Earnings Preview: Bank of America Corp (BAC), Wells Fargo (WFC), JPMorgan Chase (JPM), Goldman Sachs (GS), Citigroup (C)

Wells Fargo and JPMorgan Chase & Co. will kick off fourth-quarter bank earnings season on Tuesday with other big banks like Bank of America Corp. and Citigroup Inc. following later in the week.

Of the 100 companies that have provided guidance for fourth-quarter earnings, 80 were negative, 10 were positive and 10 were in line with expectations, according to S&P Capital IQ.

“This produces a negative-to-positive ratio of 8.0, higher than the 15-year average, offering an inauspicious glimpse of the earnings reporting period to come,” S&P Capital IQ Chief Equity Strategist Sam Stovall said in a note published Monday.

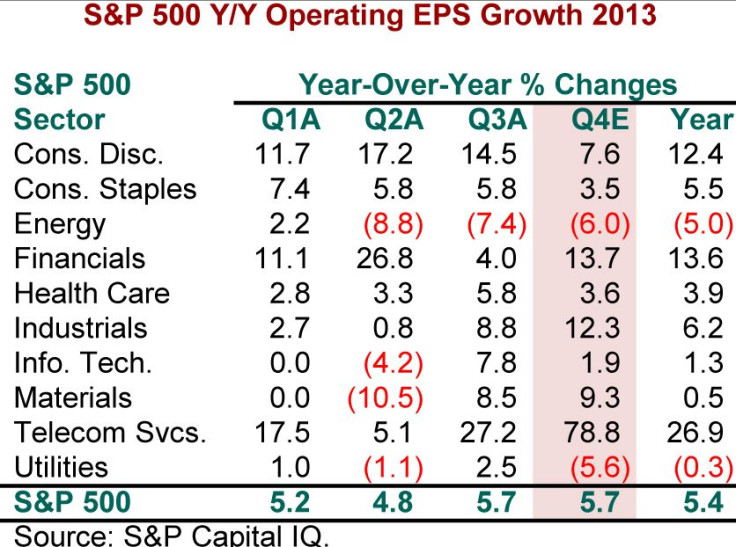

The S&P 500 (INDEXSP:.INX) is seen growing earnings per share by 5.7 percent in the fourth quarter of 2013 compared to the year-ago period, on par with the growth seen in the third quarter, according to S&P Capital IQ.

Eight sectors are expected to report year-over-year increases led by Financials, Industrials and Telecom Services, with Energy and Utilities recording the only declines.

From a revenue perspective, the fourth-quarter is expected to advance 2.6 percent, lower than the 4.2 percent gain seen in the third quarter. According to Stovall, seven of 10 sectors should report top-line growth, led by Consumer Discretionary, Health Care and Industrials. The revenue declines are projected to come from Information Technology, Telecom Services and Utilities sectors.

Capital Economics projects that the S&P 500 will end 2014 at around 1,850. “We do not expect the U.S. stock market to have another very strong year. That being said, we do not expect it to drop back sharply,” said John Higgins at Capital Economics in a note.

We ran a screen and produced a list of 20 notable companies set to report their earnings between Jan. 13 and Jan. 7. We've highlighted their expected reporting dates and times, along with analysts' earnings-per-share (fully reported) and revenue estimates from Thomson Reuters, as well as the stocks' trailing 12-month performances.

Tuesday Before Markets Open, or BMO:

Wells Fargo & Co. (NYSE:WFC) is a bank holding company. The company has a market cap of $240.20 billion. It is expected to report FY 2013 fourth-quarter EPS of 99 cents on revenue of $20.67 billion, compared with a profit of 91 cents a share on revenue of $21.95 billion in the year-ago period. Wells Fargo is trading at around $45.60 a share. Over the past 12 months, the stock has gained 31.4 percent.

JPMorgan Chase & Co. (NYSE:JPM) is a financial holding company. The company has a market capitalization of $220.97 billion. It is expected to report FY 2013 fourth-quarter EPS of $1.32 on revenue of $23.81 billion, compared with a profit of $1.39 per share on revenue of $24.38 billion in the year-ago period. JPMorgan Chase & Co is trading at around $58.80 a share. Over the past 12 months, the stock has gained 38.0 percent.

