Will Western Digital's Decision To Cut Ties with Huawei Backfire?

Western Digital (NASDAQ:WDC) recently halted shipments of its data storage products to Huawei in response to the Trump Administration's decision to blacklist the Chinese tech giant. WD also suspended a new strategic partnership with Huawei in the hard drive and flash memory markets.

Huawei was placed on a trade blacklist last month. U.S. companies cannot sell products to those companies on the list without the government's permission. The Trump Administration suspended the ban on Huawei for 90 days to allow companies to finish security updates and fulfill contractual obligations, but Huawei remains banned from installing American hardware and software in new devices.

WD's decision wasn't surprising, but it represents a significant setback for the company. WD stated that it generates less than 10% of its sales from Huawei, but orders from China accounted for 21% of its sales in 2018. Could this decision backfire and blow up its entire Chinese business?

Rubbing salt on fresh wounds

Western Digital is the world's largest maker of platter-based HDDs (hard disk drives). It's the second largest maker of flash-based SSDs (solid state drives) after Samsung(NASDAQOTH:SSNLF) thanks to its acquisition of SanDisk in 2016. It's also the third largest maker of NAND flash memory chips after Samsung and Toshiba Memory.

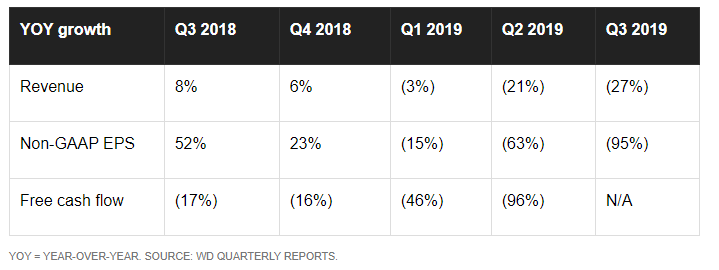

Despite the rankings, WD's revenue and earnings growth have crumbled over the past year. Sales of its HDDs fell due to weak PC sales and sluggish enterprise demand, and a global glut of memory chips torpedoed its SSD and flash memory business. Its revenue, earnings, and free cash flow growth all plummeted over the past three quarters:

At the end of April, WD forecast that its fourth-quarter revenue would decline 27% annually (at the midpoint), that its non-GAAP gross margin would hold steady sequentially, and that its non-GAAP earnings would fall 94%. Those numbers looked disastrous, but they indicated that its declines were finally bottoming out.

Unfortunately, WD's decision to cut off Huawei indicates that it hasn't hit a cyclical bottom yet. WD supplies memory chips for Huawei's smartphones, as well as hard drives for its PCs and data centers.

In a recent Nikkei interview, CEO Steve Milligan said that Huawei is still a "meaningful customer" despite accounting for less than 10% of its sales. WD's decision to cut off Huawei could also convince other big Chinese customers, like PC giant Lenovo, to buy disk drives and memory chips from non-American suppliers like Samsung, SK Hynix, and Toshiba. This means that WD could lose about a fifth of its annual revenue if the trade war escalates into a full-blown tech war.

The war on Huawei will trigger macro headwinds

Both DRAM and NAND prices have been tumbling worldwide, and most analysts don't see a meaningful recovery until the second half of 2020. The U.S. government's attempts to cripple Huawei, the world's second largest smartphone maker and one of its top telecom infrastructure equipment makers, could exacerbate that pain in two ways.

First, the loss of Huawei's orders would exacerbate the supply glut of DRAM and NAND chips and throttle any near-term recovery in market prices. Second, the Trump Administration's attacks on Huawei will encourage China's state-backed chipmakers to accelerate the development of their domestic chips. If those chipmakers flood the market with cheaper memory chips, DRAM and NAND prices could remain depressed for years and douse any hopes for a cyclical recovery.

Stuck between a rock and a hard place

Western Digital needed to cut ties with Huawei to remain in the U.S. government's good graces, but the move will exacerbate the trade war and dampen any near-term prospects for its core business. That's why WD's stock still doesn't seem cheap at less than nine times forward earnings. Investors simply don't want to touch a stock that's trapped between a rock and a hard place.

Leo Sun has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

This article originally appeared in The Motley Fool.