What's Next In The Elon Musk And Twitter Saga?

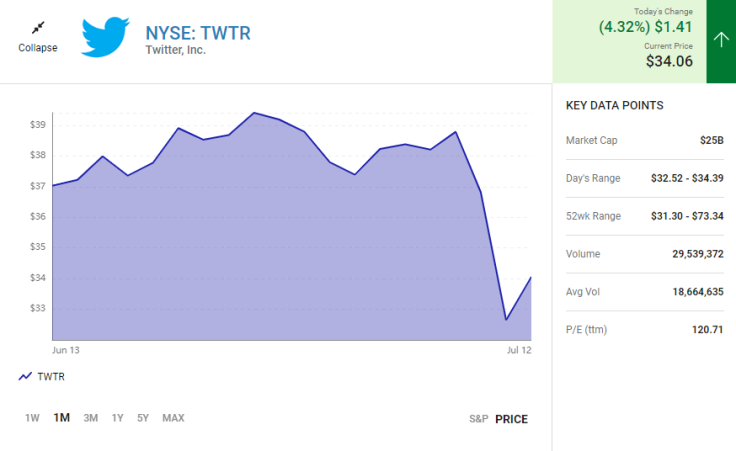

One of the more dramatic stories of 2022 is closing -- Elon Musk is terminating his deal to buy Twitter (TWTR 4.32% ). News of this sent Twitter's stock about 6% after hours to $34, still well short of the $54.20 per share Musk was offering.

While Musk may be through, is this an opportunity for investors to take a position in Twitter? After all, Twitter is one of the most popular social media companies.

Shaky user data

First, it may be good to understand why Musk terminated the deal. The biggest sticking point for the deal was Twitter's refusal to provide complete data on fake or spam bots. This data is critical, as it determines how many of its users can be monetized. Most of Twitter's revenue is derived from advertising (93% during the first quarter). If Twitter can't guarantee that most ad viewers are humans, then the price companies are willing to spend on ads is substantially reduced.

Twitter has long claimed the number of bots is less than 5% of total users, but Musk wanted to confirm those numbers for himself.

In the first quarter, Twitter reported monetizable daily active users (mDAU) of 229 million. However, they also had to revise previously stated mDAUs for the last five quarters due to an error in how they were calculated. This mistake instills less confidence in management's ability to report mDAUs accurately.

Throw in their refusal to provide Musk with the data he wants, and it makes investors wonder what they can trust.

Twitter fires back

Twitter's management isn't just going to let a $54.20 per share offer walk away (especially when there's a $1 billion breakup fee Musk is claiming he wouldn't need to pay). It responded by issuing a letter that claimed Twitter had not violated any of the obligations under its agreement. It also stated that Musk and his party "knowingly" and "willingly" breached the terms of the initial contract.

This breakup will get ugly and will likely end up in court.

While not legally required to do so, the letter did not disclose if Twitter had actually given Musk the user data he was requesting. Whether this was intentionally left off or not, it does leave outsiders wondering what is really going on.

What's next?

As mentioned above, this acquisition will likely end up in court. This battle would incur significant legal fees and consumer time from Musk and Twitter executives. A few ways it could shake out:

- Musk (or Twitter) pays the $1 billion breakup fee, and each entity goes its separate ways without the long, drawn-out court battle.

- The courts force Twitter to disclose the data Musk wants, which still leaves the question open if management was truthful or not, leaving Musk a door to still back away.

- The courts side with Twitter, and Musk would need to decide if he wants to continue his acquisition.

None of these options are ideal, and with the growing animosity between the two parties, each may want to prove that they are right.

However, with the stock now trading well below its buyout price, is this a prime opportunity to make an even larger arbitrage gain?

Should you use this opportunity to buy Twitter stock?

Unlike user data, financials are much easier to audit. However, they also aren't much better.

In Q1, revenue rose 16% YOY (year-over-year) to $1.2 billion. But, expenses rose faster at a 35% clip. This increase was primarily driven by an astounding 60% increase in stock-based compensation, diluting shareholders.

Twitter was profitable in the quarter, but only because it sold MoPub (a mobile ad publishing platform) for $1.05 billion. Without that, it would have lost about $128 million in the quarter.

However, many companies are likely reading the termination letter sent by Musk and noting Twitter's refusal to provide relevant user data. This refusal will likely have long-term damaging effects on Twitter's advertising brand. If management can't provide a suitor the data he needs to close a deal, what makes prospective customers believe the 5% spam account figure is accurate?

As an investor, I don't have a lot of faith in management. This sentiment was echoed by Musk and former CEO and co-founder Jack Dorsey. So if these two have no confidence, why would I?

There are plenty of better investments available in the market, and I think investors should appreciate the entertainment value of this acquisition more than the potential investment value.

This article originally appeared in the Motley Fool. The Motley Fool has a disclosure policy.