Why Wall Street's Trading Revenues Are Falling, Even Amid High Volatility

The biggest U.S. banks are struggling to keep their trading revenues up amid chaotic markets roiled by global economic unease. Although such conditions can be a boon for Wall Street, executives at JPMorgan Chase & Co. and other major banks are signaling to their investors that the latest quarter hasn’t been kind to their trading desks.

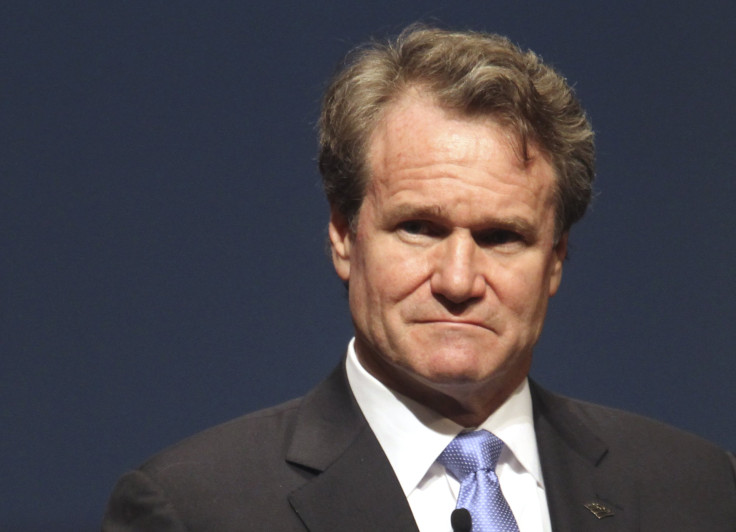

Bank of America chief executive Brian Moynihan said trading revenue may end up down at least 5 percent in the third quarter over a year earlier, an outlook Citigroup shared. Jamie Dimon, CEO and chairman of JPMorgan, said last week that his firm’s equities and fixed-income desks were performing “about the same as everybody else” -- that is, underwhelmingly.

For major banks hungry for trading revenue, market volatility is usually a treat. Rapid market movements encourage investors to move their investments around to take advantage of lucrative opportunities. That means increased orders for the trading desks -- thus more profits.

But the latest bout of turmoil sweeping domestic and international markets has bucked that trend, reducing trade flow and spreading uncertainty in the bond market. Banks are now experiencing a sort of volatility overdose.

Touchy fixed-income markets are expected to witness further volume declines as investors await the Federal Reserve’s eventual raising of historically low benchmark interest rates. In a much-anticipated decision announced Thursday, the Fed chose to keep interest rates near zero.

The coming earnings season could see a bruised Wall Street. Jefferies, the firm often seen as a bellwether for the investment banking sector’s earnings season, reported a 50 percent decline in third-quarter trading revenue, largely due to a $14 million loss in its fixed-income division.

Analysts at JPMorgan pointed to the mid-August market selloff, spurred by worries over China’s economic soundness, as a major factor in sluggish third-quarter trading. "Investment banks are not immune to the market movements," the analysts wrote earlier this month.

Market fears have trickled into the market for bond issuance, typically a major driver of Wall Street profits. Bond deals came screeching to a halt in the final weeks of August following that month’s equities rout. Banks are also still adjusting to the Volcker rule, a provision of the Dodd-Frank Act that places limits on the ways banks are allowed to trade assets.

The outlook is no brighter for stocks in the coming weeks. On Monday, Goldman Sachs analysts issued a note to clients warning of stiff headwinds for stock pickers. Correlations between disparate stocks have surged to levels not seen since the European bond crisis in 2011. That means most stocks aren’t trading based on their fundamentals, but on wider market sentiment.

For speculators, that makes it tough to gain an edge. Large-scale macro investors rebalancing portfolios are moving the market en masse, Goldman chief equities analyst David Kostin wrote, “leaving bottom-up stock pickers with a diminished opportunity set for generating alpha.” (Alpha means outperforming the wider market.)

That’s not necessarily bad news for Wall Street’s equities desks, which haven’t been hit as hard as bond traders. Moynihan said last week that subdued revenues in fixed income had been balanced out by strong performance in stock trading.

© Copyright IBTimes 2024. All rights reserved.