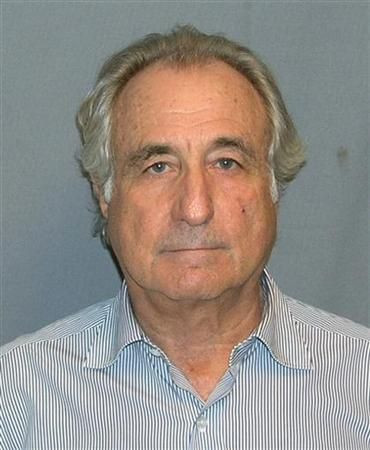

Bernie Madoff: They Had to Know

They had to know, said the jailed former fund manager Bernard Madoff in an exclusive interview with New York Times.

“But the attitude was sort of, ‘If you’re doing something wrong, we don’t want to know,’ ” he said.

The con man said big institutions -- some who made good money investing in his fund before the collapse -- were willfully blind to his scheme and failed to examine discrepancies that can be derived from his fund's regulatory filings and other available information.

Indeed, while Madoff, the fraudster himself, obviously bears the most guilt for his massive Ponzi scheme, his point about the failure of the financial system and community to do anything about it is also valid.

His $65-billion fraud wasn't impossible to detect. In fact, detection isn't the major problem; it was the system's decision to willfully ignore the glaring discrepancies.

First, Madoff pointed out in the interview that there were emails and messages, circulated around bankers, that raised doubts about his fund.

Second, there was even a Barron's article, back in 2001, that put the spotlight squarely on Madoff's fund and raised many red flags. Even though the issue was out in the public, Madoff continued to operate for nearly eight more years before his eventual arrest.

Then there was Harry Markopolos, who had repeatedly raised the issue of fraud regarding Madoff's fund to the SEC since 2000. Markopolos said Madoff's results were mathematically impossible. But regulators -- who were spoon-fed the information -- failed to stop Madoff.

From behind bars, Madoff's tale is one of the failure of the system to deal with fraud.

He isn't, however, the only one with such a tale.

Hedge fund manager David Einhorn recently republished a book called Fooling Some of the People All of the Time that detailed his battle against the fraud of Allied Capital. He made speeches, spoon-fed information to regulators and reporters, and even sued Allied Capital on behalf of the government.

However, in the end, Allied Capital largely escaped consequential legal repercussions and was eventually sold to Ares Capital in March 2010.

Email Hao Li at hao.li@IBTimes.com

Click here to follow the IBTIMES Global Markets page on Facebook.

Click here to read recent articles by Hao Li.

© Copyright IBTimes 2025. All rights reserved.