Icahn Continues Clorox Pursuit Despite Major Resistance

Analysis

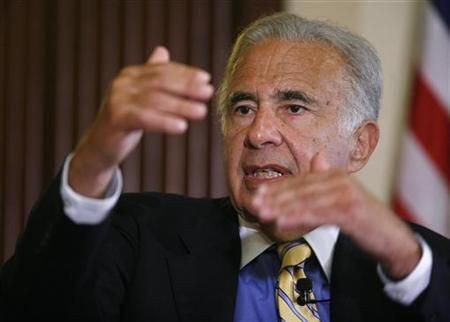

Legendary corporate raider Carl Icahn has refused to give up his pursuit of Clorox, despite the company swiftly rejecting every offer he's made.

Clorox has now rejected three Icahn bids, including the most recent offer of $78 a share, noting that Icahn's bids aren't credible.

Icahn has pushed to be on Clorox's board recently and admitted that if he would either sell the company in an auction or buy the company himself.

The company has rejected Icahn at every possible time, but yet the septuagenarian investor continues to push on.

Why?

Icahn is committed to making a profit off his large investment and will keep pushing and prodding Clorox to make a move until that happens.

Analysts have long speculated Icahn is angling for a pump and dump. Icahn seems interested in enticing a big company, like Procter & Gamble or Kimberly Clark, to make a bid on the company, which would likely push the stock price up.

In his initial offer, Icahn blatantly admitted those intentions -- calling for a bigger, better-suited company to buy Clorox if it did not accept his bid.

We understand that we are a financial buyer that lacks inherent synergies and therefore strongly suggest that the Board aggressively pursue a transaction with a strategic buyer, which should attract a higher price, a letter from Icahn stated.

Initial speculation in July was that Icahn, Clorox's largest shareholder, was looking to see the company trade at $100 before selling off his stake.

That notion likely hasn't changed, even if Icahn feigns interest in keeping the company for himself and not just to sell off some of the company's parts.

Icahn has the time and resources to battle with Clorox's leadership for a long, long time -- and you better bank on him doing so. In situations like these, and also recently seen in his dealings with Lionsgate, Icahn is in a win-win scenario.

Either he gets what he wants and the company relents to his offer, or the company, like Lionsgate, basically pays him to go away. Lionsgate reached an agreement with Icahn on Monday to end his efforts to take over the company.

Clorox continues to claim that Icahn's bids undervalue the company and while it is open to bids, it still believes its best move is to continue with its current strategy.

That might be true, but Icahn doesn't feel the same and will continue to make his voice heard.

To Clorox, Icahn might be the annoying gnat that just won't go away. But when that gnat is as influential as Carl Icahn -- it's awfully hard to shoo him away.

© Copyright IBTimes 2025. All rights reserved.