U.S. Job Openings Fall; Manufacturing Regains Speed

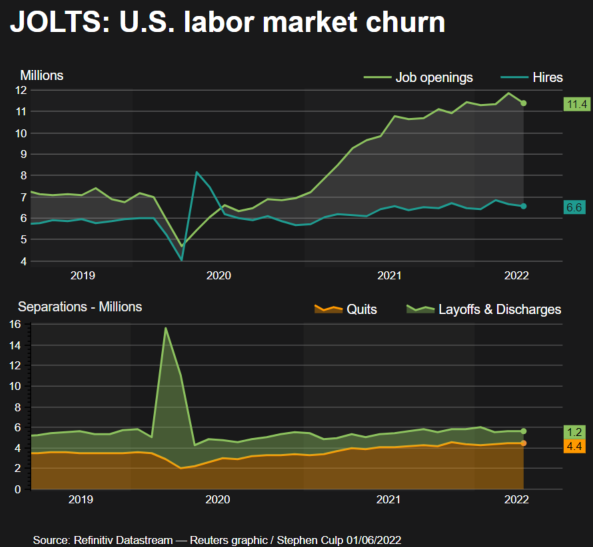

U.S. job openings fell in April, but remained at considerably high levels, suggesting that wages would continue to rise as companies scramble for workers, and contribute to inflation staying uncomfortably high for a while.

The Job Openings and Labor Turnover Survey, or JOLTS report, from the Labor Department on Wednesday also showed layoffs dropping to a record low, underscoring the jobs market tightness. The Federal Reserve, fighting to push inflation down to its 2% target, is trying to bring demand and supply of labor back into alignment without pushing the unemployment rate too high.

So far, there are few signs that the U.S. central bank's aggressive monetary policy stance is cooling demand in the overall economy. Activity at U.S. factories activity picked up in May as demand for goods remained strong, other data showed. The reports further allayed fears of an imminent recession, which have been fanned by rising interest rates and tightening financial conditions.

"Today's reports show the economy is not slowing appreciably and the labor market remains very strong," said Christopher Rupkey, chief economist at FWDBONDS in New York.

Job openings, a measure of labor demand, declined by 455,000 to 11.4 million on the last day of April. Data for March was revised higher to show a record 11.855 million vacancies instead of the previously reported 11.5 million. April's job openings were in line with economists' expectations.

Vacancies in the health care and social assistance industry fell by 266,000. There were 162,000 fewer job openings in the retail sector, while open positions in the accommodation and food services industry decreased by 113,000.

But the transportation, warehousing, and utilities sector had an additional 97,000 unfilled jobs. Job openings increased by 67,000 in nondurable goods manufacturing, while makers of durable goods had 53,000 more vacancies.

The job openings rate slipped to 7.0% from 7.3% in March.

Fed Chair Jerome Powell last month described job openings as "extraordinarily high," and said "there's a path by which we would be able to have demand moderate in the labor market and therefore have vacancies come down without unemployment going up." The jobless rate held at a two-year low of 3.6% in April.

The Fed has raised its policy interest rate by 75 basis points since March. It is expected to hike the overnight rate by half a percentage point at both its June and July meetings.

Companies struggled to find workers to fill the open jobs. Hiring fell by 59,000 to 6.586 million. That left the hires rate unchanged at 4.4%. With workers scarce, layoffs remain low. Layoffs and discharges dropped by 170,000 to an all-time low of 1.246 million. Resignations remained high, with 4.424 million quitting, little changed from March.

U.S. stocks were lower. The dollar rose against a basket of currencies. U.S. Treasury prices fell.

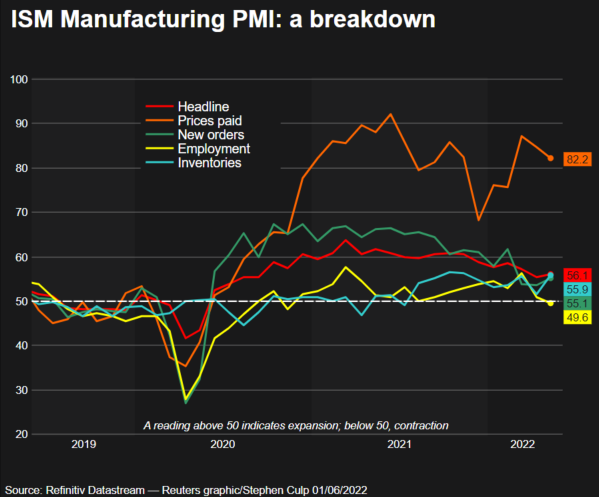

Graphic: ISM manufacturing PMI -

STRONG GOODS DEMAND

In a separate report on Wednesday, the Institute for Supply Management (ISM) said that its index of national factory activity rebounded to a reading of 56.1 last month from 55.4 in April. A reading above 50 indicates expansion in manufacturing, which accounts for 12% of the U.S. economy.

Economists had forecast the index falling to 54.5. The survey followed a report last Friday showing consumer spending increasing strongly in April. The nation has been gripped by fears of an economic downturn because of the Fed's rate hikes, rising Treasury yields and plunging equity prices.

Graphic: JOLT -

Demand for goods remains resilient even as spending is shifting back to services like travel, dining out and recreation. Goods spending surged as the COVID-19 pandemic restricted movement.

The ISM survey's forward-looking new orders sub-index increased to 55.1 from 53.5 in April. Manufacturing has been constrained by snarled supply chains, which have been further entangled by Russia's unprovoked war against Ukraine and new shutdowns in China as part of Beijing's zero COVID-19 policy.

The ISM's measure of supplier deliveries slipped to 65.7 last month from 67.2 in April. A reading above 50 indicates slower deliveries to factories. The survey's gauge of order backlogs rose to a reading of 58.7 from 56.0 in April.

News on the inflation front was encouraging. A measure of prices paid by manufacturers dropped to a reading of 82.2 from 84.6 in April, supporting views that inflation has probably peaked. But the survey's measure of factory employment dropped to 49.6 from 50.9 in April. That was the first decline below 50 since last August.

© Copyright Thomson Reuters {{Year}}. All rights reserved.