US Credit Supply Remains Supportive Of Growth, No Recession Seen: Kathy Bostjancic

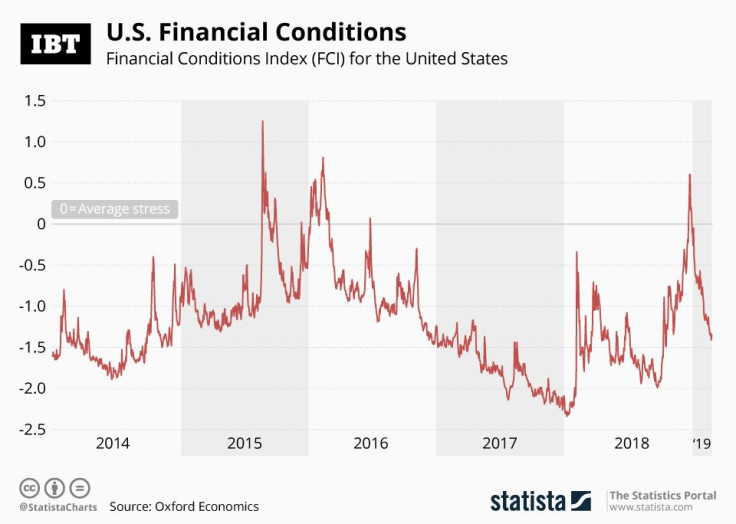

Despite rising concerns that the U.S. credit supply is tightening rapidly, a slew of recent data show that the tightening is only moderate and remains supportive of economic growth this year, an economist told International Business Times.

Kathy Bostjancic, head U.S. financial market economist at Oxford Economics, said although there are signs of tightening credit, the concerns of a downturn are overblown. She based her view on corporate bond issuance bounceback early this year, the Fed’s stance of holding off on tightening, and growth expectations, albeit slower, this year.

The financial market turmoil toward end-2018 led to speculation that the credit market was drying up and that the credit cycle was on the verge of turning. But Bostjancic said the tightening was only moderate and in-line with Oxford Economics’ overall growth expectations for this year.

“Some moderate tightening is in line with our overall projection that growth will slow this year,” she said. “We just caution people that all of this can be rather a downshifting to slower growth, but we don't see them as recessionary.”

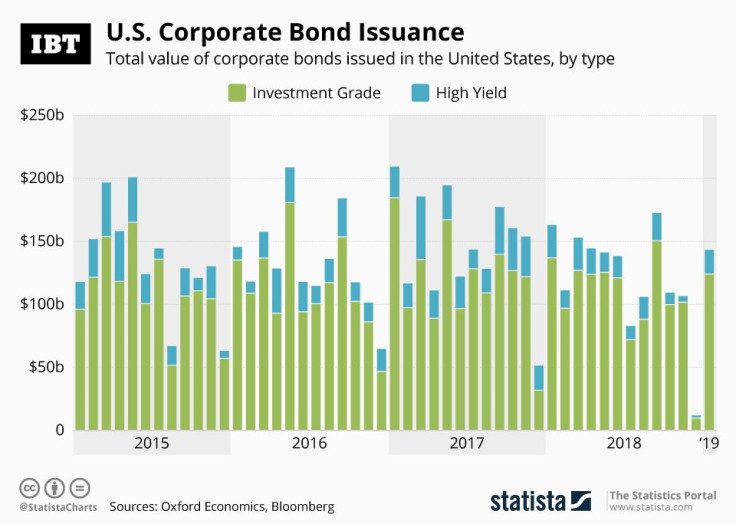

Data showed corporate bond issuance for high yield bonds was negligible in December, while investment grade issuance was marginal compared to recent years. “While issuance typically cools in December, the degree of the slowdown this past December had fueled concerns of credit tightening,” Bostjancic said.

But corporate bond issuance saw a rebound in 2019, with gross investment grade issuance totaling $123.8 billion and high yield amounting to $19.5 billion in January.

“If corporate bond issuance did not bounce back in January and if corporate bond spreads continue to widen, we’d be seeing a different picture right now,” Bostjancic said.

She added: “It was a sort of a temporary pause. Companies are not going to come to the market and issue debt among mid-market turmoil. They never do. They wait until things calm down, which makes sense as you get a better price for your debt and a better subscription to the issuance.”

