Personal income and expenditure in the U.S. rose for the fifth month during November, according to a report by the U.S. Commerce Department, indicating that the average consumer is growing more confident about the economic recovery and their financial situation.

Applications for jobless benefits in the U.S. fell unexpectedly for the week ended Dec. 18, posting a decline for three consecutive weeks.

The UK's GMB union has said thousands of public sector workers in the country are getting at risk warning letters, dampening the upcoming holidays, the BBC has reported.

Growth in the eurozone will be weaker than in the US and the UK in 2011 and the euro will fall further, despite positive near-term forecasts for the region and improving global economic prospects, analysts have said.

First-time claims for jobless benefits barely budged last week, government data showed on Thursday, suggesting the labor market is healing too slowly to drag down the unemployment rate.

US president Barack Obama welcomed the US Senate's ratification of the new strategic arms reduction treaty between the country and its former cold-war rival Russia. The President maintained that Wednesday's vote proves that Washington is not headed for 'more partisanship and more gridlock'.

Sales of previously owned homes rose in November, offering the latest sign the economy was ending the year on a more solid footing after a sluggish third-quarter.

With the Great Recession continuing to take a toll on America’s middle class, it should come as no surprise that homelessness and hunger remain tough problems for America’s cities, as the annual report by the U.S. Conference of Mayors points out.

Existing home sales in the U.S. picked up again in November, after a surprising drop during October, according to a report by the National Association of Realtors.

25 percent of employed Americans are most grateful for the stability in their jobs

Contrary to the prevailing view, the U.S. economy will gain growth momentum in the year ahead, while GDP will grow stronger in Europe and Japan, research firm IHS Global Insight has said in its forecast for 2011.

Japan's economic recovery seems to be pausing, though there are signs of a moderate recovery, the Bank of Japan said in a statement on Wednesday.

Economic evidence today suggests that we don't need QE2, said Nicholas Sargen, chief investment officer at Fort Washington Advisors.

For companies competing in the global marketplace, getting the right talent in the right place at the right time represents the most significant challenge today in terms of driving future growth.

Gold prices will keep rising over the next two years to hit $1,600 per ounce by the end of 2011 and $2,000 by end of 2012, as fresh shocks to the global financial system are expected, an analyst has said.

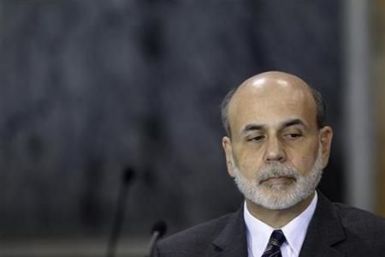

Ben Bernanke and his friends on the Federal Reserve have a PR machine to help sell their lies. Let's assess whether Ben and his Federal Reserve have helped or hurt the average American.

The fiscal squeeze promulgated by the British coalition government will increase child and working-age poverty in the U.K. over the next three years, according to a report funded by the Joseph Rowntree Foundation and published today by the Institute of Fiscal Studies (IFS).

The CBI, the British business organization, reduced its forecast for UK economic growth in the first quarter of 2011 to 0.2 percent from 0.3 percent; although it noted that the recovery is expected to be “maintained.”

The Spanish economy is slowly recovering, but broad reforms will still be required to create jobs and improve government finances, according to a report from the Organisation for Economic Co-operation and Development (OECD).

Work hard and play by the rules and you'll get ahead. That's been an article of faith, since at least the birth of this nation, in what has come to be called the American dream..

U.S. companies are turning profitable again, they have stockpiles of cash and the economy is teetering on its new 'recovery' legs as the government pumps in billions of dollars trying to keep it afloat. Yet, the one thing that is crucial to the recovery is not happening - job creation - as companies remain reluctant to hire.

President Obama's tax cut plan, by lowering unemployment and boosting economic growth, may ease the Federal Reserve's pressure to buy Treasuries via its controversial program of quantitative easing.