Shares Recover Even As Growth, Inflation Fears Linger

Global shares recovered on Tuesday on optimism about an easing of China's crackdowns on tech and COVID-19, but concerns about rising prices and slowing growth worldwide set a nervy tone elsewhere in markets.

European shares followed up a positive start in Asia, with the STOXX index of Europe's 600 biggest stocks up 1.7% and U.S. stock futures, S&P 500 e-minis, suggesting Wall Street would follow suit.

MSCI's broadest index of Asia-Pacific shares outside Japan gained 2.5%, but the index is still down 16.8% so far this year.

"There was a good session in Asia and, taking the S&P 500 as a guide, the U.S. looks set to be up around 1%...but looking ahead markets remain fixated on inflation and rate hikes," said Philip Shaw, Chief Economist at Investec in London.

"Headlines are focused on higher inflation pressures either directly stemming from the Ukraine conflict, or supply chain shortages partly coming out of the lockdowns in China," he said.

There were signs of nervousness in bonds, currencies and commodities as economic growth fears in the world's two largest economies have re-emerged following weak retail and factory figures in China and disappointing U.S. manufacturing data..

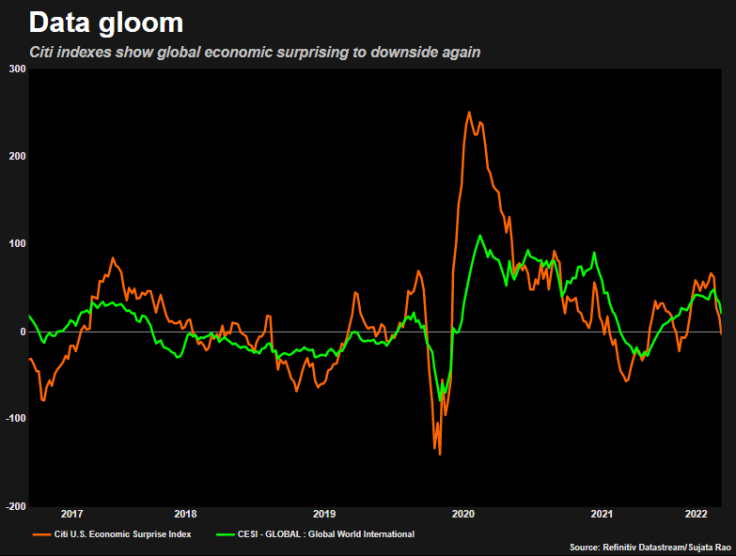

An index compiled by U.S. bank Citi that monitors whether economic data comes in better or worse than economists had been expecting is back in negative territory.

GRAPHIC: Negative surprises

The New York Fed's Empire State manufacturing index published on Monday showed an abrupt fall during May and shipments fell at their fastest pace since the beginning of the pandemic.

The yield on benchmark 10-year Treasury notes rose to 2.9185% compared with its Monday U.S. close of 2.879%, while two-year yields, which rise with traders' expectations of higher Fed fund rates, edged up to 2.6195%.

Investors will look to a slew of central bank policymakers speaking on Tuesday for further signs of the timing of rate hikes to combat inflation.

Those scheduled to speak include U.S. Federal Reserve chair Jerome Powell at 1800 GMT, European Central Bank President Christine Lagarde, and Bank of England Deputy Governor Jon Cunliffe.

Futures markets are pricing consecutive 50 basis point hikes in June and July and for the benchmark U.S. interest rate to reach 2.75% by year end. However there are growing expectations that other central banks will catch up.

CURRENCY JITTERS

Currency and commodity markets were jittery amid profit-taking from investors nervous about the downbeat economic data.

Turkey's lira fell 2%, its biggest drop since January, as concerns about a global recession fuel selling pressure on the currency.

The U.S. dollar index, which tracks the greenback against a basket of currencies, fell 0.35% to 103.8 as investors cashed out and trimmed bets on U.S. rate hikes driving further gains.

The European single currency was up 0.4% on the day at $1.0475, having lost 0.96% in a month.

Oil hit its highest in seven weeks on Tuesday, supported by the European Union's ongoing push for a ban on Russian oil imports that would tighten supply and as investors focused on higher demand from an easing of China's COVID lockdowns.

Brent crude rose as high as $115.14, its highest since March 28, while U.S. West Texas Intermediate (WTI) crude rose 63 cents to $114.84.

Gold prices firmed, as the pullback in the dollar supported demand for greenback-priced bullion and countered pressure from the recovery in U.S. Treasury yields. Spot gold traded up 0.2% at $1,827.44 per ounce. [GOL/]

Bitcoin appeared to have at least temporarily stabilised at $30,295, after days of heavy losses in cryptocurrency markets following the collapse in prices of several leading so-called stablecoins.

CHINA BOOST

Hopes that China might ease two key sets of restrictions had set the positive mood in shares early on Tuesday.

Shanghai achieved the long-awaited milestone of three straight days with no new COVID-19 cases outside quarantine zones, which could lead to the beginning of the lifting of the city's harsh lockdown.

Meanwhile Chinese Vice-Premier Liu He was scheduled to speak at a meeting on Tuesday with tech executives to promote the development of the digital economy, people familiar with the matter told Reuters.

The meeting is being closely watched for clues as to how far Chinese authorities will go in easing a regulatory crackdown in place since late 2020 on the previously high-flying tech sector.

Mainland China's CSI300 Index gained 1.25% while Hong Kong's Hang Seng Index was 3.27% higher, as tech firms listed in the city jumped nearly 6% on hopes of Beijing's crackdown on the sector being relaxed.

© Copyright Thomson Reuters {{Year}}. All rights reserved.