Bostjancic said a moderate tightening will not necessarily discourage corporate investments. She expects corporate investments in the U.S. to grow at around 3 percent this year, compared to 7 percent in 2018.

She attributed the drop in investment growth to “more a reflection of opportunities, return on investment (ROI), as opposed to the price of borrowing.”

Bostjancic explained that the 7 percent growth last year was driven by the fiscal stimulus. “The stimulus and the tax breaks did help boost investment, but the problem is that the administration had hoped that it would be more long-lasting -- that you'd have a real long-lasting impact on investment,” she said. “And what it shows is it gave a little bit of a boost, but it didn't have a long-lasting impact.”

NO SIGNALS OF RECESSION

Citing a flatter yield curve, Bostjancic said the U.S. economy is seeing a phase of slow economic growth, and not necessarily signaling a recession right now.

“A very flat yield curve, which is what we have, is more in-line with slowing growth; it's not until it actually starts to become fully inverted,” she said.

In the current scenario and with the latest round of economic data releases, Bostjancic said even a partial inversion of the yield curve does not signal a recession. But she added that the risk of a recession is rising.

She added: “But clearly we're watching it. We're not wearing rosy glasses and think that everything's okay. Growth is slowing there are a number of risks out there. I would be more concerned about a recession if the Federal Reserve didn't change its stance or its bias.”

The 10-2 year yield curve narrowed from about 35 basis points on Oct. 5 to 11 basis points on Dec. 11. It traded at around 20 basis points Thursday.

“The labor market remains quite strong. We think the retail sales data was an outlier; all the other measures of holiday sales, consumer fundamentals, look good at this point,” she said.

Retail sales unexpectedly fell 1.2 percent, following a 0.1 percent growth in November. A Mastercard SpendingPulse report showed that sales in the U.S. holiday shopping season in 2018 rose to its strongest levels in six years, recording a growth of 5.1 percent to over $850 billion.

Barring unexpected monetary and other policy changes, Bostjancic expects the U.S. economy to continue to grow this year, albeit at a slower pace.

“The economy could just keep plodding along here -- we'll be at a slower pace, but as long as the Fed doesn't make a policy mistake and as long as we don't have something negative on the trade front or some other policy, it looks as if we could continue this expansion that you saw -- just at a slower pace,” Bostjancic said.

SOME TIGHTENING IS HEALTHY

The Fed’s latest Senior Loan Officer Opinion Survey on Bank Lending Practices (SLOOS) showed a large shift in the lending standards on commercial and industrial (C&I) loans.

“The net percentage of banks tightening standards rose to 2.8 from -15.9, which was near the easiest standards of the business cycle. Despite the sharp swing, the net percentage of banks tightening standards remained low at just 2.8 percent," Oxford Economics said in its note.

Banks expect the demand for C&I loans to moderate in 2019. “For now, C&I loans remain strong. Both on a 13-week basis and year-on-year basis, the pace of loans accelerated during the period of the market turbulence and bank lending survey,” Oxford Economics said in its note.

Moderate tightening in both capital markets and banks is healthy, Bostjancic said. “Some moderate tightening is in line with our overall projection that growth slows this year,” she said.

Looking forward, Oxford Economics said 11 percent of the banks have indicated they intend to tighten lending standards for commercial & industrial (C&I) loans for large and medium-sized firms for the year. In commercial real estate, 12.3 percent of banks continue to tighten conditions.

“We've been noting the commercial real estate market -- banks have been continually tightening and I think that's a good thing as long as it's not tightened abruptly,” Bostjancic said.

Some banks have indicated they will tighten conditions for the key sub-sectors of the commercial real estate, including construction and land development, non-farm non-residential properties, and multi-family residential properties, Oxford Economics said.

“We are not surprised that banks intend to further tighten up lending in the commercial real estate sector, an area we have previously highlighted as having pockets of heightened risk,” the note said.

“From our viewpoint, the moderate tightening in corporate credit conditions is another reason for the Fed to pause its policy tightening at least through the first half of this year. Given that Fed officials had the SLOOS readings at their policy meeting on Jan. 29-30, this likely contributed to their shift to a more dovish policy stance. The tightening by banks and financial markets is doing some of the tightening for the Fed,” the note said.

© Copyright IBTimes 2025. All rights reserved.