South Africa's rand advanced to a one-week high against the dollar, breaking through resistance at 7.15, supported by a rise in U.S. stocks.

China has ordered banks to include their margin deposits in required reserves at the central bank to mop up excessive liquidity, banking sources said on Friday, the latest move in Beijing's campaign to rein in worrisome inflation.

The economy grew much slower than previously thought in the second quarter as business inventories and exports were less robust, a government report showed on Friday, although consumer spending was revised up.

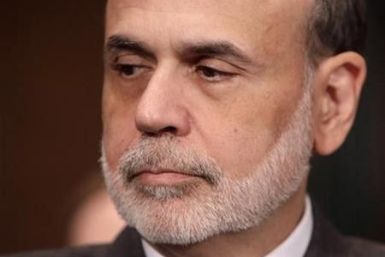

Those expecting Federal Reserve Chairman Ben Bernanke to pull a rabbit from his hat at a retreat for central bankers here on Friday may be in for a letdown.

This year's heady bout of risk aversion on financial markets has ratcheted up demand for gold, U.S. Treasuries and the Swiss franc to levels that suggest they may no longer be the safe havens they are billed as.

This year's heady bout of risk aversion on financial markets has ratcheted up demand for gold, U.S. Treasuries and the Swiss franc to levels that suggest they may no longer be the safe havens they are billed as.

China has ordered banks to include their margin deposits in required reserves to mop up excessive liquidity, banking sources said, the latest move in Beijing's campaign to rein in inflation.

The U.S. economy will continue to grow at a modest pace as consumers and businesses pare back excessive amounts of debt, a top Federal Reserve official said.

Fed Chairman Ben Bernanke's much-anticipated speech Friday will likely disappoint investors and policy makers hoping for signs the central bank will try to rev up the weak economy, but the speech is likely to relieve gold investors who have booked big profits from that same economic malaise.

Stable prices remain the top priority for the Chinese government, but any policy moves must avoid hurting economic growth, China's Finance Minister Xie Xuren said on Thursday.

The big price drop Wednesday in the price of gold is not the beginning of a trend, say analysts, but rather a pause in a longer term bull market that has a lot farther to run.

If U.S. Federal Reserve Chairman Ben Bernanke needs any more evidence regarding the slowdown in the U.S. economic recovery, he need look no further than U.S. housing prices, which have fallen for 17 consecutive quarters

You can’t blame investors for feeling slightly queasy about the U.S. stock market these days. One day of relatively positive data points is followed by a day with enough bad news to keep a stock investor up at night. But based on a condensed, cross-methodological analysis, in which direction is the Dow likely to head in the next six months?

China's factory sector is likely to slow slightly for a second consecutive month in August as sluggish overseas demand saps new orders, HSBC's China Flash PMI showed on Tuesday.

Stocks gained 1 percent on Tuesday as stronger-than-expected data from overseas sparked buying before a keenly awaited speech by Federal Reserve Chairman Ben Bernanke this week.

You can’t blame investors for feeling slightly queasy about the U.S. stock market these days. One day of relatively positive data points is followed by a day with enough bad news to keep a stock investor up at night. But based on a condensed, cross-methodological analysis, in which direction is the Dow likely to head in the next six months?

China's factory sector is likely to slow slightly for a second consecutive month in August as sluggish overseas demand saps new orders, HSBC's China Flash PMI indicated Tuesday.

Republican presidential front-runner Mitt Romney on Monday said the Federal Reserve should not go ahead with another round of monetary stimulus to boost the U.S. economy, because it would risk kicking up inflation.

Chinese Vice Premier Wang Qishan reaffirmed Beijing was sticking to a prudent monetary policy in remarks published on Monday, and stressed the need for banks to increase support for small firms and the agricultural sector.

The price of gold ripped past $1,900 per ounce Monday, boosted by fears of enough wealth-destroying developments to erase any doubts that the world's oldest safe-haven investment is still the world's No. 1 safe-haven investment.

Pimco's Bill Gross says a new recession in the U.S. is likely. Gross is manager of the world's largest bond fund. He says the decline in U.S. Treasury yields to 60-year lows reflects a high probability of a new recession, or a double-dip, in America.

Stocks closed moderately higher today. Compared to the past week, we won’t complain about any advance in the market – however small.