Economists Say Lower-Than-Expected Dips In Indicators Can Be Quietly Celebrated Just Like Slight Upticks

The U.S. economy is hardly out of the woods, but analysts aren't missing opportunities to celebrate modest upticks and point out when dips are smaller than expected.

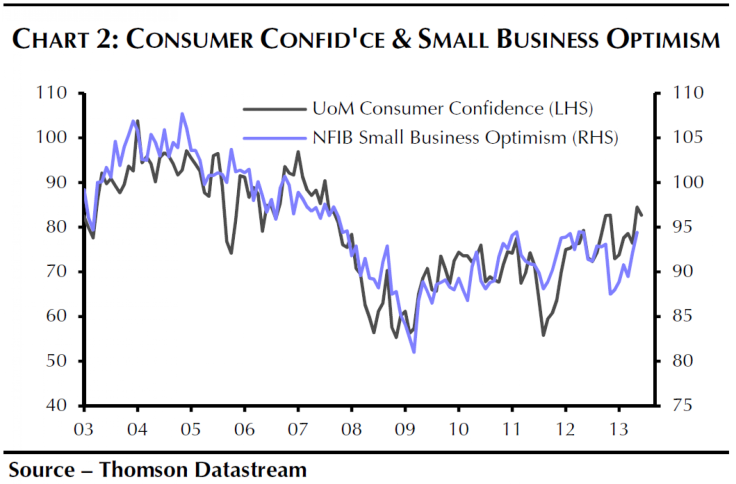

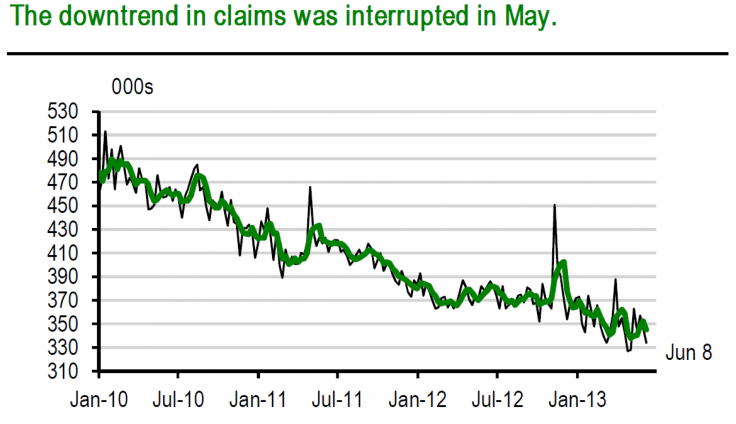

A number of research notes released Friday that assess the past few months say that indicators such as consumer confidence and initial jobless claims are trending positively overall, even if the trending has been mixed week to week.

Economists from UBS and Capital Economics say consumer confidence, despite slipping 1.8 points, still remained near its five-year high in June.

"The decline in consumer confidence was a bit odd given that all of the other measures of sentiment increased in June," said Amna Asaf with Capital Economics. "But the latest stabilization in gasoline prices, higher equity prices and the improving housing and labor markets are likely to keep consumers feeling upbeat."

Maury N. Harris, with UBS Investment Research, also stated that real consumer spending growth is better than what UBS factored into its 2.9 percent forecast for overall GDP.

"Real consumption appears to have maintained a pace a bit above 3 percent through mid-Q2," said Harris, "a good deal better than the 2.4 percent pace we have been assuming."

The consumer expectations index is normally driven by labor market conditions, which appear to be gradually improving based on the latest dip in initial jobless claims. The number of Americans applying for first-time unemployment benefits dropped June 1 to 334,000, a decrease of 12,000 and fewer than the number analysts were expecting.

Based on the relationship between expectations and labor conditions, the consumer expectations index now suggests that second-quarter consumption growth could be almost as strong as the 3.4 percent annualized gain in the first quarter, according to Asaf.

© Copyright IBTimes 2025. All rights reserved.