Stocks Climb As Traders Look To Earnings To Counter Downturn Fears

Stocks reversed early losses to rise on Monday, as investors hoped a batch of corporate earnings this week would boost sentiment and offset more signs of an economic slowdown before the Federal Reserve's two-day policy meeting.

Overall, the start of the week began quietly for financial markets, with the dollar falling but holding above a 2-1/2 week low and government bond yields nudging higher.

A widely watched survey showed German business morale falling more than expected in July as high energy prices and looming gas shortages push Europe's largest economy towards a recession.

U.S. Treasury Secretary Janet Yellen said on Sunday that U.S. economic growth was slowing but added that a recession was not inevitable. Data, however, suggests the likelihood of a downturn.

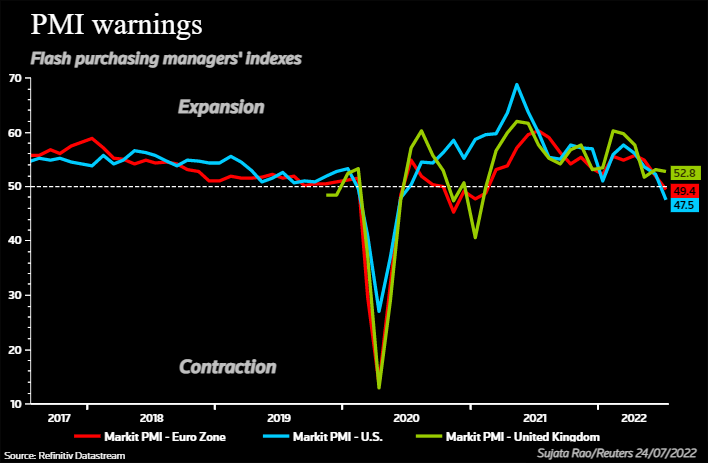

U.S. business activity contracted for the first time in nearly two years amid persistently heated inflation and rapidly rising rates, according to another survey on Friday.

"Increased gloom about the outlook for the global economy looks likely to continue in the coming months as fears over elevated inflation, rising interest rates, and Russian gas in Europe continue to weigh on sentiment," said Mark Haefele, Global Wealth Management Chief Investment Officer at UBS.

"The risks of recession are increasing, but we recommend investors avoid positioning for any single scenario."

GRAPHIC: PMIs (

)

Still, in a busy week for corporate earnings with Big Tech companies including Apple and Microsoft and European banks reporting, investors are hoping the latest quarterly numbers will show profitability is holding up despite the weakening economic outlook.

The gains on Monday follow a rebound in recent weeks, as investors bought back into markets that have fallen sharply in 2022 on fears of further central bank interest rate hiking, still-higher inflation and weaker economic growth.

"This morning we appeared to be in the 'recession-fear' mindset, but now it appears that expectations are higher for the earnings numbers we are expecting from a slew of big tech stocks in the U.S. this week, and this is providing a boost to sentiment," said Stuart Cole, Head Macro Economist at Equiti Capital.

News that European Union countries are seeking to soften the bloc's plan to require them to use less gas as Europe prepares for a winter of uncertain supplies from its main gas supplier Russia also buoyed the mood.

By 1105 GMT, the Euro STOXX was up 0.2%. Germany's DAX rose 0.4% and Britain's FTSE 0.14%.

Wall Street futures pointed to gains of around 0.5%.

Asian shares ended the day lower after closing before investor sentiment had picked up during the European day.

ALL EYES ON FED

The Fed concludes a two-day meeting on Wednesday and markets are priced for a 75 basis-point rate hike, with about a 9% chance of a full one percentage-point increase.

Investors will want to hear from policymakers about how much more tightening the United States economy can handle.

"Risk markets are obviously priced for some kind of slowdown, but are they priced for an outright recession? I would argue no," said Ray Attrill, head of currency strategy at National Australia Bank.

"In that sense, it's hard to say we've reached a bottom as far as risk sentiment is concerned."

The dollar index - which measures the safe-haven currency against six major peers - slipped 0.4% to 106.32, after climbing off a 2-1/2-week low of 106.10 reached on Friday.

The 10-year U.S. Treasury yield was 2 basis points higher at 2.81% after sliding from as high as 3.083% over the previous two sessions.

Euro zone government bond yields rose modestly, helped by last week's bigger-than-anticipated European Central Bank rate hike and expectations of more to come.

Crude oil reversed earlier losses as broader sentiment improved.

Brent crude futures reversed earlier losses and were last up 1.1% to $104.34 a barrel while U.S. West Texas Intermediate crude futures gained 1.28% to $95.92 a barrel.

Gold inched 0.1% higher to $1,729 per ounce.

© Copyright Thomson Reuters {{Year}}. All rights reserved.