Almost two weeks after the bankruptcy of commodities firm MF Global Holdings Ltd., customers at rival firms are all asking the same question: How safe is my money?

The decision to lay off 1,066 people who worked for MF Global -- effective immediately and without severance -- will give people pause. But it is only the beginning of the nastiness in the MF Global saga

MBA programs like Wharton are on a mission to actively seek out military veterans. The school said that employers are also taking special steps to do the same and have veterans take part in internships and management programs.

Toronto's main stock index was up more than 1 percent at midday on Friday as commodity prices rose on optimism that Italy would pass an austerity package that would calm fears about Europe's debt crisis.

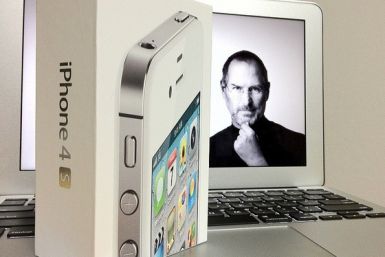

An industry source tells Business Insider that he had an Apple iPhone 5 prototype for about two weeks and dishes on the design and features of the phone, which he said was eventually cast aside in favor of the iPhone 4S.

Falling home prices and sales are pressuring liquidity and margins of Chinese property developers, raising concerns that smaller companies may be pushed to the brink of collapse.

Gold prices rode a roller-coaster this week, topping a peak midweek when the settled at $1,799.20 before plunging 2.2 percent over the next two days on fears Italy had lost control of its finances and was threatening the Eurozone's survival.

Investors are still in shock from the August-September 2011 financial market meltdown and still too deeply impacted by the 2008 financial crisis to examine the set of leading indicators that portend a strengthening of the U.S. economy.

South Africa needs to adress uncertainties including allocation of mineral rights and ownership which are impeding growth in the mining sector, the National Planning Commission said on Friday.

Somali forces allied to Kenya attacked an al Shabaab base near Afmadow on Friday and said they would press towards the strategic town seen as an obstacle to seizing the key port city of Kismayu.

Brookfield Asset Management, the Canadian investment firm with around $150 billion in real estate, infrastructure and energy holdings, reported net income of $716 million in the third quarter, more than doubling its income of $342 million in the same period of 2010.

Troubled BlackBerry developer Research in Motion has a major new investor: Omega Advisors, the investment vehicle of activist investor Leon Cooperman, has acquired 1.43 million shares.

Stocks rose at the open on Friday as debt-laden Italy moved to implement tough austerity measures crucial to avoid a Eurozone meltdown.

LVMH, the world's biggest luxury group, has acquired Swiss watch dial maker ArteCad.

Spanish telecoms giant Telefonica (TEF.MC) stuck doggedly to ambitious shareholder return targets on Friday even while 9-month profit fell a more-than-expected 69 percent in what the group described as a challenging operating environment.

Europe's health is suffering, with around 80,000 cases of tuberculosis infection a year and serious problems with measles, HIV and threats from superbug infections, an annual health report on the region said Thursday.

Gold is returning to its traditional role as a safe-haven investment and starting to break its recent link with the stock market, UBS strategist Edel Tully said Friday.

Japan's Olympus Corp risks collapsing under a massive accounting scandal, but the company's big and profitable medical business is likely to emerge from any wreckage unharmed.

Private equity firms including KKR and TPG Capital are looking to potentially buy minority stakes of up to 20 percent in Yahoo Inc with an eye to eventually taking over the whole company, people with knowledge of the situation said.

Sony and Apple are set to compete in a new space - televisions - as both technology giants are working on their own next-generation connected television sets.

Stock index futures pointed to a higher open on Wall Street Friday, with futures for the S&P 500 up 0.6 percent, Dow Jones futures up 0.4 percent and Nasdaq 100 futures up 0.7 percent at 0924 GMT (4:24 a.m. ET).

Diplomatic deadlock is curbing China's will to provide cash to help end the euro zone crisis after Europe spurned the simplest of Beijing's three key demands, two independent sources have told Reuters.