Emerging market equities, which have surprisingly underperformed so far this year, will bounce back and the total return from emerging equities will eclipse those from developed market equities in 2011, according to an analyst.

The Recovery Act, which was introduced by the US government in response to the Great Recession of the last decade, created or saved 3-4 million jobs and up to 5 million full-time equivalent jobs by the end of 2010, according to report.

World stocks hit a 30-month high on Thursday, driven by strong corporate earnings and cautious optimism on the U.S. economic recovery from the Federal Reserve, while oil prices edged higher on growing political tensions.

Foreign Direct Investment (FDI) in China rose in January despite concerns over market barriers and rising labor costs in the country.

ASX Group Ltd (ASX.AX) eked out a small first-half profit growth, but focus was squarely on the completion of Singapore Exchange's (SGXL.SI) $7.9 billion bid for the Australian bourse operator, a move to help the bourses fight growing competition.

South Africa's rand jumped more than 1.5 percent against the dollar in late trade on Wednesday, helped by an aggressive sell-off in the U.S. currency and better-than-expected local data.

China is now the world's second largest economy, but hundreds of millions of its people still rely on fouled water that will cost billions of dollars to clean.

China is likely to fail in its drive for state-owned steel giants to swallow small mills and create iron ore super buyers to wring better prices from leading sellers Vale, Rio Tinto and BHP Billiton.

China's new review body for inward M&A could bring some much-needed transparency to the deal approval process and even make it quicker for foreign companies to get tie-ups with mainland firms past the authorities.

Shares of Family Dollar Stores Inc. (NYSE: FDO) are soaring after the discount retailer confirmed late yesterday that it has received an unsolicited bid from the Trian Group, a New York hedge fund, at a price of $55 to $60 per share.

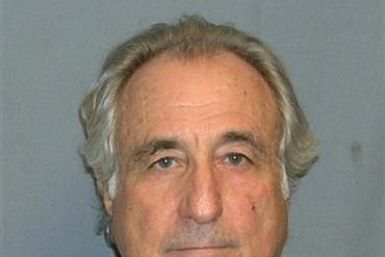

They had to know, said the jailed former fund manager Bernie Madoff, referring to bankers and investors who should have been able to uncover his Ponzi scheme.

Treasury Secretary Timothy Geithner said on Tuesday that the United States needs to cut the corporate tax rate substantially with a goal in the high 20 percent range, down from the current 35 percent. A day after the White House unveiled a budget that seeks to trim the country's massive deficit, Geithner reiterated that the Obama administration

Gold steadied on Wednesday ahead of a raft of U.S. data due later, having earlier risen to four-week highs as a retreat in the dollar and concerns over the medium-term inflation outlook helped support the precious metal.

Internet telephone service Skype said Nokia's alliance with Microsoft presented an opportunity for the company to tap into Finnish engineering talent looking for new jobs.

Futures on major U.S. stock indices point to higher opening on Wednesday ahead of wave of economic data including producer price index and building permits.

More and more investors are flocking to silver, sensing an opportunity. Mark Thomas of the Silver Shortage Report wrote on Tuesday that Soros Fund management has made an investment in Pan American Silver (PAAS).

India and Japan, two of Asia's largest economies, signed the landmark free trade agreement (FTA) on Wednesday, paving way for the elimination of tariffs on more than 90 percent of goods traded between the two countries over the next decade.

Investors in Diamondback Capital Management, one of four hedge funds raided by federal authorities last year as part of an insider trading probe, have asked to pull more than $1 billion from the firm, a source familiar with the fund's communications to clients said on Tuesday.

Prime Minister Manmohan Singh defended himself on Wednesday against accusations his government was a lameduck, saying it was trying to bring justice in some of the country's biggest corruption scandals in decades.

The Egyptian army, praised for overseeing a mostly peaceful revolution, is running into a storm of wage and subsidy demands overtaking pressure for democracy and piling more burdens on an already teetering economy. That has already happened in Tunisia, where strikes and protests continue more than a month after citizens ousted their strongman president and galvanized Egypt's opposition forces to do the same with theirs last week.

Bank of America (BofA) has selected a battery of top-end law firms to represent their legal interests but being on the legal panel comes at a price.

John Paulson, whose firm now oversees roughly $36 billion, again counted SPDR Gold Trust (GLD.P), AngloGold Ashanti (ANGJ.J), Citigroup (C.N) and Bank of America (BAC.N) as his top four holdings.