Tax Season 2015: IRS Cutbacks Cripple Taxpayer Services For Poor, Elderly

On her third trip to the tax clinic, Francoise Phisient was at wit’s end. A tax preparer examined a pile of forms and shook her head. These weren’t the right papers. “Oh boy, this is a mess. This is really a mess,” Phisient muttered.

Francoise was there to translate for her brother Elionoir, who speaks only Haitian Creole. Elionoir took his hat off and held it between his knees. He sends much of his income as a home health aide back to his family in Haiti. He was at the nonprofit Food Bank for New York City Tax & Financial Service Center in Bedford-Stuyvesant, Brooklyn to square away his tax situation.

That effort had turned into an ordeal. Elionoir didn’t mind his two previous trips to the Bedford-Stuyvesant center. What distressed him was the news, just relayed to him, that he would have to return to the IRS Taxpayer Assistance Center for the right forms. His first trip took several hours, and he ended up with the wrong form.

“He works, he pays taxes, he saves his receipts,” Francoise said, exasperated at the prospect of returning to the bustle and confusion of the downtown Brooklyn Internal Revenue Service walk-in center. “But you have to be patient.”

The Phisients and millions like them are struggling with an IRS taxpayer assistance program nearing its breaking point. At the roughly 400 IRS tax help centers across the country, which chiefly serve lower-income and elderly filers, endless lines and dwindling tempers characterize what IRS employees are calling the toughest tax season in memory.

“I’ve been here 16 years and it’s never been this bad,” said Pam Sturm, the St. Louis chapter president of the National Treasury Employees Union, which represents IRS workers. “Years past, you might go a couple days without getting cussed out. Now it happens every day.”

“A lot of people think we should just take ‘service’ out of our name altogether.”

Cutbacks

Five years of cutbacks -- including sequestration in 2013 and a Republican-led $350-million reduction in the latest budget bill -- have left the IRS with $1.8 billion less than it requested in 2015. The agency says its funding is down 17 percent since 2010.

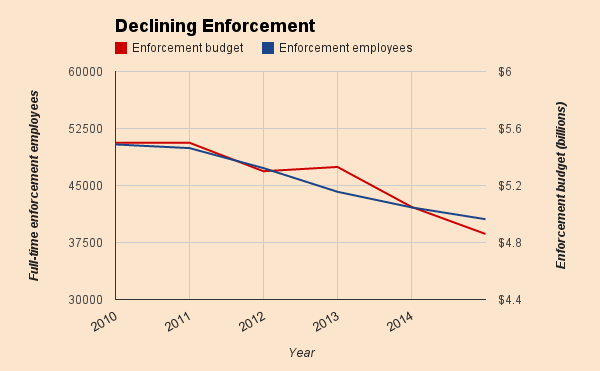

In that time, taxpayer services and enforcement efforts have suffered. Since 2010, training has been slashed by 87 percent and payrolls have dropped by 13,000, even as the number of filings has climbed by 7 million to nearly 150 million last year. The IRS estimates that it will deliver around $2 billion less to the Treasury this year than it would at full capacity.

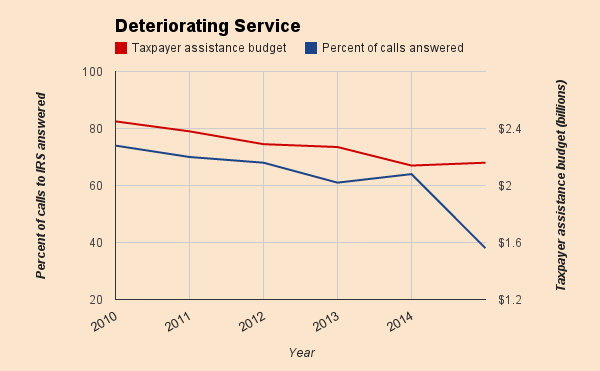

Those cutbacks mean headaches for taxpayers. The number of employees assigned to phones has dropped by 26 percent, and they answer fewer than four in ten calls. For the lucky callers who do connect with a human, wait times are up 70 percent from five years ago, and only the most basic tax questions will be answered.

