Scottish Referendum 2014: What Would Independence Mean For UK Stock Markets?

The heated debate among Scots on whether their country should break away from the United Kingdom has centered around the economic pros and cons for an independent Scotland, but a vote to go it alone would also have a major effect on U.K. markets, experts caution.

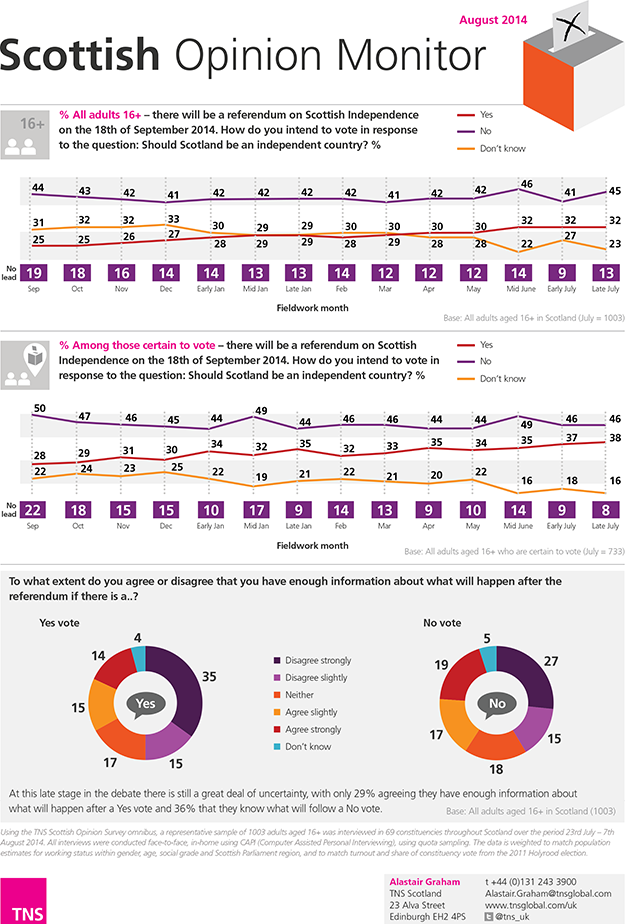

With the referendum just a few weeks away, the “no” contingent has led opinion polls, but the pro-separatist proportion of voters is still substantial.

“We think September’s referendum could have significant consequences for the financial markets of the remainder of the United Kingdom if the people of Scotland vote to go it alone,” wrote Capital Economics’ Jack Allen and John Higgins in a note Wednesday.

Some of the most important changes would be to banking regulations, the definition of a new currency regime and the division of substantial oil and gas revenues.

“There would be a large amount of uncertainty in the period after the referendum but before independence officially began, while the governments in Westminster and Holyrood thrashed out an agreement on the details of Scotland’s independence,” they wrote.

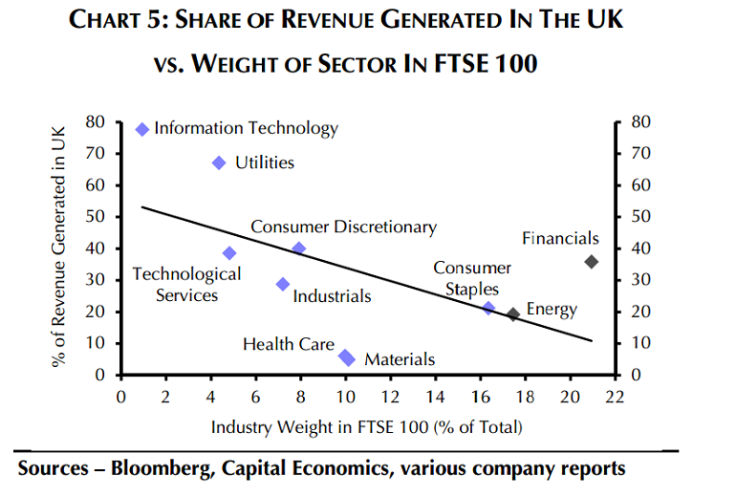

The consequences would be felt distinctly among equities. While just six companies listed on the FTSE 100 have headquarters in Scotland, many others stand to lose from new regulations.

“The companies in the FTSE 100 that would be the most likely to be affected by Scottish independence are those that are either headquartered in Scotland or those that are headquartered elsewhere but derive significant revenues from their activities in Scotland,” they wrote. Dealing with with changing regulations, tax laws and a new currency would likely slow down firms’ performance.

Some of the largest public firms that derive revenue from Scotland are in the financial and energy sectors.

“As far as the financial sector is concerned, a number of banks have expressed concerns about taxes as well as additional funding and compliance costs,” they wrote.

Meanwhile, the energy sector, which accounts for more than 17 percent of the FTSE 100, contributes a great deal to U.K. tax revenues thanks to vast deposits in the North Sea, which would belong solely to Scotland.

Consequently, even though there are relatively few Scottish companies on the U.K. markets, Scottish independence would still have a major impact on a few key sectors, according to Allen and Higgins.

Monthly poll results from U.K. research agency TNS BRMB showed that 45 percent of voters are against independence, with 32 percent in support, according to data published Wednesday. Despite the difference, the pro-separatist sentiment is stronger than it was during a similar referendum last year.

© Copyright IBTimes 2025. All rights reserved.