Streaming Music Services Are Saving The Music Business ... In Spain

There might still be some uncertainty about how streaming services will affect the global music industry, but in Europe, they’re pulling markets back from the brink of catastrophe.

The Spanish organization Promusicae released a report Monday showing that, for the first time in 12 years, Spain’s market for recorded music has grown, and the report’s authors are giving streaming services all of the credit.

“This improvement can be entirely placed on to the momentum of streaming,” a release accompanying the report read.

Through the first six months of 2015, the combined revenues of subscription and ad-supported services were almost 40 percent higher than they were through the first half of 2014, resulting in a net 11 percent uptick in revenues.

That sharp rise also pushed digital revenues past physical revenues for the first time in the history of the Spanish market for recorded music. Through the first half of the year, digital revenue accounted for nearly 54 percent of revenues, with physical sales accounting for the remaining 46 percent.

That success was also the report’s lone bright spot: streaming was the only format of music sales that saw an increase through the first half of the year. Physical album sales declined nearly five percent, from $36.9 million to $35.1 million. Downloads fell about three percent, from $7.8 million to $7.6 million. Ringtones, a category briefly regarded as a potential industry savior, continued their own precipitous decline, sliding nine percent to $744,000.

While the report noted that more growth would be needed, it framed streaming as a source of hope, calling it the “lifeline of a sector still suffering the severe punishment of the global crisis and the plundering caused by piracy.”

Long Way to Go

While every major market for music contracted sharply at the start of the 21st century, Spain’s took a particularly hard hit. Today, its revenues are still down 80 percent from where they were in 2001; the year’s gains only bring the industry back to its 2011 revenue levels.

For things to continue trending in the right direction in Spain, people will have to continue streaming, and they will have to keep subscribing. The report’s release noted that the success of Apple Music, which is in the midst of offering users a three-month free trial, will play a role in whether those gains are preserved.

Freemium

Unlike the United States, which is still wrapping its head around the growing number of streaming music services coming to market, Spain has had many years to grow comfortable with them; its consumers have had access to Spotify for nearly seven years, and the progress outlined in the Promusicae report shows Spain following the same trajectory as countries like Sweden and Norway, where streaming services generate the bulk of the revenue in their respective markets.

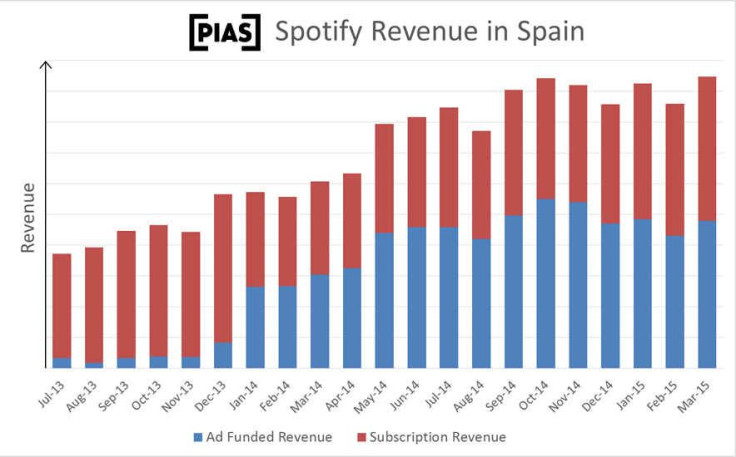

Spain has also shown great progress in its ability to make money from both subscription and advertising revenue. A recent blog post published by Adrian Pope, the director of artist and label services for the European label [PIAS] Recordings, showed that his label makes nearly as much money from Spotify’s ad-supported tier as it does from its premium tier, despite royalty rates that are nearly seven times higher on the premium side.

According to the International Federation of Phonographic Industries, Spain is the world's 13th largest music market.

© Copyright IBTimes 2024. All rights reserved.