be cutthroat.

So many jobs have been lost, markets lost, opportunities lost, he said. Everyone is going to try to get back what they lost. It will be greatly competitive. In a way, this is natural. But we need to moderate the recovery, so that everyone will benefit.

He said that the recovery needs to be monitored so that it creates jobs as it moves forward.

We are contributing to the Framework, Gurria said, referring to the G-20 Framework for Strong, Sustainable, Balanced Growth, which is the collection of policy recommendations the summit is supposed to produce.

Major parts of the Framework are expected to deal with currency and trade imbalances.

Gurria said that there is more smoke than fire regarding the threatening currencies wars between the world's nations sporting surpluses and those running deficits, and specifically the friction between the U.S., with its consumer-driven, import heavy economy, and cash-rich, export giant, China.

Gurria said that the fact that so much attention has been given to the currency issue is a sign that world leaders are being moved to deal with it.

There will be an agreement on the currency issue at this summit, Gurria said. We must keep in mind that it will not be resolved in a day. It is an ongoing process. But it is first and foremost in everyone's mind. There is movement on the issue all over the place. It is going to be successfully addressed.

On Wednesday, Kim Yoon Kyung, spokesperson for the G-20 Business Summit, told reporters that the nations' deputy finance ministers, who were discussing the currency issue, were far from agreement, but determined to continuing trying to find common ground.

According to published reports, U.S. President Barack Obama and Chinese President Hu Jintao are hopeful on reaching a political compromise on the issue when they meet in Seoul on Friday, or at the Asia-Pacific Economic Cooperation summit in Japan on Saturday and Sunday.

On Monday, while traveling with Obama to India, U.S. Treasury Secretary Timothy Geithner said world leaders will reach an agreement on a proposal to correct excessive current account balances via an early warning system.

The Chinese are very supportive of the idea, Geithner said.

In October, meeting in Gyegongju, South Korea, G-20 finance ministers agreed that each nation will refrain from competitive devaluations of currencies and keep current account imbalances at sustainable levels.

South Korea President Lee Myung-bak said that the Gyegongju agreement was a good step, but that it was incumbent on the G-20 leaders to solidify progress on the issue this week, or risk delegitimizing the G-20.

Gurria said Thursday that, as nations come out of the recession, the international trade system will eventually balance itself out, if - and it's a major if - the big economies behave properly.

In the competitive recovery, it is a great temptation for nations to pursue protectionist policies, he said.

We must fight the temptation. Gurria said. We must fight protectionism. It is always wrong. Protectionism does not take us out. It takes us into a deeper hole.

Gurria dismissed the idea - floated in some financial circles - of putting the world's nations on a gold standard to stabilize currencies and balance trade.

If everyone abides by the same rule, then the system we now have will work, he said. We do not have to think about redesigning the whole system. Rather, we need to maintenance the system that we have. The best way forward is to make the system that we have work better.

© Copyright IBTimes 2025. All rights reserved.