Commodities 2013: Not The Best Investments, By A Long Shot

Commodities, which include everything from industrial and precious metals to agricultural goods and energy supplies, fared badly almost across-the-board in 2013, according to a Capital Economics research note on Wednesday.

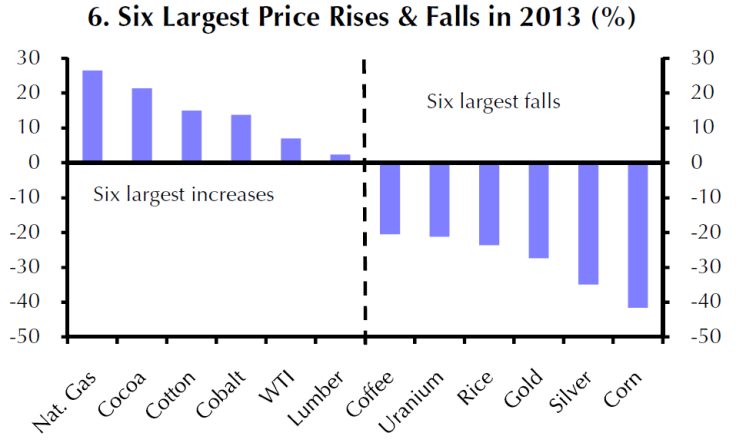

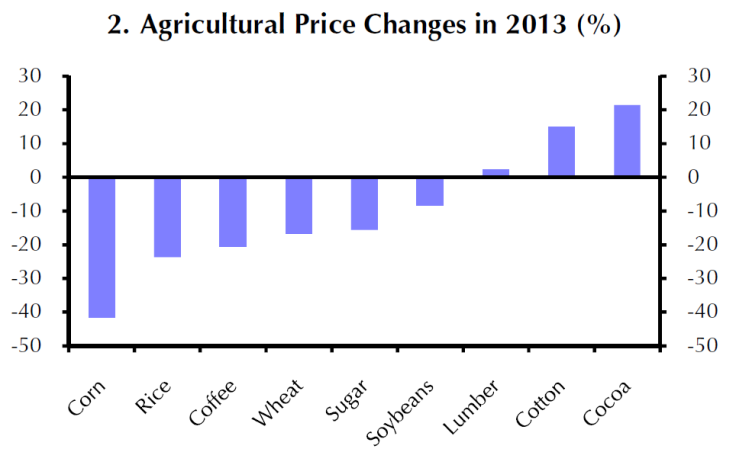

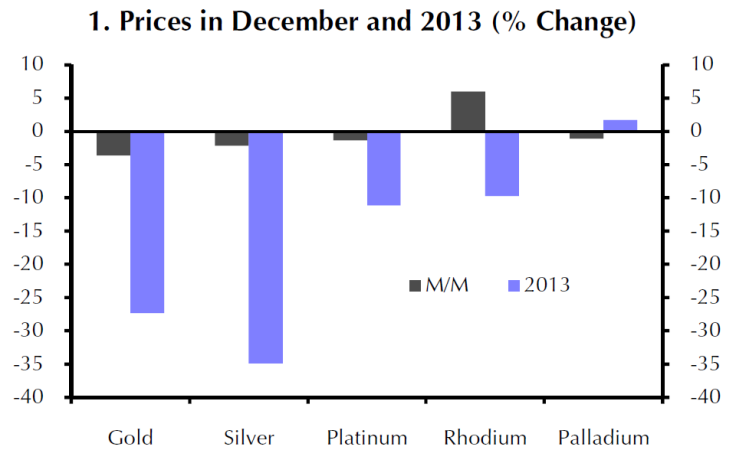

“Dismal returns” confronted commodities investors by the end of 2013, as key benchmark indices like the S&P GSCI index fell significantly, led by poor precious metals and agricultural prices. Gold fell 28 percent in its worst year since 1981, while corn had its worst year since 1970.

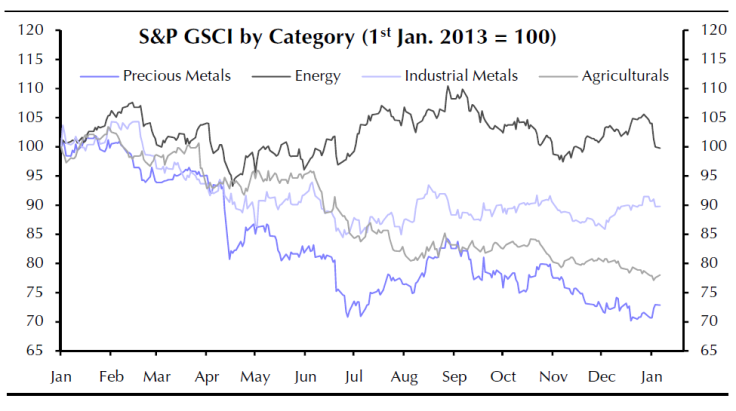

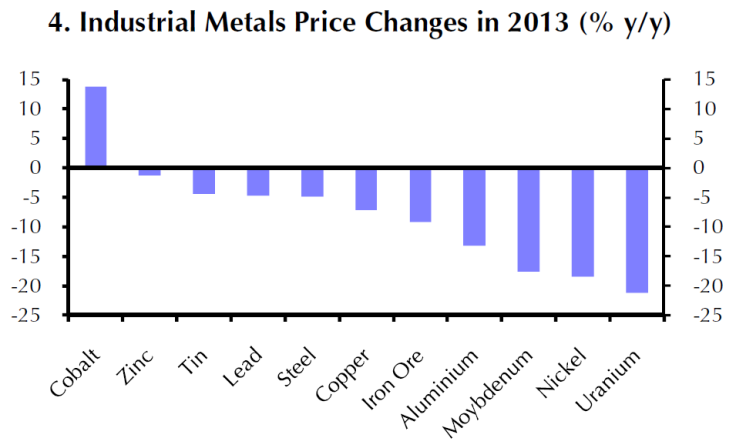

Much of the drag was caused by improved global supplies, at least for agricultural commodities and industrial metals, like copper and aluminum. Precious metals, industrial metals and agricultural commodities all fell broadly in price from January 2013, with energy prices performing modestly over the year.

