RIM Shares Set New Low Despite E-Mail Outage Fix Plan

Shares of BlackBerry developer Research in Motion set a new 52-week low despite the company's renewed pledge to fix its network that caused a three-day October e-mail glitch.

RIM shares were at $19.58, down $1.70 or 8 percent, in late morning trading. Earlier, they set a 52-week low of $19.

The Waterloo, Ontario-based company has been under pressure for months after reporting dismal second-quarter results in August and coming under shareholder assault from Toronto activist Jaguar Financial. It also botched the introduction of its tablet, the BlackBerry Playbook.

Last month, RIM's computer servers in England failed, causing a glitch in BlackBerry e-mails that eventually became a global problem. Co-CEOs Mike Lazaridis and James Balsillie took nearly three days to respond.

Tuesday's decline, amid an overall market dip, followed a slashing report by Veritas Investment Research's Neeraj Monga who suggested RIM shares could fall to $10 because the company is behind the competition in every respect.

Monga told investors RIM has an outdated platform, is unable to launch winning devices, is bleeding management talent, is unable to attract the best to work for it, is in a slash-and-burn mode and all the R&F efforts and spending don't seem to be producing either winning [smartphones] or a decent tablet computing device.

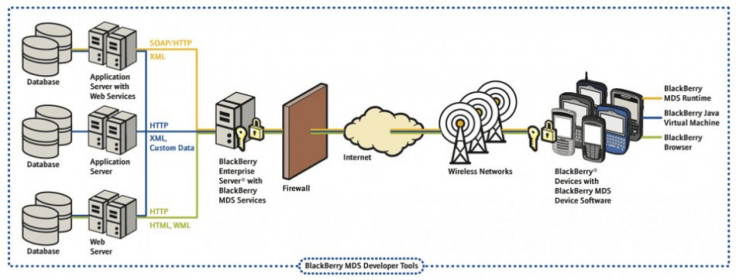

Separately, Bloomberg reported a London-based marketing executive suggested the company has set up an in-house SWAT team under David Yach, the chief technology officer, which might redesign the entire e-mail system.

The official, Patrick Spence, said RIM may consider offloading some of its internal traffic to carriers such as Vodafone Group, which is the minority owner of Verizon Wireless, controlled by Verizon Communications.

The latest tumble brings RIM's market capitalization down to $10.24 billion, a 66.4 percent drop this year.

© Copyright IBTimes 2024. All rights reserved.