Tuesday After Markets Close, or AMC:

Linear Technology Corp. (NASDAQ:LLTC) is designing, manufacturing and marketing a range of analog integrated circuits for companies globally. The company has a market cap of $10.61 billion. It's expected to report FY 2014 second-quarter EPS of 44 cents on revenue of $334.79 million, compared with a profit of 38 cents a share on revenue of $305.28 million in the year-ago period. Linear Technology Corporation is trading at around $45.28 a share. Over the past 12 months, the stock has gained 26.9 percent.

Wednesday BMO:

Bank of America Corp. (NYSE:BAC) is a financial institution. The company has a market cap of $177.88 billion. It is expected to report FY 2013 fourth-quarter EPS of 27 cents on revenue of $21.28 billion, compared with a profit of 3 cents a share on revenue of $21.66 billion in the year-ago period. Bank of America is trading at around $16.62 a share. Over the past 12 months, the stock has gained 38.9 percent.

Wednesday AMC:

CSX Corp. (NYSE:CSX) is a transportation supplier. The company has a market cap of $28.52 billion. It is expected to report FY 2013 fourth-quarter EPS of 42 cents on revenue of $2.99 billion, compared with a profit of 43 cents a share on revenue of $2.88 billion in the year-ago period. CSX is trading at around $28.15 a share. Over the past 12 months, the stock has gained 37.2 percent.

Kinder Morgan Inc. (NYSE:KMI) owns and manages a diversified portfolio of energy transportation and storage assets. The company has a market cap of $37.31 billion. It is expected to report FY 2013 fourth-quarter EPS of 33 cents on revenue of $3.81 billion, compared with a profit of 34 cents a share on revenue of $3.08 billion in the year-ago period. Kinder Morgan Inc. is trading at around $35.97 a share. Over the past 12 months, the stock has lost 3.7 percent.

Thursday BMO:

BB&T Corp. (NYSE:BBT) is a financial holding company that has a market cap of $26.82 billion. It's expected to report FY 2013 fourth-quarter EPS of 72 cents on revenue of $2.37 billion, compared with a profit of 71 cents a share on revenue of $2.53 billion in the year-ago period. BB&T is trading at around $38.04 a share. Over the past 12 months, the stock has gained 27.6 percent.

Citigroup Inc. (NYSE:C) is a global diversified financial-services holding company with a market capitalization of $165.54 billion. Citigroup is expected to report FY 2013 fourth-quarter EPS of $1.02 on revenue of $18.42 billion, compared with a profit of 38 cents a share on revenue of $18.66 billion in the year-ago period. It is trading at around $54.51 a share. Over the past 12 months, the stock has gained 28.6 percent.

Goldman Sachs Group Inc. (NYSE:GS) is a global investment-banking, securities and investment-management firm. The company has a market cap of $80.49 billion. It's expected to report FY 2013 fourth-quarter EPS of $4.27 on revenue of $7.62 billion, compared with a profit of $5.60 a share on revenue of $9.24 billion in the year-ago period. Goldman Sachs is trading at around $177.62 a share. Over the past 12 months, the stock has gained 33.5 percent.

Huntington Bancshares Incorporated (NASDAQ:HBAN) is a multi-state diversified regional bank holding company. The company has a market cap of $8.06 billion. It's expected to report FY 2013 fourth-quarter EPS of 17 cents on revenue of $679.23 million, compared with a profit of 19 cents a share on revenue of $731.71 million in the year-ago period. Huntington Bancshares Inc. is trading at around $9.70 a share. Over the past 12 months, the stock has gained 45.9 percent.

PNC Financial Services Group Inc. (NYSE:PNC) is a financial service company with a market cap of $41.69 billion. It's expected to report FY 2013 fourth-quarter EPS of $1.64 on revenue of $3.84 billion, compared with a profit of $1.24 a share on revenue of $4.07 billion in the year-ago period. PNC Financial Services Group Inc. is trading at around $78.36 a share. Over the past 12 months, the stock has gained 30.0 percent.

