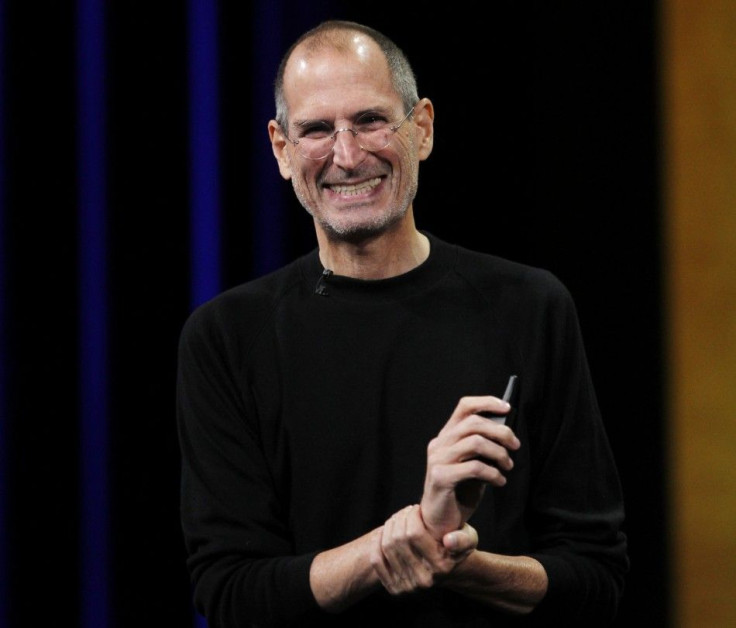

Steve Jobs, Warren Buffett: Can Apple, Berkshire Survive Without Them?

Analysis: Don't expect Berkshire Hathaway to nose dive when Buffett leaves

Investors and analysts have long loved to speculate shares of Apple and Berkshire Hathaway would greatly suffer when each companies' star executive, Steve Jobs and Warren Buffett, eventually called it quits.

Last week Jobs surprisingly left his job as Apple CEO, and even though many investors and reporters, including this writer, speculated the company's share price would take a nose dive -- it didn't.

Apple shares did initially trade down more than 5 percent in after-hours trading, but leveled off the next day and traded this Tuesday at $390.19 -- higher than where it was at before Jobs' resignation announcement.

It could mean Jobs' departure was already priced into the share since he had been on medical leave since January. Tim Cook, who has previously run the company in Jobs' absences, succeeds him as chief executive.

Analysts predict Berkshire Hathaway would also be fine with Buffett.

Buffett has been invaluable in creating the company that is there today but the company that exists today doesn't really need Buffett anywhere near as much as it did 20 years ago, The Motley Fool analyst Matt Koppenheffer told the IBTimes.

Buffett, 81, one of the world's most influential investors, has an estimated net worth close to $50 billion that allows him to make some substantial investments with little risk.

He recently bought a $5 billion stake in Bank of America -- a deal which allegedly earned him a $1 billion profit on the day of the announcement. Critics though allege Buffett gets sweetheart deals that no one else would get, in part due to positive market reaction when Buffett invests in a company.

Bank of America, for example, saw its shares jump more than 9 percent after the announcement.

Despite Buffett's considerable investment success -- he's had some failures as well -- Berkshire Hathaway wouldn't suddenly fall off the map when he leaves.

Why?

Part of the reason could be Buffett's investment strategy. His company largely invests in blue chip stocks, such as Coca-Cola and Procter & Gamble. You don't need Buffett to pick those stocks, noted Motley Fool's Koppenheffer.

Not only does the company invest in a lot of steady, blue chip companies, but also Buffett doesn't have his hands on the day-to-day management of those investments; that task largely falls on individual managers.

You have all these different income streams that Buffett doesn't have a whole lot to do with, said Koppenheffer. His decisions lately have been to hold onto a whole lot of cash.

It's certainly possible that investors might lose some confidence in the company without Buffett and the company's share price could take the slightest of dips.

But unless the company moves away from investing in large, established companies, which is doubtful, Buffett's eventual retirement shouldn't have much of an impact on the company.

© Copyright IBTimes 2025. All rights reserved.