China's Urbanization Pace To Slow, So Will Growth

China bulls, take note. It’s time to drop the conventional wisdom that urbanization will underpin long-term growth in China. The pace of urbanization is set to slow and its contribution to economic growth is set to decline, Nomura warns.

“While urbanization has undoubtedly served as a pillar of growth in the past, we believe it may become a source of future volatility and risk,” Nomura economists led by Zhiwei Zhang said in a note.

The pace of urbanization in China has already showed signs of significant slowdown in recent years. In 2013, the urbanization ratio, measured as the urban population’s share of the total population, rose by only 1.16 percentage points. That’s the slowest since 1996, except for 2008, when the global financial crisis hit China.

Growth of the urban population has also fallen in the last three years, to 2.7 percent in 2013 from 3.9 percent in 2010, having averaged 4.0 percent from 2000 to 2010.

Nomura economists believe the pace of urbanization is set to slow further. “If the trend since 2010 holds, we estimate that the annual increase in the urbanization ratio may drop to around 1 percentage point in 2014-15 and below 1 percentage point thereafter,” they said.

Zhang and his colleagues see three structural factors driving this slowdown:

1. Rapid industrialization and servitization may have ended.

Industrialization played a crucial role in China’s urbanization process. A typical example is the transformation Shenzhen, a city close to Hong Kong, experienced. Between the 1980s and 2012, Shenzhen developed from a small fishing village of 30,000 into China’s third-largest city, with a population of 10.6 million.

The amazing growth was driven largely by market forces as multinationals moved their production basis into Shenzhen to take advantage of the cheap labor and its convenient location close to Hong Kong. Shenzhen’s gross domestic product per capita hit $19,524 in 2012.

As households with higher incomes demand more services, the service sector growth starts to outpace industrial sector growth. The service sector share of Shenzhen’s GDP rose from 46 percent in 2005 to 57 percent in 2012.

For the country as a whole, the share of industrial and service sectors of GDP rose quickly during the period from 1960 to 2006, averaging 0.64 percentage points of growth per year, economists at Nomura pointed out. However, that figure has fallen from an average of just 0.16 percentage points between 2007 and 2013.

Countries like Japan and Korea have experienced similar sharp slowdowns of industrialization and servitization, after which the pace of urbanization slowed by an average 0.9 percentage points per year.

2. Lewis turning point and depletion of rural surplus labor.

The second structural factor that drove rapid urbanization was the migration of surplus rural labor to the cities.

According to the National Bureau of Statistics, the amount of migrant workers rose from 225.4 million in 2008 to 268.9 million in 2013, accounting for 36.9 percent of the urban population. The increase in the number of migrant workers itself pushes up the urbanization ratio by 2.8 percentage points over this period, while the urbanization ratio rose from 47.0 to 53.7.

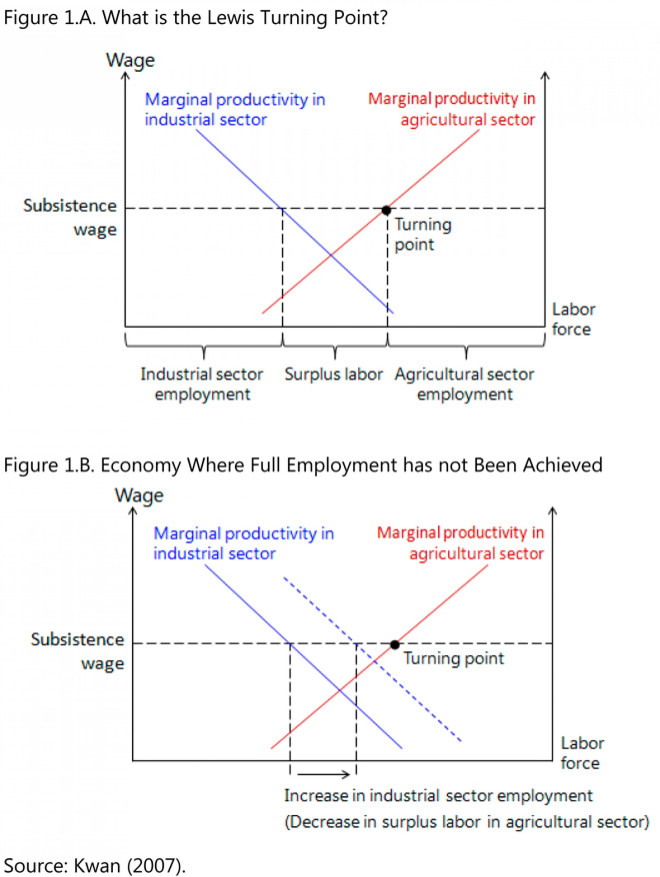

But a spate of worker unrest and rising wages in China suggest that the world’s second-largest economy has passed what economists call the “Lewis turning point,” when low-cost manufacturing industries become less competitive, forcing a change in the nation's growth structure.

When an economy first becomes industrialized, it grows very fast by importing foreign technology and employing capital and plentiful, cheap labor mainly drawn from the agricultural sector. The migrant labor force accepts lower wages corresponding to the living standards prevalent in farming.

However, a point is reached when no more labor is forthcoming from the underdeveloped sector and wages begin to rise. This is known as the “Lewis Turning Point,” named after the late economist and 1979 Nobel laureate W. Arthur Lewis.

This is a key reason why companies like Caterpillar Inc. (NYSE: CAT) and Ford Motor Co. (NYSE: F) are either “re-shoring” from China back to the U.S. or relocating their factories to India and the ASEAN economies.

The number of new migrant workers halved to 6.3 million in the three years to 2013, despite salaries on offer almost doubling. “If this deceleration trend continues, as we expect it to, the number of migrant workers may begin to contract by 2016,” Zhang said.

A paper released by International Monetary Fund economists Mitali Das and Papa N'Diaye -- “Chronicle of a Decline Foretold: Has China Reached the Lewis Turning Point?” -- predicts China would move from a vast supply of low-cost workers to a labor shortage economy sometime between 2020 and 2025.

3. Government-driven urban expansion is unsustainable.

“The pace of urbanization did not slow until 2011, despite the significant moderation of industrialization and servitization since 2007,” Zhang said. “This was largely due to urban area expansion, driven by the government, which picked up speed after the onset of the 2008 global financial crisis.”

However, government-driven urban expansion is facing binding constraints. It has been financed by government debt and land sales, while fiscal conditions have deteriorated sharply.

The actual fiscal deficit, based on IMF estimates, rose to 10 percent of GDP in 2012 -- comparable to India, Japan and the U.S. If local government financing vehicle (LGFV) debt, railway debt and asset management companies’ debt are included, Nomura estimates total public debt-to-GDP reached 75 percent in 2013,

Nomura estimates that more than half of LGFVs would be unable to service even their interest expenses, not to mention the principle repayments.

The second constraint is land sales, which were equivalent to 59.4 percent of local government and 68.1 percent of central government budgetary revenues in 2013. Land sales look set to slow on the oversupply of properties in third- and fourth-tier cities, according to Zhang.

Pollution is also a constraint on massive urban construction plans. Many cities, including Shanghai and Beijing, suffer from severe air pollution.

© Copyright IBTimes 2024. All rights reserved.