Amazon: Could it Buy Sony Ericsson to Bolster Battling the iPad?

Could Amazon, the world's biggest Internet store, jump into the tablet sector by buying lagging Sony Ericsson? Now that Motorola Mobility has agreed to be sold to Google, the lines are getting blurred as tech savvy companies plan disruptive technologies.

Amazon, which Citigroup estimates will sell 17.5 million Kindles just this year, is already in the wireless sector, downloading millions of titles from its bookstore Competing against Apple and Netflix, Amazon already offers several thousand titles licensed from CBS and NBCUniversal to offer digital entertainment.

In the current auction of web-based entertainment site Hulu, investment bankers are said to have offered it to Seattle-based Amazon, as well as Google, Yahoo and DirecTV.

Amazon, whose sprawling network accounts for nearly 10 percent of all U.S. consumer electronics sales, according to Consumer Electronics Association data, plans to enter the tablet market next quarter with an Android-based product trademarked as Lab126. The Amazon tablet will be slightly smaller than Apple's iPad2 and surely priced well below it to be competitive.

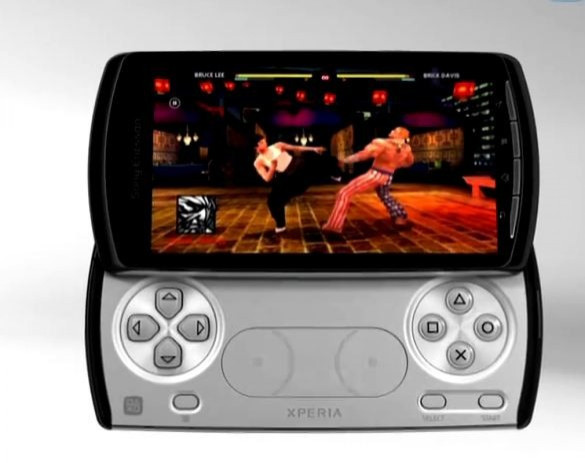

So why not buy Sony Ericsson, the 10-year-old joint-venture company between Japan's Sony and Sweden's L.M. Ericsson, to jump into the market faster? London-based Sony Ericsson's share of the smartphone market is in the other category listed by IHS and other researchers. Last year, Sony Ericsson executives estimated their share around 6 percent.

Amazon, by contrast, is thriving. It reported second-quarter revenue leaped by 51 percent to nearly $9.9 billion, although net income fell 8 percent to $191 million. The success came as one of the biggest U.S. booksellers, Borders, collapsed and the overall retail economy lagged.

The company, which reported cash and securities exceeding $6.3 billion, could pretty much do whatever it wants. Besides selling books, e-books and consumer electronics, Amazon also offers computing services in the so-called cloud to businesses.

Amazon also has some creative minds in top management, headed by founding CEO Jeffrey Bezos, 47, a Princeton-trained engineer.

Director Jonathan Rubinstein, 54, the former CEO of Palm, now is HP's Vice President and General Manager for Palm or the ill-fated TouchPad. Another director with vision is John Seely Brown, 71, who was director of Xerox's Palo Alto Research Center, which developed the mouse and the computer icon, inspiring Apple founders Steve Jobs and Steve Wozniak, among others.

Taking over Sony Ericsson would add a leg up to Amazon's already thriving Kindle business, adding smartphones that could be rebranded as Amazon phones or Kindlephones to the tablet. Amazon already works with contract manufacturers like Taiwan's Foxconn, the reputed maker of the iPhone and iPad, for the Kindle, as well as with top chipmakers like Freescale Semiconductor and Samsung Electronics.

For the sellers, Ericsson could focus on its expertise as one of the telecommunications world's pioneers in digital switching and mobile communications, minus the handsets. Sony, which has never recovered the luster it held under founding CEO Akio Morita, could focus on consumer electronics and entertainment --- using Amazon as a growing venue for e-commerce.

Mobile phones and smartphones, of course, usually need to be seen and evaluated by the consumer, but Amazon wouldn't need to open stores, like Apple, at least to start. They could be handled through the thousands of mobile phone storefronts already maintained by the carriers and their authorized representatives.

To sell the Amazon tablet, though, perhaps Bezos might consider testing the waters by opening a brick-and-mortar store, a first in his company's 17-year history. For Amazon, that would be the ultimate disruptive technology.

Amazon shares Wednesday closed at $193.73, up 1 percent, giving the retailer a market capitalization of $87.9 billion.

© Copyright IBTimes 2025. All rights reserved.