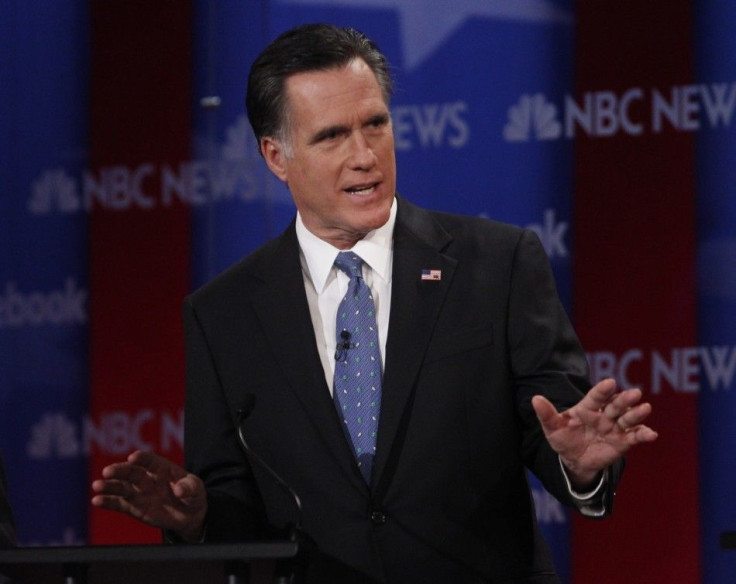

Romney’s Tax Rate is About 15% - The Bain of His Political Existence?

Analysis

At this stage of the 2012 presidential campaign, it's too soon to tell whether Mitt Romney's years at private equity firm Bain Capital will turn out to be the bane of his political existence, but they may spark a new debate regarding income taxes on upper income groups.

Romney's estimate that his income tax rate is probably closer to 15 percent than anything suggests his tax rate is substantially lower than what most Americans pay.

The reason? Capital gains / carried interest.

Capital gains / carried interest is the portion of private equity firm/hedge fund/alternative investment manager's income that stems from a manager's performance, and it's nice work, if you can get it. Here's why:

All Income Is Not Taxed Alike

Management fees are taxed at the ordinary U.S. income tax rate: 35 percent, 33 percent, 28 percent, 25 percent, or 15 percent, depending on the person's income.

However, an investment manager's performance is taxed at the capital gains tax rate / carried interest rate - only 15 percent.

Capital gains / carried interest is one of the biggest loop holes in the current tax law -- a potential 20-percentage-point tax differential that encourages tax filers to find ways to reclassify wage income as investment income.

Romney's income tax rate estimate suggests- - like many upper income adults -- that a substantial portion of income stems from investments -- including carried interest and capital gains - rather than ordinary income.

Earlier this year, billion investor Warren Buffett, chairman of Berkshire Hathaway (BRK.A), increased public awareness of the issue by saying it's wrong for society to require him to pay a smaller share of his income in taxes than his secretary does.

Liberal and populist groups generally favor changing the tax code to eliminate the capital gain / carried interest because they argue it is a flaw results typical citizens being taxed at a higher rate than many upper-income American.

Conservatives, including almost all if not all congressional Republicans, are against closing the loop hole for capital gains/ carried interest. They argue that taxes are already high enough on the wealthy -- and that upper-income groups already pay a disproportionate share of federal taxes. The GOP also argues that raising taxes will reduce business investment and discourage initiative.

Political/Public Policy Analysis: It's too soon to tell if Romney's candid admission will hurt. At this stage, put the admission in the category of a gaffe. Like Romney's offer of a $10,000 bet, the comment provides additional fodder for those who argue that Romney is not in touch with the typical person's concerns and struggles. To be sure, these gaffes will not determine the outcome of the 2012 election -- political science research indicates that party voter turnout, voter attitude toward the candidates, and issues (such as the U.S. economy's health) will, but they do project an image of Romney that is upper-crust, not typical-person oriented -- not what a national party seeking the largest coalition possible wants to project in an election year.

More broadly, the carried interest loophole is one of the egregious injustices in the U.S. tax code. Congress should eliminate it post-haste.

The notion that an office secretary or janitor or construction worker would pay a higher tax rate than a hedge fund manager or private equity director making $5 million, $10 million, even $20 million per year is intrinsically un-fair and un-American.

© Copyright IBTimes 2025. All rights reserved.