In January, the IRS's chief watchdog, Nina Olson, warned the cuts would produce a "devastating" tax season. Her warnings have been borne out.

At the overburdened IRS walk-in center where Sturm's office is located, she estimates the agency sends away upwards of 35 people every day. “They spent all this money training us, and we can’t even help the people who call,” Sturm said.

Overflow

It’s impossible to know how many taxpayers are turned away daily from the IRS' Taxpayer Assistance Centers. But the nonprofit community organizations that supplement the IRS' tax help efforts, like the Bedford-Stuyvesant Food Bank, have seen a marked increase in traffic, one they attribute directly to IRS spillover.

“Taxpayers are waiting three or four hours in our offices and they’re getting sent home,” said J. C. Craig of the Taxpayer Opportunity Network, a nonprofit coalition of 470 organizations that assist low-income and inexperienced filers.

Though independent nonprofit tax centers have always had busy tax seasons, IRS shortfalls have ratcheted up the pressure. Taxpayers shunted away by the IRS stream into nonprofit sites. “The ones closest to the tax centers are getting slammed,” Craig said. “People see the lines and they don’t even walk in the door.”

Tarneice Roulhac, a manager at the Bedford-Stuyvesant tax help center, dismisses the notion that the IRS might help lighten the load. “When we refer clients to the IRS they come back and complain they have to wait hours,” Roulhac said. “The phone lines are crazy.”

The IRS awards grants to hundreds of nonprofit tax preparation centers. Though these programs have also weathered cutbacks, demand for them has steadily increased. Last year, volunteers helped return a total of $3.9 billion in tax credits to low-income taxpayers.

At these sites, as well as at the IRS Taxpayer Assistance Centers, it’s elderly, disabled and non-English-speaking taxpayers who lose out most when budgets shrink. “It’s a disgrace, both in the short term and the long term,” said Chuck Marr of the Center for Budget and Policy Priorities, a Washington, DC think tank.

The slimming-down of the IRS, Marr said, hurts honest lower-income taxpayers while empowering potential tax cheats, who typically occupy higher tax brackets. Though some might breathe easy at the prospect of fewer audits this year, the flipside is fewer needy taxpayers receiving assistance.

The IRS estimates that every dollar invested in tax enforcement yields $6 in recovered funds. The number of tax enforcement employees, however, has fallen by 20 percent since 2010.

A “Concerted Attack”

Always an unpopular agency, the IRS has felt particular ire from congressional Republicans upset over allegations that the IRS targeted conservative groups and nonprofit policy groups in 2010. Though an FBI investigation has reportedly failed to uncover any illegality, officials criticized the agency for its jumbled bureaucracy and pervasive mismanagement.

These concerns have added heft to perennial right-wing broadsides against the IRS. “It’s a concerted budget attack, and it’s been going on for years,” Marr said.

Even if IRS funding recovered, the effects of current shortfalls might be felt for years. An ongoing hiring freeze has kept the agency from bringing on fresh talent, and older workers are snatching up retirement as soon as they can.

In a speech to Congress last month, IRS Commissioner John Koskinen reported that by 2019, 40 percent of the IRS’s workforce will be eligible to retire. Meanwhile, the agency has struggled maintain young workers. Less than 3 percent of its employees are under 30.

"This situation makes it extremely difficult, if not impossible, for the IRS to properly develop its next generation of leaders,” Koskinen said.

In the meantime, community tax prep centers will have to pick up the slack. A 59-year-old administrative assistant named Rosa, who declined to give her last name, came to the Food Bank center after calling the IRS for three weeks. When she finally got through, the employee couldn’t answer her simple question about claiming 401(k) withdrawals. A wait of nearly a month hinged on whether to check a single box.

“It’s so frustrating,” said Rosa, who described herself as the “working poor.” But when her name was called, she smiled. “I’ve only been here fifteen minutes.”

Leaving the Food Bank center, the Phisients were weary but undeterred. "Those people, they're fine," Francoise said, nodding toward the building. But the thought of returning to the IRS walk-in center was daunting.

"He doesn't want to have this problem. It can hurt his wife and daughter," Francoise said. "It's no good."

© Copyright IBTimes 2024. All rights reserved.