Sen. Harry Reid D-NV called on state legislators to ban prostitution in Nevada on Wednesday.

The companies whose shares are moving in pre-market trade on Thursday are: Priceline.Com, Integrys Energy, ConocoPhillips, Chesapeake Energy, Chevron Corp, E TRADE Financial, Red Hat, Suntrust Banks, Monster Worldwide and eBay.

Gold steadied near seven-week highs on Thursday, as investor fears over inflation stemming from the spike in crude oil were partially offset by pockets of profit-taking after the market's 6 percent rise this month.

Western investment banks are keen to underwrite more IPOs on China's Shenzhen exchange this year as a surging economy turns the once insignificant market into a fundraising hotbed.

The top after-market NYSE gainers on Wednesday are: Polypore International, Jarden, iStar Financial, Calgon Carbon and K-V Pharmaceutical. The top after-market NYSE losers are: American Equity Investment, St. Joe, Magna International, Tenet Healthcare and Whiting Petroleum.

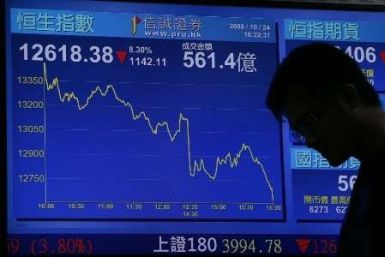

Hong Kong stocks are expected to open lower on Thursday, pressured by a surge in oil prices on fears turmoil in Libya could spread to other oil exporters in the region, and declines in global markets.

A Wikileaks document also reported that the Libyan government had received (and rejected ) investment offers from Bernard Madoff and Allen Stanford, two men were involved in huge Ponzi schemes.

Wall Street's financial giants continue to pose major risks to the U.S. economy, and must be broken up to avoid another meltdown, Kansas City Federal Reserve Bank President Thomas Hoenig said on Wednesday.

King Abdullah of Saudi Arabia - jointly the world's biggest oil producer alongside Russia, and so far immune to the civil unrest sweeping North Africa and the Middle East - returned from hospital treatment abroad to announce a near US$38 billion package of new housing projects, a 15% pay-rise across the board, and the kingdom's first-ever unemployment insurance.

Throughout the ages, many things have been used as currency: livestock, grains, spices, shells, beads, and now paper. But only two things have ever been money: gold and silver. When paper money becomes too abundant, and thus loses its value, man always turns back to precious metals. During these times there is always an enormous wealth transfer, and it is within your power to transfer that wealth away from you or toward you. --Michael Maloney, precious metals investment expert

At least 100,000 trade unionists marched through the Indian capital on Wednesday in a protest against high food prices and unemployment, piling pressure on an administration under fire over corruption scandals.

Nigeria's parliament has begun a detailed debate of the latest version of long-delayed reforms to Africa's biggest energy industry, just two months ahead of elections, the head of the state oil company said on Wednesday.

Mutual fund giant Fidelity is actively preparing to enter China by securing a trust company licence in one of the world's fastest-growing asset management market, a person familiar with the situation said on Wednesday.

US stocks were mixed in early trade on Wednesday after plunging in the previous session amid political unrest in the Middle East.

The Persian Gulf kingdom of Qatar has expressed some interest in investing in two major partially-nationalized British banks, Royal Bank of Scotland (NYSE: RBS) and Lloyds Banking Group (NYSE: LYG).

Spot gold was bid at $1,401.50 an ounce at 0933 GMT, against $1,399.20 late in New York on Tuesday. U.S. gold futures for April delivery eased 30 cents an ounce to $1,400.80.

South African resource-heavy stocks slipped on Tuesday as Libyan unrest prompted an equities sell-off while the rand firmed against the dollar, recovering from earlier losses as better-than-expected GDP data boosted the currency.

African farmland investment has the potential to match the exponential growth of Brazil's agricultural industry, the head of business development at privately owned agricultural operator Quifel said.

Crude oil prices have surged more than 7 percent this morning in New York trading, reaching as high as $98 per barrel, as the chaos in Libya raised fears of supply disruptions.

Temasek Holdings has hired former China International Capital Corp (CICC) investment banking head Ding Wei to lead its China operations, the Singapore state investor said late on Monday.

China should account for 8-9 percent of global mergers and acquisition activity this year, continuing close to its strong levels in 2009 and 2010, JPMorgan's head of China M&A said Tuesday.

Spot gold was last down 0.8 percent at $1,394.14 an ounce at 1025 GMT, having risen on Monday to its highest in about seven weeks. U.S. April gold futures were up 0.5 percent at $1,395.20 an ounce.