“Weakness in the three worst performing sectors was widespread, with almost all the individual commodities which make up these indices declining,” wrote Capital Economics economists in their note.

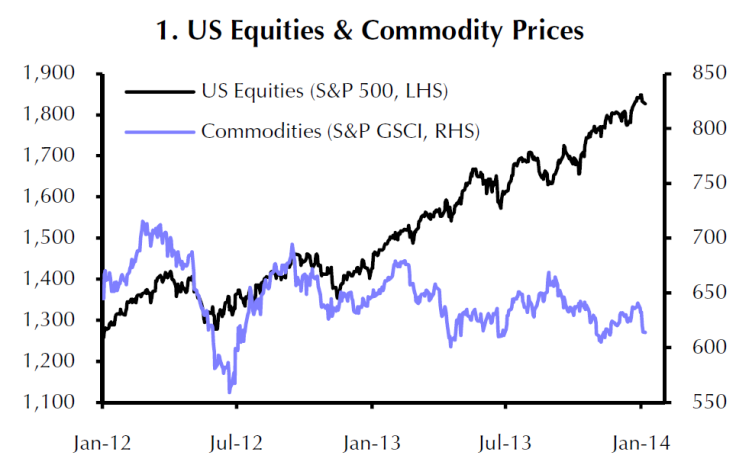

Investors likely fared much better if they’d piled into equities, especially in the U.S., where index records were repeatedly broken in 2013. Industrial metals in particular have yet to emerge from a three-year malaise, according to the economists.

2013’s poor showing is the latest leg in a broader, longer and much discussed commodities slump. Some assets, especially U.S. natural gas and crops like wheat and orange juice, however, have seen recent bumps in December and January, as record cold weather disrupted harvests and logistics.

Capital Economics doesn’t expect this market landscape to change anytime soon. Price forecasts for many of the commodities foresee yet lower prices by early 2015. Some exceptions include platinum and palladium, alongside a handful of industrial metals. They expect platinum to reach $1800 per ounce in early 2015 from $1409 per ounce presently, in one of the strongest potential rises percentage-wise among commodities.

Other outperformers include cocoa, used to make chocolate, where prices have risen sharply since July, due to poor weather in major producers like the Ivory Coast and Ghana and fears of a supply deficit.

It’d take significant supply disruptions to boost agricultural prices, and a stronger-than-expected global economic recovery to lift demand for industrial metals, Capital Economics’ head of commodities research Julian Jessop told IBTimes.

From 2000 to 2008 or so, commodities advanced on a strong uptrend, but many analysts believe prices peaked from 2008 to 2010, with a much more difficult environment since 2010, said CPM Group commodities trader Carlos Sanchez at a New York commodities conference in September.

“Prices going forward this year, into next year, will probably see a sideways [trading] fashion, perhaps a bottoming out of commodities, particularly gold, perhaps base metals, and a few agricultural commodities,” he said then. He said factors external to internal supply and demand dynamics, like political dysfunction or monetary policy, are likely to impact commodities heavily, and are factors which investors have little control over.

Other analysts, like noted investor Dennis Gartner, have warned against treating commodities as a single asset class, partly because each good often trades on its own supply-and-demand dynamics.

Commodities analyst Edward Meir wrote in a Jan. 6 report that commodity prices in 2013 were at least more stable than in 2011 and 2012, even though there were declines.

“Several commodities could retest their 2013 lows over the first half of 2014 and break below them in some cases,” he wrote. A better economy in the U.S., Europe and Japan may not compensate for a potential slowdown in China, he said, insofar as many commodities, particularly industrial metals, have thrived in the past decade on booming Chinese demand.

Meir highlighted gold, silver, aluminum and nickel as particularly vulnerable.

Investors took money away from passive index funds and commodity exchange-traded funds, to the tune of a record $50 billion in 2013, according to a Citigroup Inc. (NYSE:C) note from Tuesday. That compares to a net inflow from investors of $27.5 billion in 2012, marking up a $75 billion change in sentiment.

“Citi remains a neutral-to-bearish stance across most major commodities in 2014 although the pace and amount of price retrenchment is likely to be much less severe this year versus last,” Citi analysts wrote.

One contrarian perspective, though, comes from Jessop.

“Commodities performed pretty poorly for three years, particularly last year compared to equities,” he told IBTimes. “Equity valuations are starting to look a bit stretched. There might be a switch of investment out of equities into commodities, where the upside is a fair bit higher.”

He said a switch from booming equities to cheap commodities is supported theoretically by the idea that equities have been artificially buoyed by loose monetary policy in Western economies, which in the U.S. has begun to scale back.

© Copyright IBTimes 2024. All rights reserved.