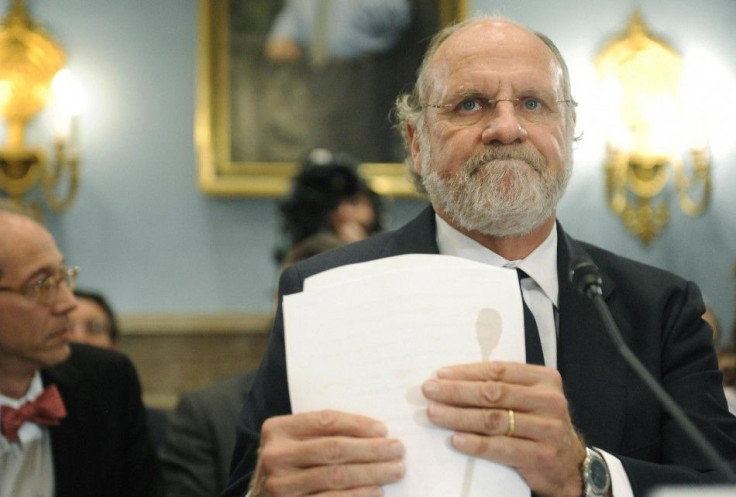

Failed Brokerage CEO Jon Corzine Likely To Dodge Criminal Charges

Poor risk control, not fraud, was the reason for the disappearance of $1 billion during the collapse of MF Global, which filed for bankruptcy in October, 20 months after former New Jersey Democrat senator and governor Jon Corzine took the helm of the futures brokerage firm.

That is the likely conclusion being made by investigators who have spent the past 10 months poring over thousands of documents and interviewing former employees only to find they lack enough evidence to file criminal charges against any of the firm's top executives, according to The New York Times.

Corzine, who was once the head of Goldman Sachs, has agreed to meet next month with federal investigators who are hoping the former MF Global CEO and chairma can offer guidance into how and why customers lost millions of dollars on risky bets that went sour during Europe's sovereign debt meltdown.

Corzine's cooperation is seen as indication investigators have nothing related to fraud to pin on him, according to The New York Times.

However, even if Corzine is freed from any criminal charges he faces a slew of lawsuits and has regulators seeking to slap him and other executives with civil penalties for allegedly misleading investors about the firm's financials.

For his part, Corzine is staging a comeback with his own money and is reportedly considering founding a hedge fund, a comeback that could be blocked if the Commodities Futures Trading Commission bars him from working in securities.

Corzine become one of many symbols of Wall Street's tolerance for excessive risk-taking, if not criminal fraud, by large financial institutions. He was one of the many executives in recent years to be forced to travel to Washington to for a grilling by lawmakers in show hearings.

Meanwhile, James Giddens, the trustee overseeing the firm's parent company, MF Global Holdings Ltd., is cooperating with plaintiffs in the case against Corzine and other firm executives, according to Businessweek. The agreement, which requires a judge's approval, would have the trustee work with the plaintiffs to help them with whatever available financial compensation during the company's liquidation.

MF Global was wiped out with $6.3 billion worth of wagers on Europe's sovereign debt. By the time the company filed for bankruptcy on Oct. 31 it had $40 billion in debt. Corzine resigned shortly after the bankruptcy was announced.

© Copyright IBTimes 2024. All rights reserved.