Global Oil Glut To Stretch Into 2016 As Demand Growth Slows: IEA Monthly Oil Market Report

The glut in global oil supplies will stretch into 2016 as demand growth slows worldwide and Middle East exports are poised to surge, a top energy watchdog said Tuesday. The report prompted volatility in morning oil prices amid fears the oversupply of crude will continue to swell.

“The market may be off balance for a while longer,” the Paris-based International Energy Agency said in its closely watched monthly oil report for October. “A projected marked slowdown in demand growth next year and the anticipated arrival of additional Iranian barrels … are likely to keep the market oversupplied through 2016.”

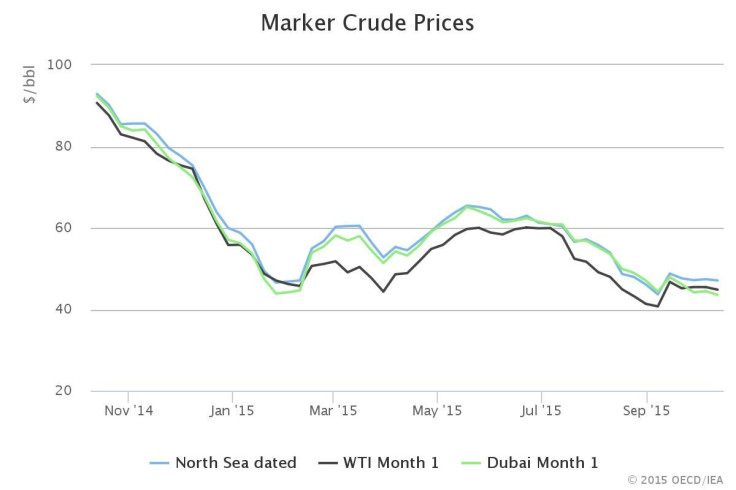

Abundant crude supplies have slashed oil prices by about half since last summer, when prices hovered in the triple digits. Brent crude, the global benchmark, was trading at $50.15 Tuesday morning, while U.S. benchmark crude was at $47.60.

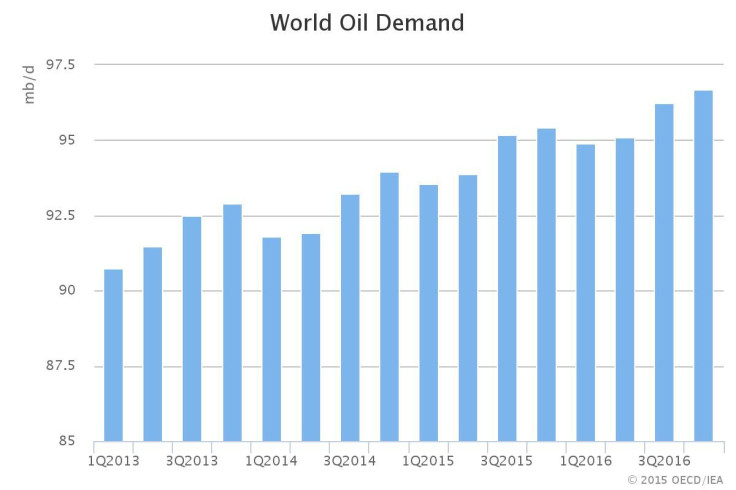

Lower prices this year boosted demand in the United States and China, the world’s top consumers, spurring a five-year high in global demand growth. But China’s economic slowdown and sluggish economic growth in oil-dependent economies, such as Canada, Brazil and Russia, are projected to soften oil consumption next year. Global demand growth is projected to slow to 1.2 million barrels a day in 2016, about a one-third decline from 1.8 million barrels a day in 2015, IEA reported.

The demand growth decline will offset the drop in oil production from nations outside OPEC, allowing the glut to endure in 2016. Falling oil prices and steep spending cuts by oil and gas producers are expected to slash non-OPEC production by nearly 0.5 million barrels a day next year, according to IEA.

OPEC production, meanwhile, is expected to surge on gains in Iraqi production and the likely return of Iranian crude to the market. If Iran, the U.S. and five other world powers complete a nuclear accord, restrictions on Iran’s crude sales could be lifted. Iranian officials said the country could export more than 1 million additional barrels of oil a day in the absence of sanctions, although U.S. energy experts said they expected figures closer to 300,000 to 500,000 barrels of additional oil per day.

Declining U.S. oil production will drive the decline in total supplies from nations outside OPEC, the IEA said. U.S. oil output will fall to 12.56 million barrels a day next year, from 12.75 million barrels in 2015. “The previously relentless growth in non-OPEC supply is also shrinking fast,” the agency said.

“The IEA stands out as more bearish on the outlook” than OPEC and the U.S. Energy Information Administration, Jens Naervig Pedersen, an analyst at Danske Bank A/S, said in a report cited by Bloomberg. “Global growth concerns should limit upside above the current range” in oil prices, he said.

© Copyright IBTimes 2024. All rights reserved.