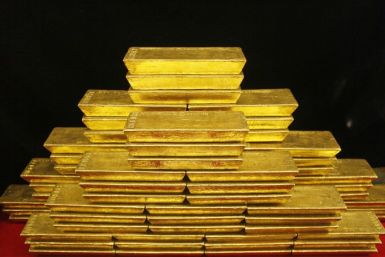

President Hugo Chavez's government formalized the nationalization of Venezuela's gold industry on Monday with a decree that prohibits exports of the metal and gives the state 55 percent of joint ventures.

Billionaire investor George Soros is continuing to overhaul the management team of his Soros Fund Management LLC, which is converting from a hedge fund to a family office.

U.S. stocks fell sharply on Monday as renewed fears of a Greek debt default prompted investors to book some of last week's gains and turn toward the safety of U.S. government debt.

French engineering company Schneider Electric SA (SCHN.PA) has delayed the roughly $1.4 billion auction of its sensors business because of turbulence in financing markets, people familiar with the matter said.

In the second quarter of 2011, the bank lost an astounding $8.8-billion, partially due to the burden of its enormous mortgage/legal liabilities.

Wall Street stock indexes were set to drop more than 1 percent at the open on Monday as renewed fears of a Greek debt default prompted investors to book some of last week's gains and turn to safer assets such as gold.

Blair was flown to Tripoli on Gaddafi’s private jets at the Colonel’s expense.

India and China drove the second-quarter's robust demand for gold, the World Gold Council said in its analysis of industry trends during the three-month period.

Gold prices rallied on Monday after European policy makers failed to soothe fears of Greek default and contagion to other euro zone countries, prompting investors to seek refuge in the precious metal.

The London Bullion Market Association is working out ways for refiners on its Good Delivery List to avoid falling foul of new regulations against conflict gold as a number one priority, LBMA chairman David Gornall told Reuters on Sunday.

Foreign investors in mineral-rich Mongolia hope parliament will revoke a controversial law banning mining in the country's river and forest areas when it convenes for its busy autumn session next month.

Swiss bank UBS has kicked off an internal investigation into the catastrophic failure of its risk systems after raising the amount it lost on rogue equity trades to $2.3 billion.

China should refrain from boosting credit and fiscal spending again as stimulus measures to avoid fueling inflation and pushing up government debt, Wu Xiaoling, a former deputy central bank governor said in remarks published on Monday.

Sany Heavy Industry Co Ltd , China's largest construction machinery maker, could raise up to $3.33 billion in the second biggest stock offering this year in Hong Kong, braving volatile markets to raise funds for expansion of its factories.

China's securities regulator is asking the government to clamp down on the controversial corporate structure used by companies such as Sina (SINA.O) and Baidu (BIDU.O) to list overseas, and employed in thousands of other investments by foreigners into domestic Chinese companies, four legal sources told Reuters.

President Barack Obama will once-again try to right the nation's fiscal ship of state by proposing a new tax levy for U.S. taxpayers whose income exceeds $1 million per year. Congressional Republicans have already said they're opposed to the levy, but it remains to be seen whether that latter view will hold amid a public that wants upper-income groups to pay more in taxes.

UBS announced the loss from unauthorized trading equated to approximately $2.3 billion, more than the $2 billion that was initially reported.

President Barack Obama will propose a new minimum tax rate for U.S. taxpayers who make more than $1 million to help lower the nation's $1.5 trillion long-term debt, according to media reports. This plan will be adopted from a suggestion made by billionaire investor Warren Buffett.

Kweku Adoboli is now famously known as the allegedly rogue trader of UBS who lost $2 billion on unauthorized trades.

UBS, it appears, had no idea that accused rogue trader Kweku Adoboli might be messing around with unauthorized risks in its London office, losing $2 billion. It's shocking that $2 billion could slip away so easily, but that's apparently what happened. The bank's analytics simply never caught on, and by now, you know what happened from there -- $2 billion is gone, and the 31-year-old Adoboli has been arrested by London police and charged with three counts while UBS, the Swiss bank with ...

Regulators are still trying to figure out how 31-year-old trader Kweku Adoboli caused $2 billion in bad bets over three tears. But as the probe continues analysts and politicians say UBS trading losses has strengthened the case for separating retail banks from their investment arm, according to The Associated Press.

UBS is still committed to its investment bank, under fire after one of its London traders was charged over a $2 billion loss, the bank's Chairman Kaspar Villiger told a Swiss newspaper.