Indian Movie And Music Streaming Company Hungama Close To Raising $100 Million: Report

Hungama Digital Media Entertainment Pvt. Ltd., an Indian music and video streaming company, is close to raising more than $100 million in fresh funding, TechCrunch reported Thursday, citing people familiar with the development.

The move could help Mumbai-based Hungama, a privately held company, strengthen its ability to sell its content on smartphones as millions of people in India switch from basic phones, accessing the Internet on faster data networks.

The rise of smartphones in India is an opportunity for music and video streaming companies such as Hungama and local competitors Saavn and Gaana to push their premium subscriptions in a market where offline storage is popular. The Indian players also face competition from foreign entrants such as Rdio, which purchased another Indian music streaming company Dhingana to get access to the market.

Hungama was in “advanced” talks with existing investors Intel Capital and Bessemer Venture Partners, from whom the 16 year-old Indian company raised $40 million last July. Intel Capital had also invested an undisclosed sum in the business in 2012.

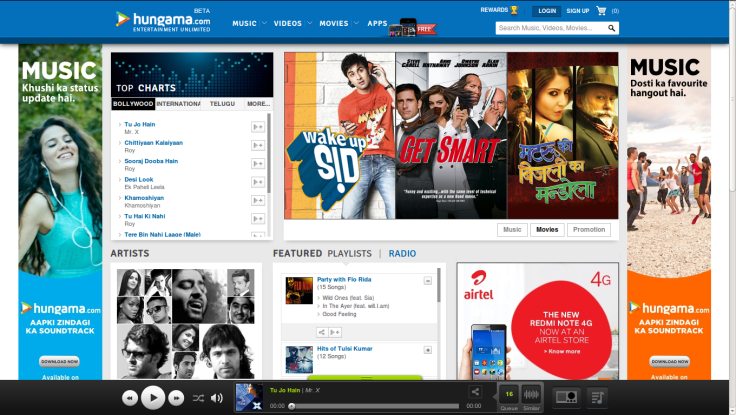

Hungama operates an eponymous on-demand digital entertainment storefront, Hungama.com, which according to the company’s website has over 2.5 million pieces of content across genres and languages, in the form of music tracks, movies, music videos and dialogues, and mobile content such as ringtones and wallpapers.

Hungama.com has more than 20 million users accessing its content on computers as well as mobile devices. Its library includes 5,000 “Bollywood” -- a mashup of Bombay and Hollywood for the Hindi-language movies that are mostly from studios in Mumbai city, which was called Bombay earlier -- Hollywood, regional Indian movies and television series. The company offers Internet storage, and access via smartphone app, according to its site.

TechCrunch reports that the funding deal will be closed soon, and the money will be used for further growth on the mobile front, including investments in mobile technologies and adding content libraries. Acquisition of competitors or technology providers was also being considered, according to the report.

© Copyright IBTimes 2024. All rights reserved.