UnitedHealth Group Inc. (NYSE:UNH) is a diversified health and well-being company. It has a market cap of $76.07 billion. The company is expected to report FY 2013 fourth-quarter EPS of $1.40 on revenue of $31.07 billion, compared with a profit of $1.20 a share on revenue of $28.77 billion in the year-ago period. UnitedHealth Group Inc. is trading at around $75.53 a share. Over the past 12 months, the stock has gained 1.2 percent.

Thursday AMC:

Capital One Financial Corp. (NYSE:COF) is a diversified financial services holding company. The company has a market cap of $44.72 billion. It's expected to report FY 2013 fourth-quarter EPS of $1.55 on revenue of $5.46 billion, compared with a profit of $1.41 a share on revenue of $5.62 billion in the year-ago period. Capital One Financial Corp. is trading at around $77.60 a share. Over the past 12 months, the stock has gained 24.8 percent.

Intel Corp. (NASDAQ:INTC) designs and manufactures integrated digital technology platforms. The company has a market cap of $126.14 billion. It's expected to report FY 2013 fourth-quarter EPS of 52 cents on revenue of $13.72 billion, compared with a profit of 48 cents a share on revenue of $13.48 billion in the year-ago period. Intel Corp. is trading at around $25.34 a share. Over the past 12 months, the stock has gained 20.1 percent.

Skyworks Solutions Inc. (NASDAQ:SWKS) offers analog and mixed signal semiconductors. The company has a market cap of $5.25 billion. It's expected to report FY 2014 first-quarter EPS of 50 cents on revenue of $500.00 million, compared with a profit of 34 cents a share on revenue of $453.72 million in the year-ago period. Skyworks Solutions Inc. is trading at around $27.85 a share. Over the past 12 months, the stock has gained 36.5 percent.

SLM Corp. (NASDAQ:SLM) originates, services, and collects loans it makes to students and/or their parents to finance the cost of education. The company has a market cap of $11.51 billion. It's expected to report FY 2013 fourth-quarter EPS of 72 cents on revenue of $673.67 million, compared with a profit of 74 cents a share on revenue of $832.00 million in the year-ago period. SLM Corp. is trading at around $26.40 a share. Over the past 12 months, the stock has gained 51.3 percent.

Friday BMO:

General Electric Co. (NYSE:GE) is a diversified technology and financial-services company. The company has a market cap of $274.99 billion. It's expected to report FY 2013 fourth-quarter EPS of 49 cents on revenue of $40.22 billion, compared with a profit of 38 cents a share on revenue of $39.33 billion in the year-ago period. GE is trading at around $27.20 a share. Over the past 12 months, the stock has gained 30.1 percent.

Schlumberger Limited (NYSE:SLB) provides a range of products and services from exploration through production. The company has a market cap of $114.35 billion. It is expected to report an FY 2013 fourth-quarter EPS of $1.34 on revenue of $12.02 billion, compared with a profit of $1.02 a share on revenue of $11.17 billion in the year-ago period. Schlumberger is trading at around $86.90 a share. Over the past 12 months, the stock has gained 19.7 percent.

SunTrust Banks, Inc. (NYSE:STI) is a commercial banking organization. The company has a market cap of $19.99 billion. It is expected to report FY 2013 fourth-quarter EPS of 69 cents on revenue of $2.03 billion, compared with a profit of 65 cents a share on revenue of $2.29 billion in the year-ago period. SunTrust Banks is trading at around $37.25 a share. Over the past 12 months, the stock has gained 28.6 percent.

The Bank of New York Mellon Corp. (NYSE:BK) is a global financial-services company. The company has a market cap of $39.81billion. It's expected to report an FY 2013 fourth-quarter EPS of 54 cents on revenue of $3.72 billion, compared with a profit of 53 cents a share on revenue of $3.64 billion in the year-ago period. Bank of New York Mellon is trading at around $34.66 a share. Over the past 12 months, the stock has gained 27.0 percent.

© Copyright IBTimes 2024. All rights reserved.